![]()

The relentless march of artificial intelligence – a force both promising and terrifying – compels a reassessment of the technological landscape. The hyperscalers, those modern titans building digital empires, are not merely planning to expand; they are driven by an almost feverish compulsion, a desperate need to solidify their dominion over the future. FactSet Research whispers of over $500 billion earmarked for data centers and chips by 2026, a sum that speaks not of prosperity, but of a profound anxiety – the fear of being left behind in this accelerating age.

To assume this expenditure benefits only the usual suspects – Nvidia, AMD, Broadcom, Taiwan Semiconductor – is a dangerously simplistic view. It’s a failure to grasp the subtle currents beneath the surface, the hidden dependencies that bind these giants together. We are all, after all, interconnected, caught in a web of mutual reliance, and the strength of the whole depends on the least visible strand.

Thus, my gaze falls upon Micron Technology (MU 4.80%). Not as a mere component supplier, but as a reflection of the deeper psychological forces at play. A company poised on the precipice of either extraordinary ascent or agonizing collapse, much like the souls Dostoevsky so meticulously dissected.

The Weight of Memory, The Burden of Progress

The developers, these architects of the new reality, are no longer content with chatbots and superficial applications. They crave something more substantial, more demanding – agentic AI, robotics, autonomous systems. These are not mere toys, but extensions of human will, imbued with a nascent intelligence that both fascinates and frightens. And what fuels these ambitions? Memory. Storage. The very capacity to remember, to learn, to evolve. This is where Micron resides, at the heart of the machine’s awakening.

The era of indiscriminate chip acquisition is waning. The hyperscalers are growing discerning, realizing that quantity must yield to quality. They seek not simply more processing power, but optimized memory – high-bandwidth memory (HBM), dynamic random access memory (DRAM), and NAND chips – the very foundations upon which these complex systems are built. Micron, then, is not merely participating in this expansion; it is becoming indispensable.

A Triple Ascent? The Illusion of Certainty

The past year has witnessed a staggering 277% surge in Micron’s share price. A meteoric rise, indeed. One might reasonably suspect a correction is imminent, a return to the mundane realities of market gravity. And yet, to assume such a predictable outcome is to underestimate the power of this secular tailwind, this relentless demand for memory and storage. The market, like a tormented soul, often defies logic.

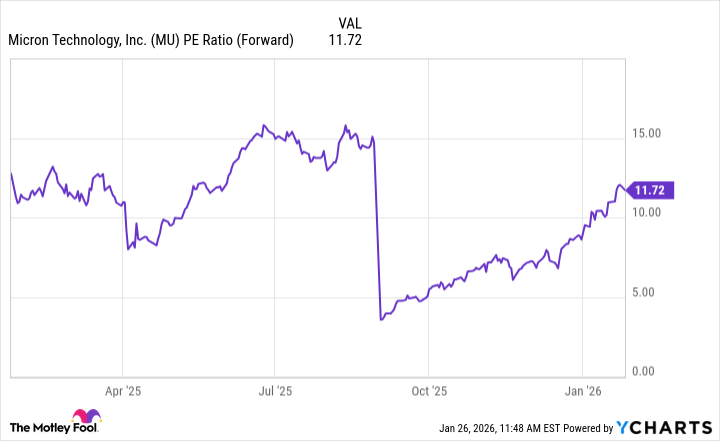

Even with these gains, Micron’s forward price-to-earnings (P/E) ratio remains remarkably modest. A pale shadow compared to its peers, those other chip leaders boasting multiples in the 30s and beyond. This disparity is not merely an anomaly; it’s a symptom of a deeper miscalculation, a failure to recognize Micron’s true potential. The market, it seems, is slow to awaken to the truth.

Wall Street anticipates a tripling of Micron’s earnings per share this fiscal year. A bold prediction, perhaps, but not entirely unreasonable. The confluence of factors – the relentless demand for AI infrastructure, the critical importance of memory and storage – suggests a trajectory that is, at the very least, promising. To deny this possibility is to succumb to a debilitating cynicism.

Should Micron’s forward P/E align with its competitors, a surge to $1,000 per share is not merely conceivable; it’s almost inevitable. A substantial return, certainly, but one that is, in my estimation, entirely justified. The market, after all, is not driven by reason, but by emotion, by fear, and by the insatiable desire for growth.

Regardless of where Micron’s stock ultimately lands by 2026, I remain confident that it will ascend, meaningfully and relentlessly. Not because I possess some infallible foresight, but because I have glimpsed, within the company’s trajectory, a reflection of our own collective striving, our own desperate search for meaning in a world consumed by change. And that, my friends, is a force that cannot be easily ignored.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2026-01-31 19:22