One observes, with a certain detached amusement, that the current enthusiasm for Artificial Intelligence isn’t actually benefiting those clever chaps writing the software. No, darling, the real profits are accruing to the manufacturers of the utterly mundane, yet increasingly vital, hardware. A most predictable state of affairs, wouldn’t you agree?

Nvidia, of course, is the current darling of the market. A perfectly ghastly valuation, naturally – $4.2 trillion! – but one must admit, they’ve cornered the GPU market rather neatly. They’ve even managed to create a few millionaires along the way. A bit vulgar, perhaps, but undeniably effective. The question, then, is who’s next to enjoy such a vulgar display of wealth?

I believe I have a perfectly serviceable answer, if one is willing to look beyond the usual suspects.

Memories of Boise

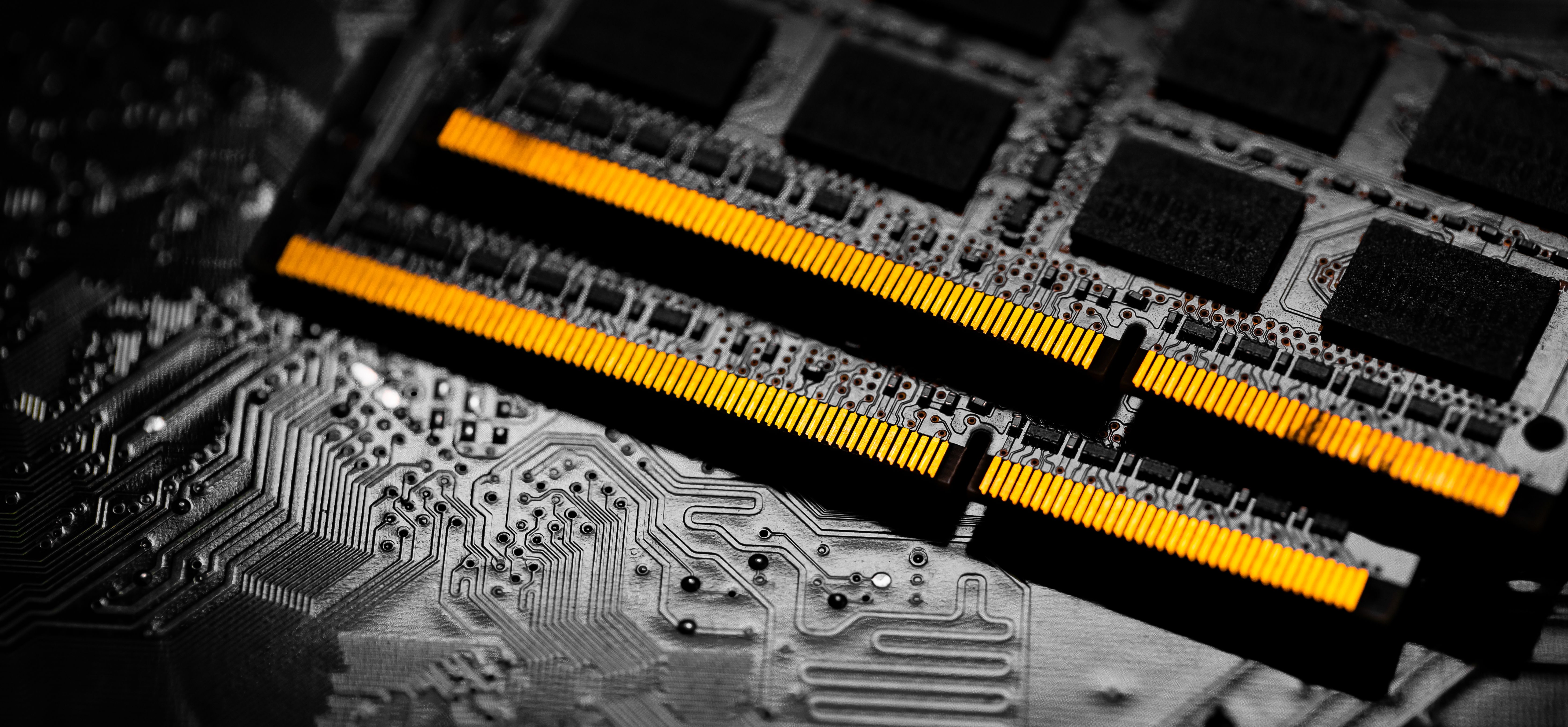

Micron Technology, based in Boise, Idaho – a location that sounds suspiciously like a character in a Western – specializes in memory hardware. RAM and DRAM, to be precise. Utterly essential for computers, and, it transpires, for these demanding AI contraptions. One might say they require a great deal more than the average laptop, which, let’s be honest, is usually filled with cat videos and questionable online shopping.

The demand, you see, is becoming rather acute. Tom’s Hardware – a publication I occasionally glance at, purely for research, you understand – projects that data centers will consume a staggering 70% of all memory chips this year. A shortage, naturally. A perfectly tiresome situation, but one with rather obvious implications.

The price of memory for smartphones is already experiencing a lift – 10% to 15% by 2026, if one is to believe the reports. Even Intel’s CEO, a man not usually prone to hyperbole, suggests this predicament will persist for at least the next two years. A most inconvenient truth, wouldn’t you say?

There’s money to be made, darling, a great deal of it, by those who can supply this increasingly scarce commodity. Micron, commendably, has prepared itself. They’ve wisely abandoned the consumer RAM market – a perfectly sensible decision – and are currently constructing a rather substantial factory near Syracuse, New York. A bit chilly, perhaps, but undoubtedly efficient.

Their share price has, unsurprisingly, responded favorably – a 300% increase in the last 12 months. Yet, despite this rather impressive performance, they remain, if one examines the figures, remarkably undervalued compared to their competitors. A most intriguing proposition.

The Memory Game

Micron’s recent growth has been, shall we say, rather spirited. Fiscal 2025 brought in revenue of $37.4 billion – a 49% increase year over year. And their margins – 39% gross, 26% operating, 22.8% net – are, frankly, rather pleasing to the eye. A solid performance, wouldn’t you agree?

And the momentum, according to their Q1 fiscal 2026 results, shows no sign of abating. Revenue of $13.6 billion – up 57% year over year. Margins expanding to 56.8%, 47%, and 40% respectively. A most satisfactory state of affairs.

Yet, despite this rather impressive trajectory, Micron still trades at a forward P/E ratio of only 10.57. Samsung, their principal competitor, commands a ratio of 12.7. And Nvidia, the current market darling, is trading at a positively extravagant 24.34. A most curious discrepancy.

Therefore, Micron appears to be one of the more sensible – and potentially lucrative – ways to participate in the AI hardware boom. It warrants a closer look, and the company’s current growth trajectory suggests a rather significant potential for wealth creation. One suspects a few more millionaires are in the making. After all, anyone with a $250,000 stake a year ago is already rather comfortably off. And I, for one, believe Micron’s ascent is only just beginning. A most diverting prospect, don’t you think?

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-08 02:12