For three years, the name Nvidia has echoed through the halls of the semiconductor world, a gilded idol. They ignited the artificial intelligence craze with their GPUs, each new iteration a boastful claim of power. A spectacle, certainly. But the ground grows weary of spectacle. It craves substance, a quiet strength.

The whispers now speak of a different current, a challenge not from the expected rivals—AMD, Broadcom, the usual parade of giants—but from a more unassuming source. A place where the work is less about flash and more about the steady accumulation of value.

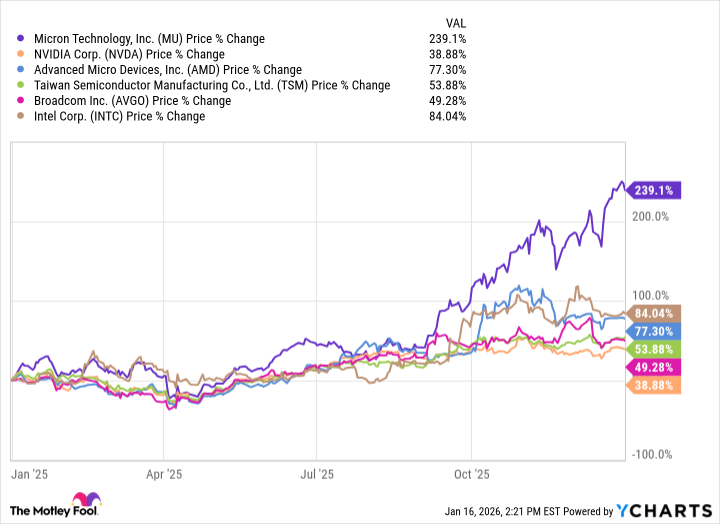

Micron Technology. In the last year, it’s risen like a stubborn weed in a carefully manicured garden. A 239% gain. A figure that draws the attention of those who chase quick returns. But for those of us who watch the long game, it’s not the speed of the ascent, but the strength of the roots that matters.

Beth Kindig, of the I/O Fund, sees it too. She’s named Micron among her top picks for 2026. Not a fleeting fancy, but a reasoned judgment. A recognition that value isn’t always found in the loudest pronouncements, but in the quiet labor of those who build the foundation.

She doesn’t chase the surface glitter of valuation metrics. She looks deeper, at the flow of capital, the rhythm of supply chains. She sees the real forces at work, the ones that sustain growth not for a quarter, or a year, but for a decade. And she understands that sometimes, the most fertile ground lies hidden in the shadows.

The Labor Behind the Machine

Nvidia and AMD build the brains of this new intelligence. But brains require a nervous system, a means of transmitting signals. That’s where Micron steps in. They provide the memory, the storage, the very pathways that allow these AI systems to function. It’s a less glamorous role, certainly. But no less essential.

These AI workloads are growing, becoming ever more demanding. They strain the infrastructure, pushing it to its limits. And as the demand for memory and storage increases, Micron’s importance only grows. It’s a simple equation, really. A fundamental need, met by a reliable provider. A solid foundation, built on honest work.

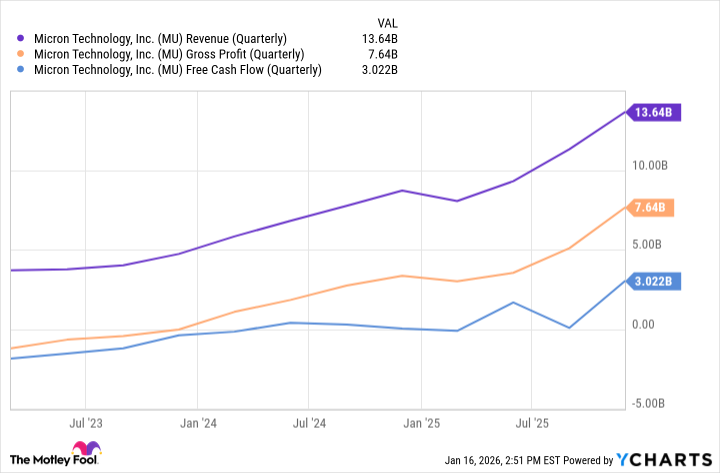

Their revenue is accelerating, their profits are rising. They’re generating free cash flow, the lifeblood of any sustainable business. It’s not a story of overnight riches, but of steady, consistent growth. A testament to the power of long-term planning and diligent execution.

The hyperscalers are doubling down on their infrastructure plans, and the chip designers are releasing new architectures. This creates a virtuous cycle, driving demand for Micron’s HBM platform. It’s a durable business, supported by a secular AI narrative, not the fleeting whims of the PC and smartphone markets.

A Seed Worth Nurturing

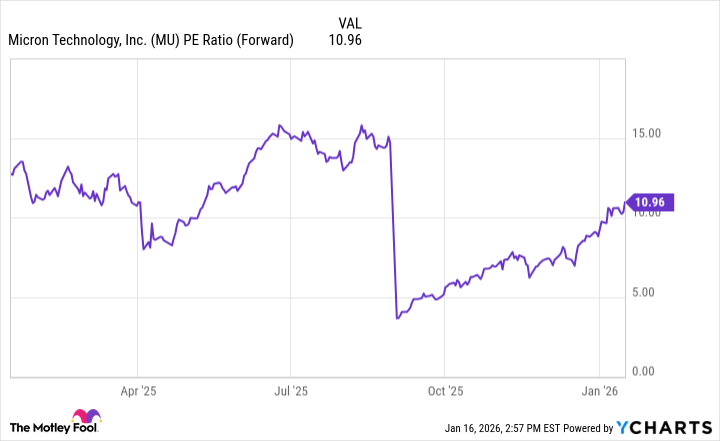

Despite its recent gains, Micron still trades at a modest price-to-earnings ratio. Why? Because growth investors are blinded by the spectacle of Nvidia and AMD. They see the flash, but not the substance. They chase the hype, but not the value.

They don’t understand Micron’s importance on a technological level. They don’t appreciate its position to grow alongside its adjacent chip counterparts. It’s a failure of imagination, a shortsightedness that often plagues the market.

Wall Street is quietly calling for a record year in 2026. Earnings per share are expected to nearly triple. This degree of compounding growth should fuel valuation expansion, as more investors come to understand Micron’s true potential.

Micron isn’t a glamorous investment. It won’t deliver overnight riches. But it offers something far more valuable: a solid foundation, a sustainable business, and a potential for long-term growth. It’s a seed worth nurturing, a quiet strength in a world obsessed with noise. And for those of us who seek value in the long run, it’s a no-brainer buy.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 23:32