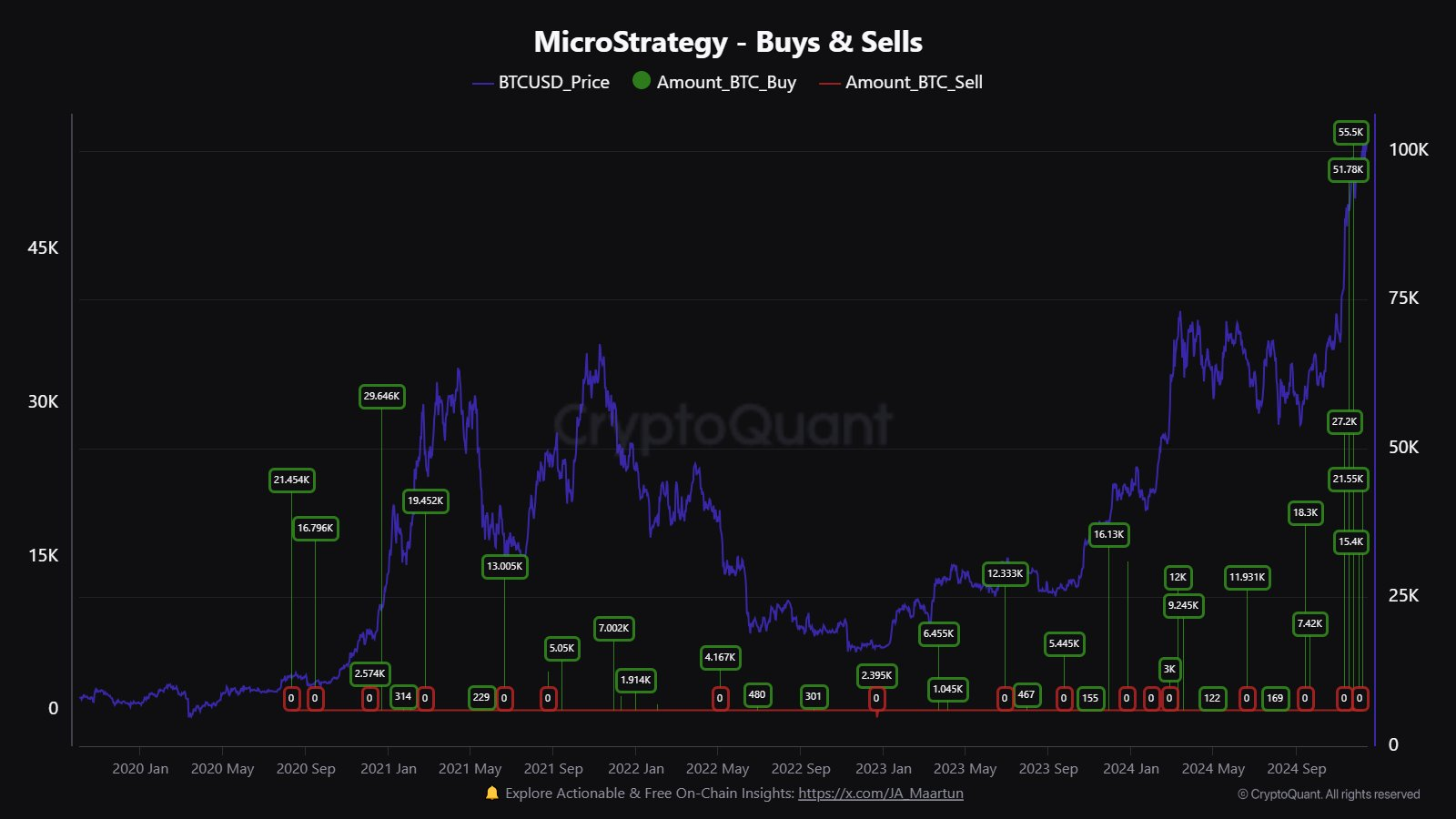

As a seasoned analyst with over two decades of experience in the tech and financial sectors, I find MicroStrategy’s continued interest in Bitcoin acquisitions intriguing. The company’s recent inclusion in the Nasdaq-100 Index is a testament to its growing influence, and if history repeats itself, we might expect another significant Bitcoin purchase from MicroStrategy soon.

Michael Saylor, a co-founder of MicroStrategy, has ignited discussions about potential large-scale Bitcoin purchases.

After being added to the prestigious Nasdaq-100 Index, this is a notable achievement indicating the company’s expanding impact in technology and finance industries.

MicroStrategy Eyes Bitcoin Acquisition

On December 15th, Saylor subtly raised doubts about whether the SaylorTracker, which is used to monitor the company’s Bitcoin investments, might have overlooked a green symbol. Typically, this green symbol indicates fresh Bitcoin purchases, leading some in the cryptocurrency community to speculate that a new acquisition could be imminent.

For the past five weeks, Saylor has been making discreet suggestions about buying Bitcoins on social media, which were later followed by formal declarations of significant purchases every Monday. In this timeframe, MicroStrategy significantly increased its Bitcoin holdings to more than 171,000 BTC, investing approximately $15 billion in the process.

Should MicroStrategy verify a fresh acquisition, it would represent their first Bitcoin purchase since they became part of the Nasdaq-100 Index on December 13. Analysts consider this membership as a possible indicator that the company might soon join the S&P 500, an index that follows the performance of the 500 biggest U.S. companies.

According to James Van Straten from CoinDesk, all that’s left for MicroStrategy to join the S&P 500 is demonstrating profits in the last four quarters.

According to Van Straten’s prediction, if FASB gets implemented in the first quarter of 2025 and the price of Bitcoin remains at $120,000 without any additional BTC purchases, MicroStrategy (MSTR) could potentially generate approximately $25 billion in net income. This scenario could see MSTR being added to various financial reports as early as the second quarter of 2025.

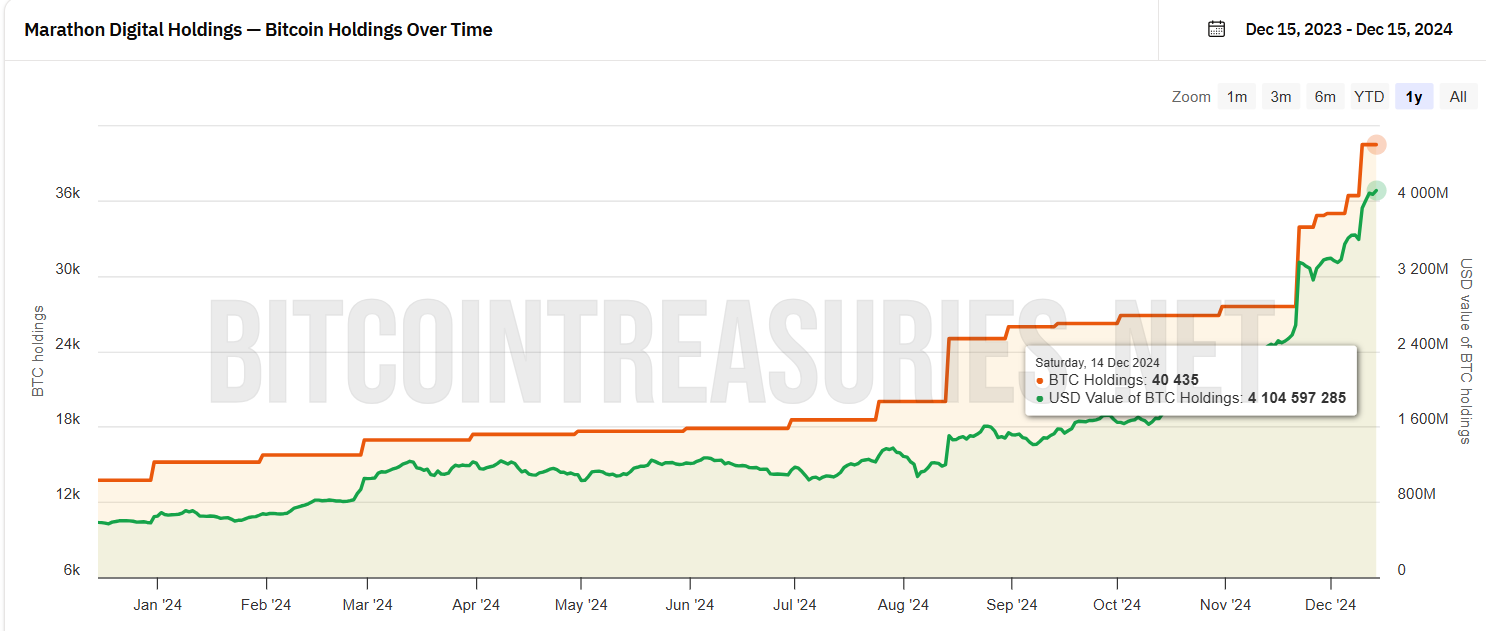

Marathon Digital Targets Nasdaq-100 Entry

As MicroStrategy solidifies its standing, Marathon Digital Holdings is striving to match its success. Saylor predicts that Marathon could be the next Bitcoin-focused firm to gain a place on the Nasdaq-100, following in the footsteps of MicroStrategy. In a recent post on December 14th, he expressed his faith in Marathon’s growth trajectory, in response to CEO Fred Thiel’s congratulatory message.

“Thanks Fred. I expect MARA will be the next,” Saylor stated.

For Marathon, the path forward remains demanding as its market value currently falls below the $10 billion mark, significantly less than MicroStrategy’s previous figures. Nevertheless, Marathon has been proactive in its Bitcoin approach, investing over a billion dollars this month alone to boost its Bitcoin holdings to approximately 40,435 coins, now worth nearly $3.9 billion.

In brief, this purchase strengthens Marathon’s status as the second biggest corporate Bitcoin owner, with MicroStrategy holding the top spot. With each additional Bitcoin acquisition, Marathon is establishing itself as a significant player in the emerging world of institutional cryptocurrency investments.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

2024-12-15 21:54