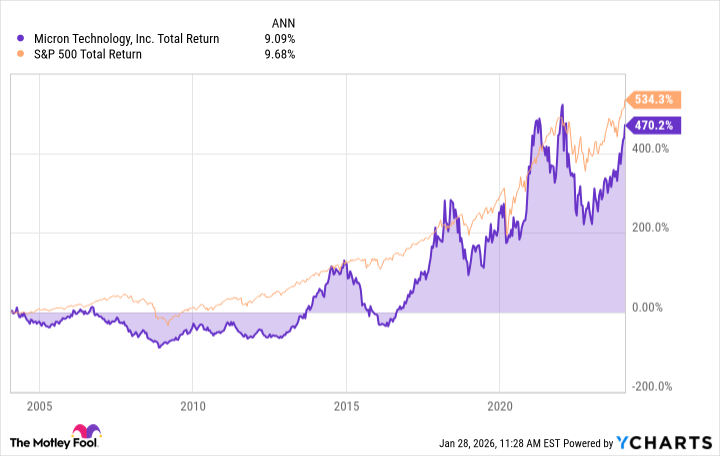

Two years past, Micron Technology – a name that, even then, possessed a certain crystalline resonance – appeared as a volatile specimen, a flickering candle in the draughty hall of long-term returns. Its chart, a capricious line dance, lagged behind the placid, almost bovine, progress of the S&P 500, a comparison spanning from January 2004 to that same, indifferent month in 2024. A pedestrian performance, one might say, lacking the chromatic vibrancy of true ascendance.

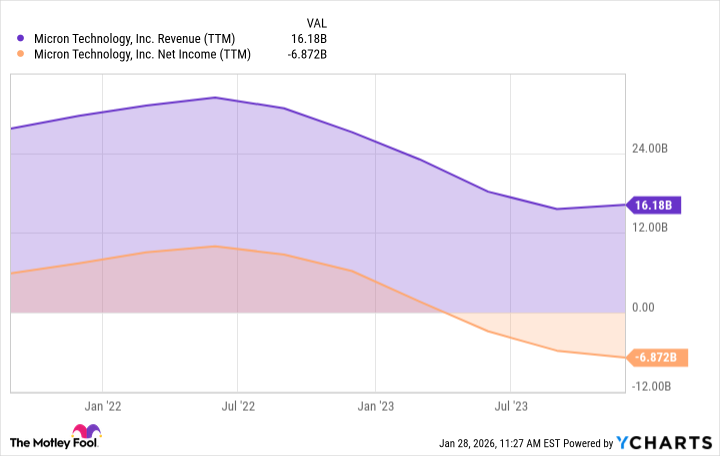

The average annual return, a mere 9.1%, trailed the S&P’s 9.7% – a difference slight enough to be dismissed as statistical whimsy, yet persistent enough to warrant a raised, skeptical eyebrow. The artificial intelligence bloom, then in its nascent phase, hadn’t yet recognized the humble memory chip as a vital organ in its digital body. Supply wasn’t constricted, prices had retreated by more than half from the summer of ’21, and Micron, consequently, found itself expending more currency than it garnered – a distinctly unharmonious state of affairs.

The Insatiable Appetite of Data

But the tectonic plates of the market, as they so often do, shifted. The year 2025 witnessed a tightening of the memory market, a consequence of hyperscale AI specialists constructing vast data cathedrals – monuments dedicated to large language models, generative artifices, and other services with an insatiable appetite for memory. A digital gluttony, one might observe.

The price of last-generation DDR4 memory modules experienced a 37% ascent over the past two years. More modern DDR5, a more sophisticated breed, nearly tripled in value. Yet these are merely the appetizers. The true delicacy, the bleeding-edge high bandwidth memory (HBM), is what truly excites the palate of AI servers. These chips, costing roughly four times that of standard DRAM, have become Micron’s singular focus, a strategic pruning of consumer-grade production to cultivate this far more lucrative strain. A rather elegant botanical analogy, wouldn’t you agree?

Every Nvidia accelerator card, a vessel of computational power, carries a substantial cargo of this precious HBM. The recently unveiled Vera Rubin superchip, for example, boasts half a terabyte of it – accompanied by a more pedestrian 1.5 terabytes of DDR5 for the system processor. In essence, Micron plays a significant, if often overlooked, supporting role in Nvidia’s grand narrative. A silent partner, if you will, in the choreography of silicon and code.

A Cycle Renewed, or Something More?

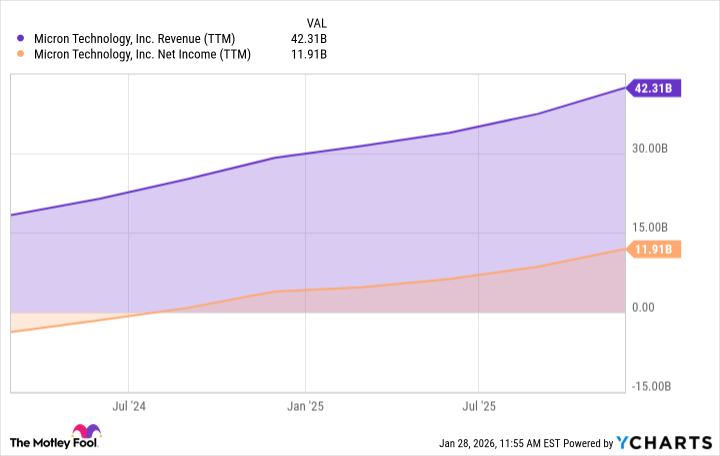

This reversal of fortune, this cyclical upswing, feels… different. If the AI bloom persists, and all indications suggest it will, Micron may be poised for an extended period of prosperity. Management anticipates chip shortages well into 2028, a forecast that lends a certain weight to the optimism. And the explosive growth of the HBM market is reshaping the entire industry, rearranging the constellations of supply and demand.

“We forecast an HBM TAM CAGR of approximately 40% through calendar 2028, from approximately $35 billion in 2025 to around $100 billion in 2028,” Micron’s CEO, Sanjay Mehrotra, declared in December’s Q1 2026 earnings call. “Remarkably, this 2028 HBM TAM projection is larger than the size of the entire DRAM market in calendar 2024.” A rather audacious claim, one might say, yet supported by the momentum of the market.

Thanks to this transformative trend, Micron’s revenues have doubled in the past two years, and profits have swung decisively into positive territory – not by a negligible margin, either. The trailing net margin now stands at a robust 28%. A pleasingly symmetrical number, wouldn’t you concur?

A Stock Ascendant

Wall Street, predictably, has taken notice of Micron’s resurgence, sending the stock soaring in recent months. Whether one examines returns over the past month, year, three years, or decade, Micron consistently ranks among the top performers in the S&P 500. A rather impressive pedigree, wouldn’t you say?

| Price Performance Period | Micron | S&P 500 |

|---|---|---|

| Month | 51% | 1% |

| 1 year | 371% | 16% |

| 3 years | 594% | 74% |

| 10 years | 4,171% | 275% |

Assuming the AI bloom continues to flourish, Micron has established itself as a high-octane growth stock for the long term. The stock isn’t exactly cheap by conventional metrics, but the narrative shifts when one accounts for its projected growth. Trading at 9.9 times forward earnings estimates, the PEG ratio is a mere 0.13 – essentially tied for the lowest in the S&P 500. From this perspective, Micron’s shares may be profoundly undervalued. A curious anomaly, wouldn’t you agree?

So Micron is currently crushing the market, and the stock appears poised to maintain its outperformance for some time to come. As a longtime Micron investor, that is music to my ears. Like the best synth riffs of the 1980s, delivered over ultramodern memory channels. A rather apt metaphor, don’t you think?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

2026-01-30 20:52