The proliferation of artificial intelligence applications has demonstrably impacted the semiconductor industry, though the effects have not been uniformly distributed. While Nvidia, Taiwan Semiconductor Manufacturing, and Broadcom have experienced significant valuation increases, these gains have largely been predicated on specific market positions within the AI ecosystem. A reassessment of the broader supply chain is warranted to identify potential beneficiaries beyond the current leaders.

Micron’s Role in the Evolving AI Infrastructure

The initial wave of generative AI, exemplified by large language models, has captured considerable attention. However, the long-term trajectory of AI development extends beyond text-based applications to encompass more sophisticated areas such as agentic AI, autonomous systems, and robotics. These advanced applications necessitate substantial investments in inference capabilities, driving demand for increased data processing capacity.

Hyperscalers – including Microsoft, Alphabet, Amazon, and Meta Platforms – are positioning themselves to capitalize on these emerging trends. Their strategic focus extends beyond chatbot functionality to encompass a broader range of AI-driven services. This necessitates a holistic approach to infrastructure development, emphasizing the importance of efficient data transfer and storage. Micron Technology’s portfolio of high-bandwidth memory (HBM), dynamic random access memory (DRAM), and NAND chips addresses these critical requirements by mitigating data bottlenecks and optimizing memory and storage performance.

Assessing the Potential for Accelerated Growth

Recent market dynamics indicate a tightening supply base for memory and storage solutions, coupled with robust demand from hyperscalers. Preliminary data suggests potential price increases for DRAM and NAND chips, potentially exceeding 60% and 38%, respectively, in the current quarter. Micron’s first-quarter fiscal 2026 results – reporting revenue of $13.6 billion, a 57% year-over-year increase – corroborate these trends. Furthermore, the company has demonstrated consistent performance across its core segments – cloud memory, core data, mobile, and automotive/embedded devices – achieving gross and operating margins of at least 40% and 30%, respectively.

These metrics suggest that Micron is not merely benefiting from favorable market conditions, but is also demonstrating an ability to generate lucrative unit economics across its entire operation. With the total addressable market for HBM projected to reach $100 billion by 2028 – nearly tripling its current size – Micron’s growth trajectory appears compelling. The company’s positioning within the AI infrastructure stack, therefore, warrants careful consideration.

Valuation Considerations and Potential Upside

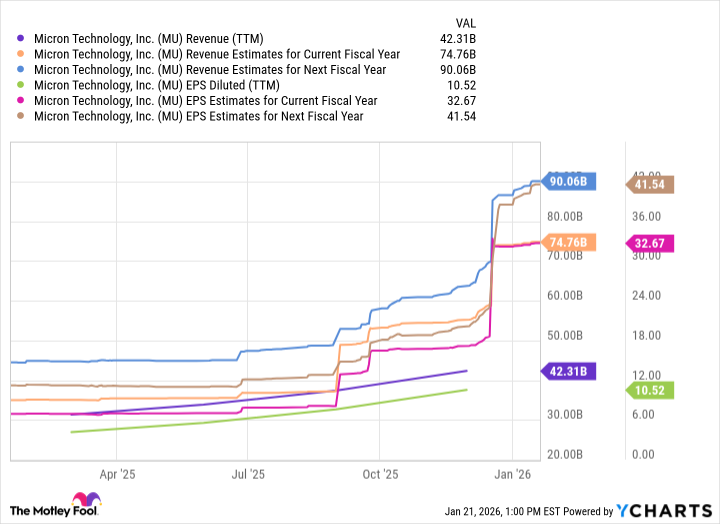

Over the past 12 months, Micron has generated $42 billion in revenue and approximately $10 in earnings per share. Wall Street analysts anticipate substantial growth over the next two years, projecting a doubling of revenue and a near fourfold increase in EPS by fiscal 2027. Despite these optimistic projections, Micron currently trades at a modest forward price-to-earnings (P/E) multiple of 12.3, a notable discount compared to industry leaders such as Nvidia, TSMC, and Broadcom, which command forward P/Es ranging from 30 to 60.

While Micron is not a direct competitor to these companies, the valuation disparity highlights a potential disconnect between market perception and underlying fundamentals. Assuming a conservative forward P/E of 23, Micron’s implied market capitalization would reach approximately $850 billion. A more optimistic scenario, utilizing a forward P/E of 30, would result in a valuation exceeding $1 trillion.

Given the multiyear, multitrillion-dollar opportunity presented by AI infrastructure, Micron’s stock warrants consideration as a long-term investment. However, investors should remain cognizant of potential risks, including cyclicality inherent in the semiconductor industry, macroeconomic headwinds, and evolving technological landscapes. A thorough assessment of these factors is essential before making any investment decisions.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-01-25 13:02