Now, listen closely. There was this company, Micron Technology, see. Not a terribly exciting name, I grant you. Sounds like something you’d find lurking in a dusty laboratory. But these chaps, they make memory chips. Tiny little things, but absolutely vital. Like the brain cells of computers, only much, much smaller. And recently, demand for these little brain cells has gone quite bonkers. A mere two years ago, ten thousand dollars slipped into their coffers would now be worth… well, nearly fifty-two thousand! A rather splendid return, wouldn’t you say?

The reason? Artificial Intelligence, of course. A monstrous, ever-hungry beast demanding more and more memory to stuff its digital gullet. Data centers are popping up like particularly unpleasant mushrooms, and each one requires mountains of these memory chips. Supply is struggling to keep up, which, as any sensible market observer knows, means prices go… well, upwards! And upwards, and upwards. The good news for Micron investors is that this peculiar situation is likely to persist for a good few years yet.

But the question is, could ten thousand dollars today blossom into a full million? Let’s have a ponder.

Micron’s Long-Term Prospects: A Rather Tall Order

To turn ten thousand into a million, the stock would need to multiply by a hundred. A hundred! That’s a rather hefty jump, isn’t it? Micron’s currently worth around four hundred and sixty-three billion dollars. To reach a trillion-dollar valuation would require a market capitalization equivalent to a considerable chunk of the entire world’s economic output. A bit ambitious, even for a company dealing in the utterly fantastical world of microchips.

However, don’t entirely dismiss the possibility of a fortunate outcome. Adding Micron to a diversified portfolio, a sensible precaution against the unpredictable whims of the market, could indeed help an investor reach millionaire status. It still possesses a considerable amount of potential, even after its recent, rather impressive, gains. The AI-fueled demand is likely to keep memory prices buoyant through 2028, particularly as the manufacturers are being remarkably restrained with expanding their production capacity. They seem to be aiming for profit, can you believe it?

The three largest memory manufacturers are indeed building new factories, enormous glass and steel cathedrals dedicated to the creation of these tiny chips. But these facilities won’t be churning out product anytime soon. This means, according to the clever chaps at TrendForce, the memory market’s revenue is expected to jump to a whopping five hundred and fifty-two billion dollars in 2026, up from two hundred and thirty-five billion last year. And then, an even bigger leap to almost eight hundred and forty-three billion in 2027. Micron, naturally, is well-positioned to capture a generous slice of this expanding pie.

Their share of the dynamic random-access memory (DRAM) market has been steadily increasing, putting them in a rather solid position to sustain their impressive growth in revenue and earnings. A clever move, wouldn’t you agree?

A Multibagger Still Possible

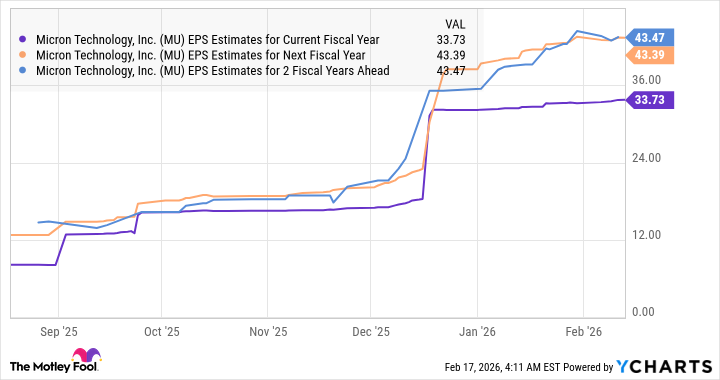

The consensus estimates suggest Micron’s earnings could quadruple this fiscal year, reaching a rather handsome thirty-three dollars and seventy-three cents per share. The forecasts for the next couple of years suggest a cooling down of this growth rate. But I suspect it may not moderate as predicted. The insatiable demand for AI-capable servers is gobbling up the world’s memory supply at an alarming rate.

Chip designer AMD anticipates the data center AI chip market to grow to a staggering one trillion dollars by 2030. And these processors, naturally, require memory manufactured by Micron and others. So, there’s a good chance the company will sustain its terrific momentum. A rather clever arrangement, wouldn’t you say?

Moreover, Micron is currently trading at just thirteen times forward earnings. If it were to trade in line with the tech-focused Nasdaq-100 index’s forward earnings of twenty-five, the stock could multiply from its current levels, given its earnings growth potential. A rather enticing prospect, wouldn’t you say?

All of this makes Micron a remarkably sensible AI stock to buy right now, especially if you’re looking to grow a million-dollar portfolio. A rather splendid investment, wouldn’t you agree? Just remember, the market is a fickle beast. And always, always, be wary of anyone promising guaranteed riches.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2026-02-19 17:42