As a seasoned researcher with years of experience following the tech industry and cryptocurrencies, I have to admit that Michael Saylor’s latest tease about MicroStrategy’s potential Bitcoin acquisition has me intrigued. Having closely monitored the company’s meteoric rise this year, I have come to appreciate Saylor’s knack for making strategic moves that shake up the market. His cryptic post on X regarding the “disconcerting blue lines” on SaylorTracker is a classic example of his ability to create buzz and generate excitement among investors.

Having followed MicroStrategy’s journey from an enterprise analytics company to a Bitcoin heavyweight, I am well aware that their aggressive strategy has been met with both admiration and criticism. However, I believe that the company’s success can be attributed to Saylor’s foresight and bold decision-making.

In terms of the potential impact on Bitcoin and MicroStrategy’s stock price, I think it is safe to say that we are in for a rollercoaster ride if another large-scale buy is indeed imminent. As someone who has witnessed the volatility that follows Saylor’s announcements, I am bracing myself for the inevitable shorting and retracement, followed by potential gains once the dust settles.

Finally, as a light-hearted aside, I can’t help but chuckle at the irony of it all: MicroStrategy, a company that started out helping businesses make smart data decisions, is now making one of the biggest bets on Bitcoin, a notoriously volatile and unpredictable asset. It’s like watching a game of chess where the pieces keep moving in unexpected ways, keeping me on my toes and making every day exciting!

Michael Saylor, a co-founder of MicroStrategy, has sparked discussions once again about the potential upcoming large-scale purchase of Bitcoin by the company.

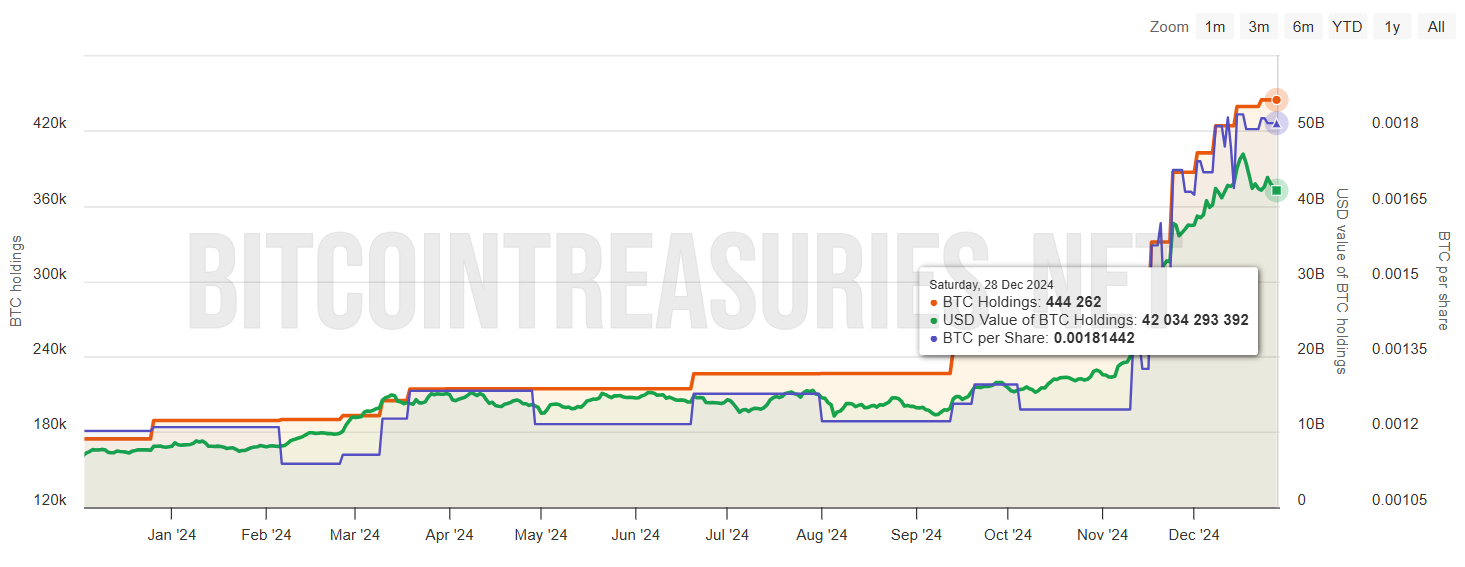

On December 28th, Saylor utilized social media platform X to post mysterious observations regarding the SaylorTracker portfolio, a tool that tracks MicroStrategy’s Bitcoin acquisitions.

A Hint of More Bitcoin Ahead?

In his latest update, Saylor pointed out some “unsettling blue lines” on the chart, fueling rumors that a significant Bitcoin purchase could be just around the corner. Notably, such indications from Saylor often come before he makes formal declarations about substantial Bitcoin investments.

“Disconcerting blue lines on SaylorTracker,” Saylor stated.

MicroStrategy has been on a massive Bitcoin purchasing spree, amassing approximately 192,042 Bitcoins at an approximate cost of $18 billion. Over this period, the price of Bitcoin rose from $67,000 to $108,000. Simultaneously, MicroStrategy’s stock price has skyrocketed more than fivefold in 2021, currently trading around $360 – a significant increase of 400% compared to the year-to-date figures.

MicroStrategy’s stock success and addition to the Nasdaq-100 have been quite impressive. The company’s transition from primarily dealing with enterprise data analytics to amassing a significant amount of Bitcoin has made it the biggest public owner of cryptocurrency. Yet, this bold approach has drawn some skepticism.

Certain market observers contend that when Saylor publicly reveals his Bitcoin acquisitions, it triggers market volatility. Detractors suggest that once these transactions are made public, some day traders sell Bitcoin short, causing a temporary decrease in its price and negatively impacting MicroStrategy’s share value.

As a seasoned crypto trader with years of experience under my belt, I’ve noticed a recurring pattern that has cost me dearly on more than one occasion: Saylor’s Bitcoin purchases. Every time he announces a purchase, it triggers an immediate reaction from day-traders who start shorting BTC, knowing full well that the big buyer has finished their transactions. The result? A sudden drop in Bitcoin’s value and a subsequent decline in $MSTR stock prices, instead of the expected rise. It’s frustrating to see my investments take such a hit due to this predictable pattern, and I can only hope that Saylor will find a way to keep his purchasing strategies under wraps in the future.

Furthermore, it’s been proposed that the pattern of purchases might have been affected by their announced intention to halt Bitcoin buying during a blackout period in January. During this time, they won’t be making any Bitcoin acquisitions.

It appears that Bitcoin purchases are likely to continue unabated according to initial signs. On the other hand, MicroStrategy is making preparations for its future moves. These steps involve boosting the number of authorized shares for Class A common stock and preferred stock. The plan is to increase Class A stock from 330 million to over 10 billion shares and preferred stock from 5 million to 1 billion.

Experts predict that this action could substantially expand its ability to sell additional shares, thereby providing more resources for potential Bitcoin investments.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-30 02:18