- Strategy acquired an extra 3.4k BTC for $285M raised through the sale of MSTR stock

- Firm still has a $37 billion capital raising capacity yet to be deployed for BTC buys

On the 14th of April, Michael Saylor, creator of Strategy (previously known as MicroStrategy), disclosed that the company purchased an additional 3,459 Bitcoins [BTC] at a total cost of $285.8 million.

Strategy, a leader in Bitcoin corporate holdings, currently possesses approximately 531,644 Bitcoins. This news didn’t come as a shock, given the hint dropped by Saylor more recently – “There’s no tax on Bitcoin (represented by orange dots)”.

What’s next for BTC?

According to a document filed with the Securities and Exchange Commission (SEC), the recent purchase was made possible through the selling of MSTR shares.

According to the company’s strategy for acquiring $42 billion (a combination of $21 billion in debt and $21 billion through stock issuance), there remains an opportunity to raise an additional $37.6 billion via different means.

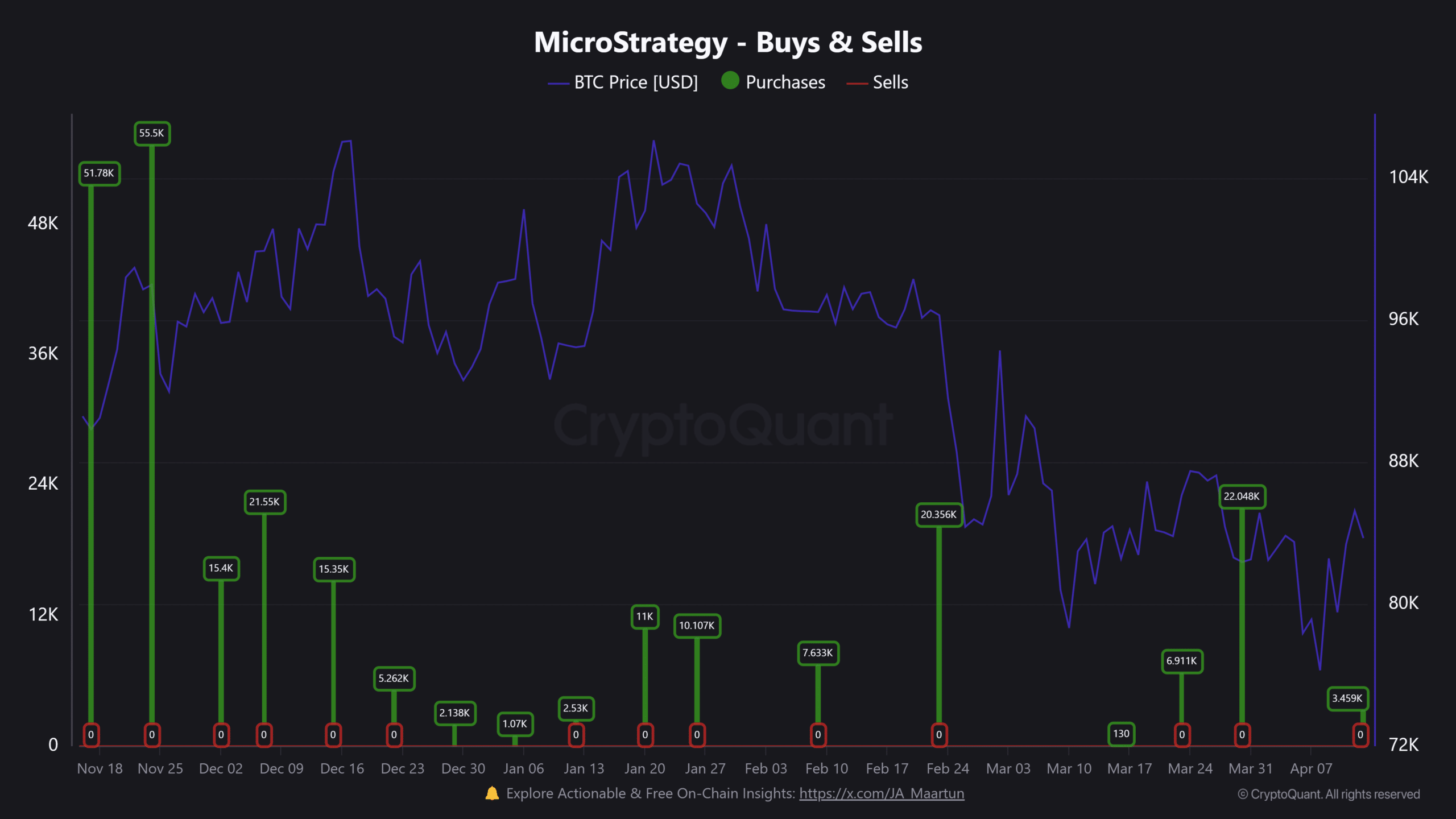

It’s been suggested by some analysts that the recent Bitcoin price movements from last week may have been influenced or triggered by Strategy’s bidding actions.

“That explains last week’s relative strength. Was all just Saylor.”

Bitcoin experienced a 7% surge over the past week, reaching as high as $86,000. As we speak, its value stands at around $85,000, falling slightly below the key bull support level of the 200-day simple moving average.

Speaking of which, the spending in 2025 has been significantly smaller than that seen in late 2024. Simultaneously, the value of Bitcoin dropped from approximately $109,000 to as low as $74,000, but it’s since held steady above $70,000.

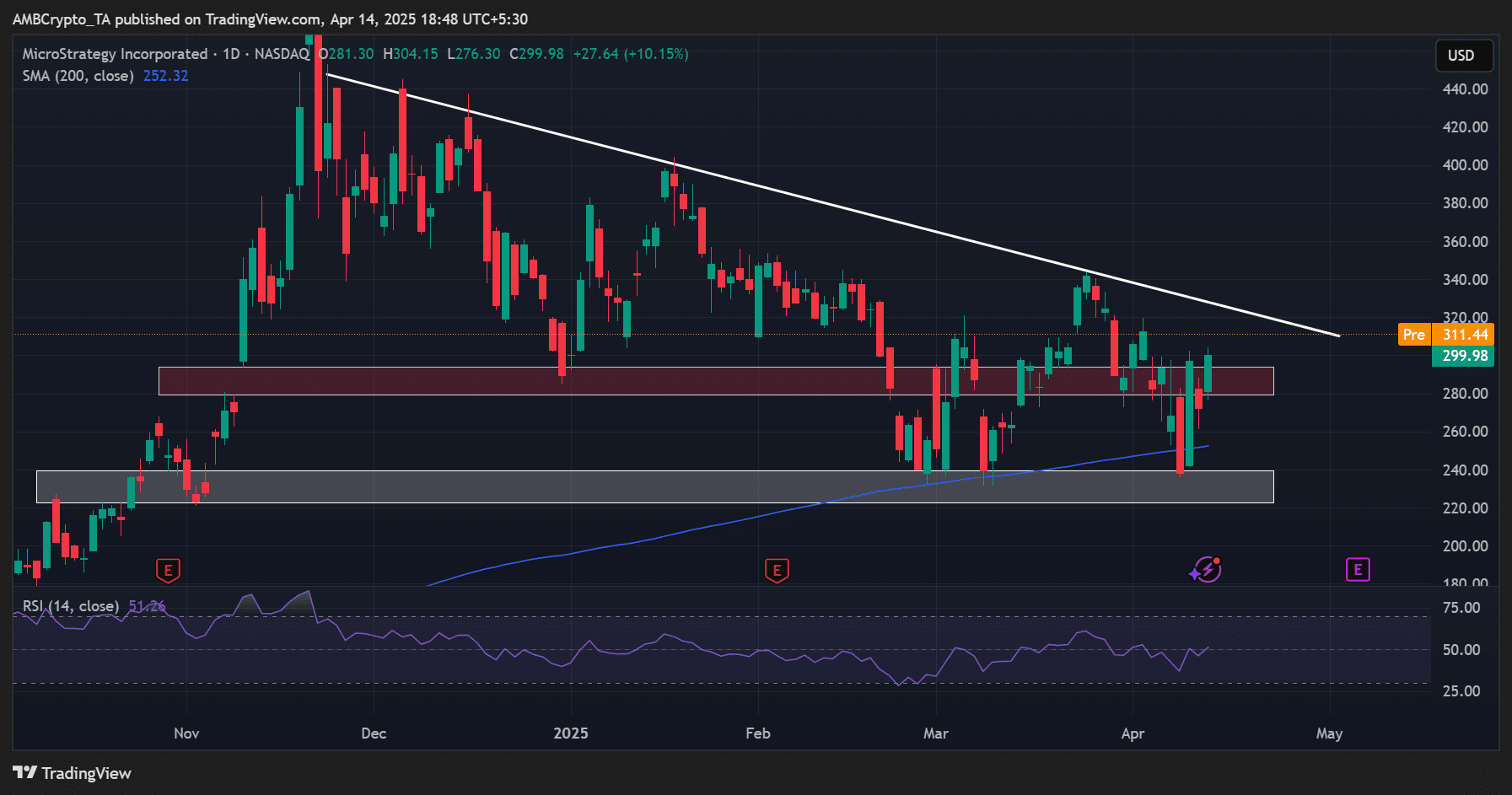

Consequently, Strategy’s potential earnings dropped by approximately $10 billion, from around $19 billion to $9 billion – Indicating a significant loss of $10 billion. The volatility in the price of Bitcoin seemed to impact MSTR as well. Since last November, Strategy’s shares have been experiencing a downtrend.

Over the last two months, it hit a local low near the 200-day moving average (represented by blue), fluctuating between approximately $230 and $330. If this upward trend continues beyond the trendline resistance, it could give bulls the strength to push prices even higher.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-15 11:14