Okay, look. I said Micron would do well. Last September. It felt… optimistic at the time. Like suggesting pineapple belongs on pizza. But here we are. Micron (MU +0.52%) hasn’t just soared; it’s basically achieved liftoff, fueled by the AI boom and a desperate need for high-bandwidth memory (HBM) chips. It’s like everyone suddenly realized their data centers needed a serious upgrade, and Micron was holding all the ethernet cables.

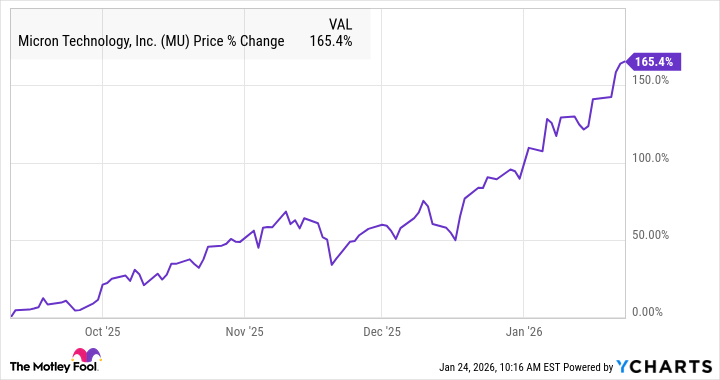

Three months? Nearly doubled. Since my September prediction – a prediction I’m now legally obligated to remind everyone about – we’re up 165%. Which, frankly, is embarrassing for all the other chip companies. It’s like watching a rom-com where the underdog actually gets the girl. And the stock? Scorching hot into 2026. I’m starting to think I should quit my day job and just become a stock whisperer.

Why Micron Has Basically Tripled (No, Really)

Turns out, there’s a supply crunch in the memory sector. Who knew? It’s like the entire industry simultaneously decided to go on vacation. This has sent prices sky-high, benefiting everyone from Samsung to SK Hynix… and even Sandisk, bless their little flash memory hearts. They’re the quirky supporting character in this drama.

Micron, in its latest earnings report, casually dropped that the $100 billion HBM total addressable market (TAM) is now expected in 2028 – two years earlier than previously thought. They’re basically saying, “Oh, this whole AI thing? It’s happening faster.” Management also predicted a 40% compound annual growth rate through 2028, which should soothe any lingering fears about the cyclical nature of the memory sector. Because, let’s be real, the only thing more predictable than market cycles is the plot of a Hallmark movie.

And the report? They smashed expectations. Wall Street clearly underestimated Micron’s growth and margin expansion. Revenue around $18.7 billion? Consensus was $14.3 billion. Earnings per share at $8.42? They were expecting, like, $4.71. It’s like showing up to a potluck with a five-layer cake when everyone else brought chips and dip.

Is Micron Still a Buy? (Asking for a Friend)

The forecast suggests this strong industry dynamic will persist through 2028, and they’ve already contracted out HBM supply for 2026. That’s… comforting. It’s like pre-ordering concert tickets for a band that hasn’t formed yet, but with potentially higher returns.

Intel, meanwhile, just reminded us they’re on the other end of this memory shortage, hindering their 2026 growth. Which, honestly, is just good business for Micron and its peers. It’s the circle of life, but with semiconductors.

And here’s the kicker: Micron is still valued like a high-risk, cyclical stock, trading at a forward P/E of just 12 based on fiscal 2026 estimates. That’s… a steal. It’s like finding a vintage designer handbag at a garage sale. Someone messed up, and we’re here to benefit.

So, with that low price tag and no end to the memory shortage in sight, Micron continues to look like a strong buy for 2026. Don’t tell everyone, though. I’d like to keep the stock price reasonable for, you know, the rest of us.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- The Best Movies to Watch on Apple TV+ in January 2026

2026-01-26 07:32