On the precipice of a momentous Wednesday, the giant in the semiconductor realm, Nvidia (NVDA), prepares to unveil its second-quarter earnings report. Yet beneath the flickering shadows of this corporate behemoth lie the laboring prospects of Micron Technology (MU), a name perhaps obscured by the glimmer of the larger titan but poised for ascension in the murky theater of investor speculation.

This tumultuous year, dominated by the rise of DeepSeek and marred by the erratic dance of U.S.-China trade policies, has cast a pall over Nvidia’s ambitions. Still, with cautious optimism, some see promise amid the fray; signs that the AI chip colossus clangs along a path of continuity and growth persist, despite the din of uncertainty.

While Wall Street’s gaze fixates like a hawk on Nvidia’s fate, there exists a common wisdom that whispers to the astute investor: to cast thine eye towards the impending transformations within the semiconductor domain. In a striking reversal of fortunes, Micron’s well-composed talents could shine even brighter in the wake of favorable news from Nvidia, as their mission-critical solutions entwine themselves within the very fabric of the AI supply chain.

Let us delve into what might propel Micron’s stock skyward after Nvidia delivers its anticipated Q2 earnings. Is this the moment to seize an opportunity cloaked in half-shadow?

Why Nvidia is destined to eclipse expectations in Q2

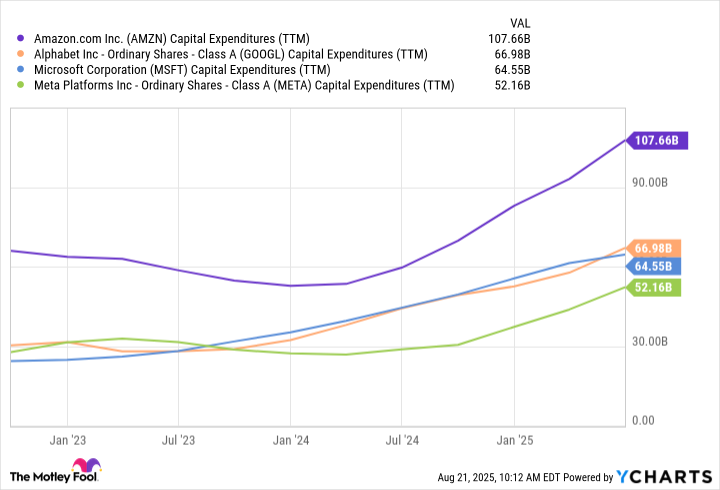

The last month has unfurled a tapestry rich with hints, as significant players like Microsoft, Alphabet, Amazon, and Meta Platforms splash into unprecedented capital expenditures, crafting a digital fortress of data centers and cloud infrastructure. These endeavors stretch far and wide, abiding by a collective ambition to support the burgeoning demands of AI.

In this cacophony of investment, the furnaces that forge the backbone of AI-primarily GPU technology, where Nvidia remains king-remain fed by an insatiable hunger for higher performance. Not insignificantly, the recent proclamation from Taiwan Semiconductor Manufacturing, the very lifeblood behind Nvidia’s illustrious chips, marks a staggering provision of $30 billion in revenue, a clear semaphore signalling an upturn in demand.

Amid the smog of escalating expenses on AI infrastructure, reason may be found in the anticipation: Nvidia’s Q2 report may very well sing the tune that even the harshest skeptics among us might find palatable.

Micron: An undervalued player in the AI infrastructure narrative

Yet, as Nvidia’s ascent garners deserved attention, let us not forget the silent strength of Micron, nestled in the shadows of this colossal production. GPUs, after all, do not operate as solitary stars in this galaxy; they require high-performance memory chips that serve as the unsung enablers of AI’s voracious data appetite. Herein lies Micron’s crucial position.

Consider, for example, initiatives like Project Stargate-an ambitious testament to the extensive data center expansions that are reshaping the landscape. Whether it be from corporate behemoths or governmental ambitions, these centers, designed with the next generation of GPUs and advanced networking, represent a vital pivot point for the modern economy.

With an impending shift from the acquisition of GPUs to implementing AI software in enterprise workflows, we witness the emergence of inference tasks-an extensive requirement for real-time data processing. Micron stands poised with its DRAM and high bandwidth memory (HBM), ready to answer this demanding call for robust computational support. The interplay of escalating capex from hyperscalers, massive projects like Stargate, coupled with the burgeoning need for AI inference capabilities, crystallizes a burgeoning demand for computing power.

In this grand structure of AI infrastructure, while the GPUs might be the dazzling center stage performers, Micron’s HBM-a steadfast support-ensures that the production runs smoothly behind the scenes.

Thus, as Micron continues to navigate the undercurrents of global investment and AI proliferation, it quietly earns its keep, benefitting from the expansive AI infrastructure spending of our time. Each maneuver made by Nvidia ripples forth to touch Micron’s fortunes, often eclipsed but intimately entwined in the unfolding drama.

Micron’s valuation: A hidden gem amid semiconductor giants

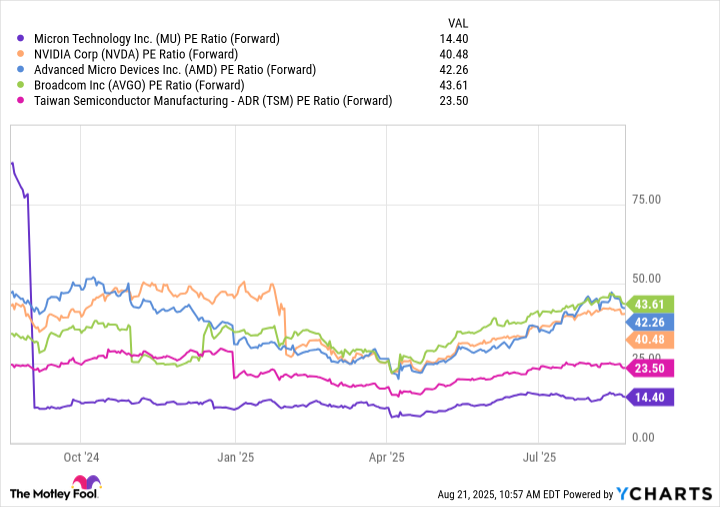

The charts reflect an intriguing reality; titans like Nvidia and Broadcom trade like gold bullion while Micron, perhaps a diamond cloaked in dust, lingers at undervalued levels. Investors beget wealth from the hopeful clamor surrounding GPUs, yet there lies a deeper truth in how Micron fits into this evolving narrative.

Many misconstrue Micron’s role, sealing it away amidst the commodity likeness of HBM, neglecting the dependency that emerges as Nvidia’s chips flourish. Each dollar allocated for those AI GPUs magnifies the necessity for memory solutions to maintain the wheels of progress, a fact which positions Micron as an indispensable player.

Yet, as the clouds of valuation loom large, Micron’s forward price-to-earnings (P/E) ratio languishes well beneath those of its semiconductor kin. The market remains blind to the integral role HBM will inevitably play in the next chapter of AI’s ascendancy. In light of such, we find Micron veiled as an underappreciated opportunity, awaiting discovery amidst the clamor.

While the stock may sway with the weather of market volatility, we ought not to weave our strategies solely into the winds of chance. Instead, let us endorse a practice rooted in wisdom: dollar-cost averaging-an investment approach that mitigates the pangs of time and allows us to grow our positions in Micron steadily, riding the wave of the AI infrastructure narrative from afar.

This prudent method shall see investors acquire shares at diverse prices while engaging with the long-term currents that shape our industries. 🌊

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

- Games That Faced Bans in Countries Over Political Themes

2025-08-23 19:37