![]()

One does tire of the relentless hype surrounding these silicon ventures, doesn’t one? Everyone is quite frantic about GPUs and the like – Nvidia and AMD are having a perfectly ghastly time keeping up with demand. Broadcom, too, is rather busy. But, darling, beneath the surface, something rather more interesting is brewing. It’s not just about processing power, you see. It’s about remembering things. And that, my dears, is where Micron Technology comes in.

For years, Micron was dismissed as a cyclical bore – endlessly rising and falling with the whims of consumer gadgetry. How dreadfully predictable. But this AI business, you see, is forcing a re-evaluation. These tech behemoths – Microsoft, Alphabet, Amazon, Meta, even Tesla – are all dabbling in robots, self-driving cars, and other frightfully ambitious projects. They need processing, of course, but also a prodigious amount of memory. And memory, my dears, is Micron’s particular forte.

It’s a simple equation, really. These companies are finding that adequate capacity isn’t enough. They require – and I do hate to use such a vulgar word – scale. And the current bottleneck isn’t processing speed, but the ability to store and access information quickly. Micron specializes in high-bandwidth memory – HBM, they call it – and a comprehensive range of DRAM and NAND chips. Unsurprisingly, they’re rather busy at the moment.

A Rather Promising Outlook

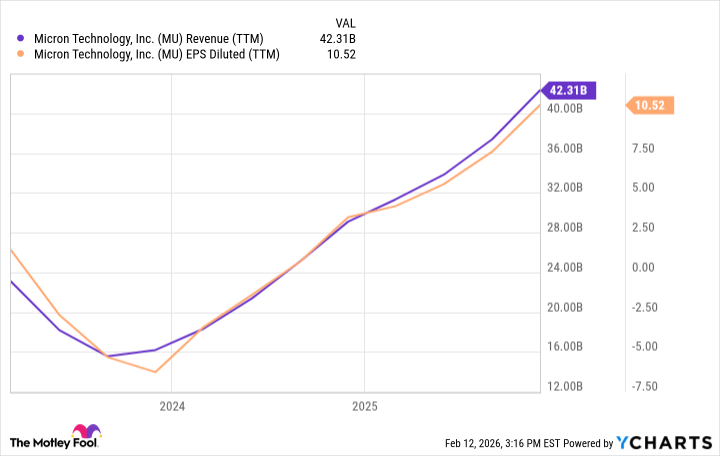

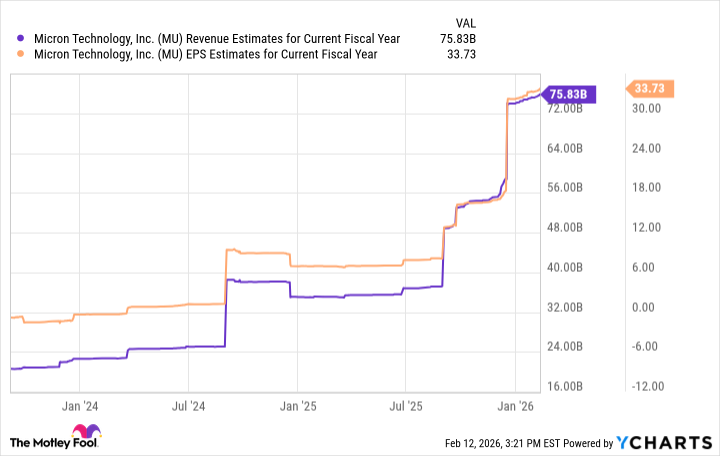

Micron’s management, bless their pragmatic souls, have informed investors that their existing inventory is already sold out. Quite a state of affairs, wouldn’t you say? Though one trusts they aren’t planning on resting on their laurels. They are, sensibly, investing in additional manufacturing capacity to keep pace with this rather insistent demand. The analysts, predictably, are forecasting a rather spectacular surge in revenue and profits by 2026.

They anticipate revenue of $76 billion this year – a rather substantial 81% increase. Earnings per share are expected to roughly triple. One can hardly blame them for being optimistic. Though, of course, optimism is such a terribly vulgar emotion.

A Prediction, If One May Be So Bold

Despite this rather promising outlook, Micron currently trades at a rather pedestrian price-to-earnings multiple of 12. Honestly, it’s almost offensive. Let’s compare it to its peers, shall we?

| Company | Forward P/E |

|---|---|

| Nvidia | 25 |

| Advanced Micro Devices | 32 |

| Broadcom | 34 |

| Taiwan Semiconductor Manufacturing | 27 |

| Average | 30 |

Micron doesn’t have quite the same addressable market, naturally. But the disparity is, frankly, rather startling. It’s as if the market has completely overlooked the importance of memory. One suspects a correction is inevitable.

The Nasdaq-100 boasts a forward P/E of 25. If Micron were to trade in line with that level, shares would reach $843 – a rather agreeable 105% upside. Doubling this year might be a bit ambitious, naturally. But I foresee significant upside in Micron stock throughout 2026 and beyond. By the end of the year, I suspect a price range of $650 or more is entirely plausible. It’s a rather sensible speculation, don’t you think? And, darling, one always appreciates a sensible investment.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 15:52