The pursuit of undervalued assets in the shimmering, often illusory, realm of artificial intelligence is akin to chasing a particularly iridescent butterfly – a fleeting spectacle promising riches, yet demanding a discerning eye. Most contenders bear the inflated plumage of expectation, preening under the gaze of hopeful investors. However, there exists, tucked away amongst the more flamboyant specimens, a rather unassuming creature – Micron Technology – whose current valuation suggests a temporary lapse in collective perception. A curious anomaly, wouldn’t you agree?

Micron (MU +7.68%), purveyor of those ephemeral repositories we call memory chips, operates in a cycle – a predictable oscillation between glut and scarcity. Unlike the logic chips, those meticulous architects of computation, memory is a more… capricious mistress. A commodity, really, though one increasingly vital to the voracious appetite of our burgeoning digital deities. And it is precisely this cyclical nature, this inherent predictability, that has lulled the market into a state of, shall we say, complacency.

The Peculiarity of Price

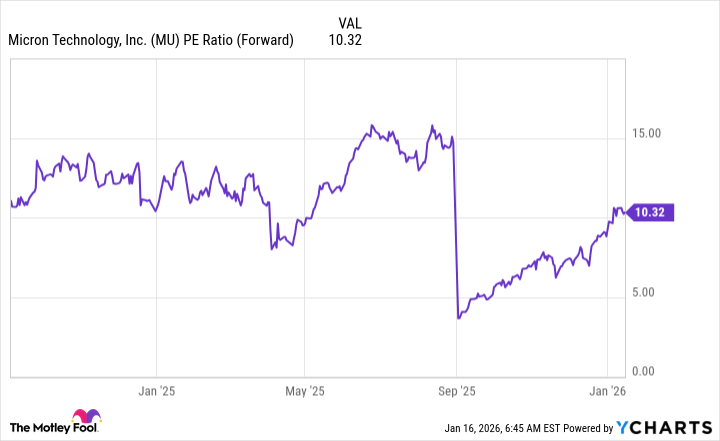

The prevailing metric, that blunt instrument of financial assessment – the price-to-earnings ratio – reveals a rather startling discrepancy. While the larger technological behemoths swagger about with valuations approximating thirty times forward earnings, Micron languishes at a mere ten. A significant difference, wouldn’t you say? One might even suspect a miscalculation, a momentary lapse in the market’s otherwise relentless efficiency. Yet, a closer inspection reveals a logic, however perverse, at play.

It is crucial to resist the siren song of simple valuation. A low multiple does not automatically equate to opportunity. One must delve beneath the surface, to understand the forces at play. Micron’s comparatively modest valuation is not a testament to weakness, but rather a reflection of the market’s ingrained skepticism towards cyclical industries. Investors, understandably wary of repeating past disappointments, tend to discount these companies, anticipating an inevitable downturn. They see the pendulum swinging, and they choose to avoid the arc.

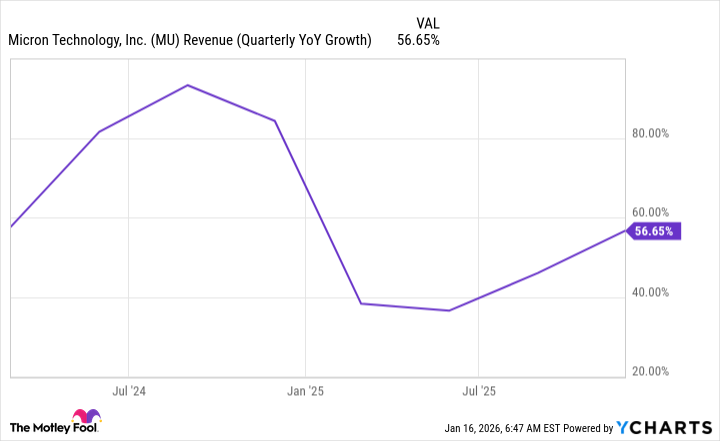

And yet, consider this: Wall Street, in its collective wisdom (or lack thereof), anticipates a rather impressive 133% growth in the next quarter, followed by a 100% surge for fiscal year 2026. Such figures, if realized, would seem to warrant a more enthusiastic valuation. The disconnect, my dear reader, is intriguing, wouldn’t you agree? It suggests a certain… irrationality, a lingering doubt that defies logical explanation.

The explanation, as is often the case, lies in the inherent nature of the beast. Memory chips, unlike their logic-based brethren, are largely undifferentiated commodities. There are no groundbreaking innovations, no proprietary technologies that set one manufacturer apart from another. The game, alas, is one of scale, of efficiency, of ruthless cost control. And, crucially, it is a game perpetually haunted by the specter of overcapacity. Fabricators, eager to capitalize on the next wave of demand, invariably overbuild, creating a glut that sends prices tumbling. A rather predictable pattern, wouldn’t you say?

The Imminent Squeeze

Micron, at present, finds itself in a rather enviable position. Demand for its high-bandwidth memory (HBM) is soaring, fueled by the insatiable appetite of artificial intelligence applications. And, crucially, the company is, as its chief business officer, Sumit Sadana, recently noted, “more than sold out.” A delightful predicament, wouldn’t you say? A temporary reprieve from the relentless pressure of competition.

The market opportunity for HBM is projected to expand at a compound annual growth rate of 40% – a staggering figure – reaching a colossal $100 billion by 2028. Micron, however, faces a critical constraint: its production capacity is, at present, maxed out. A rather inconvenient situation, wouldn’t you say? A potential bottleneck that threatens to derail its ambitious growth plans.

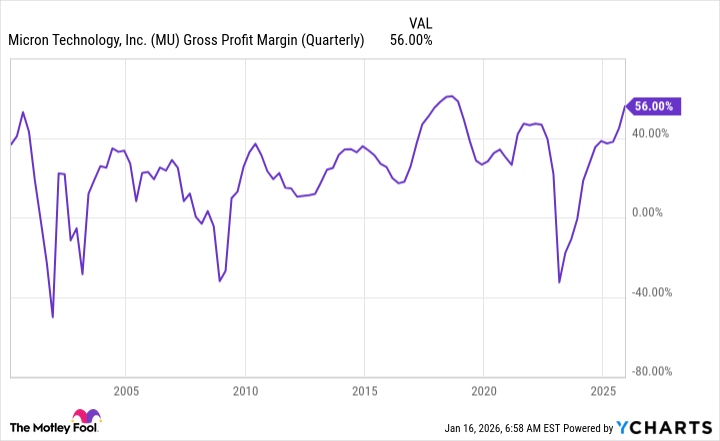

The company is, of course, addressing this issue, investing heavily in new fabrication facilities. Construction is underway in Idaho and New York, but these facilities will not come online until well into the future – too late to alleviate the immediate supply crunch. The inevitable consequence? Soaring prices, and a windfall for Micron. Its gross margin is already approaching recent highs, and management anticipates achieving record levels this year. A rather pleasant prospect, wouldn’t you say?

For the second quarter, Micron expects its gross margin to reach an all-time high of 67%. This surge in profitability will undoubtedly propel its earnings to new heights. And, I suspect, it will also ignite a corresponding surge in its stock price. The memory capacity crunch is not a temporary blip, but a structural issue that will persist for years to come. And Micron, with its strategic positioning and its commitment to innovation, is uniquely positioned to capitalize on this opportunity. It is, in my estimation, one of the most compelling investment opportunities in the artificial intelligence landscape for 2026 – a fleeting bloom, perhaps, but a bloom nonetheless.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 06:03