As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by Michael Saylor’s ambitious Bitcoin strategy for the United States. His vision to establish a Strategic Bitcoin Reserve (SBR) is indeed bold and innovative, leveraging his deep understanding of the digital asset sector. The incorporation of crypto advocates into MicroStrategy’s Board of Directors underscores his commitment to this cause.

Michael Saylor, currently serving as the Executive Chair at MicroStrategy, has shared his Bitcoin-focused plan aiming to make the U.S. a frontrunner in the rapidly developing digital economy landscape.

Having spent the past decade working in the fast-paced world of finance and technology, I have witnessed firsthand the rapid evolution of digital assets and their potential to revolutionize our financial landscape. Given my extensive background in this field, it is no surprise that I am thrilled about my company’s recent decision to expand its Board of Directors, adding prominent crypto advocates to strengthen its strategic focus on digital assets. This move underscores the growing importance of blockchain technology and digital currencies within our industry, and I believe it positions us at the forefront of this exciting development. As someone who has dedicated my career to understanding and navigating these complex financial systems, I eagerly anticipate the opportunities that this expansion will bring for both our company and our clients as we continue to innovate and push the boundaries of what is possible in the digital asset space.

Saylor Advocates for Bitcoin Reserve

On December 20th, Saylor outlined his plan to establish a Strategic Bitcoin Reserve (SBR), which aims to tackle economic difficulties, further strengthen the U.S. dollar‘s leading position, and open up unparalleled growth prospects within the digital assets industry.

According to Saylor, a well-planned digital asset policy could fortify the US dollar, balance out our national debt, and establish America as a dominant player in the 21st-century digital economy. This, in turn, would stimulate countless businesses, spur economic growth, and potentially generate immense wealth totaling trillions of dollars.

Saylor’s proposal outlines how a robust digital asset policy could create a capital markets renaissance, unlocking trillions in value. He envisions a $10 trillion digital currency market driving demand for US Treasuries while fostering growth in digital assets.

Additionally, he thinks broadening this market might boost the digital economy’s worth from a trillion dollars to an astounding 590 trillion dollars, with the U.S. taking the front seat in this expansion.

Saylor proposed that setting up a Bitcoin reserve could potentially generate between 16 and 81 trillion dollars in wealth for the U.S. Treasury, offering a means to mitigate our country’s debt burden,” is a natural and easy-to-read paraphrase of the original statement.

Although these assertions are strong, doubters such as investor Nic Carter continue to express reservations. Carter contends that the SBR idea is unclear and might not fortify the dollar but instead create market instability instead.

He points to Bitcoin’s volatility, referencing its recent price dip from over $108,000 to $92,000, as evidence that it may not be a reliable reserve asset. Additionally, Carter believes such a move could undermine the dollar’s global position rather than enhance it.

“I don’t support a Strategic Bitcoin Reserve, and neither should you,” Carter stated.

New MicroStrategy Board Members Bring Crypto Expertise

As a crypto investor, I recently learned that the board of a Bitcoin-centric company has welcomed some new members, as stated in a December 2021 SEC filing. Among these additions are Brian Brooks, who previously led Binance US and is well-known for his role in cryptocurrency regulations; Jane Dietze, the Chief Investment Officer at Brown University; and Gregg Winiarski, holding the position of Chief Legal Officer at Fanatics Holdings.

The freshly appointed board members each possess a range of skills spanning finance, technology, and up-and-coming markets, complementing MicroStrategy’s overall strategic aims. Notably, Brooks is recognized for his extensive knowledge in regulatory matters and cryptocurrencies. He has occupied key positions at prominent digital currency companies such as Coinbase and BitFury Group, and also served temporarily as the Acting Comptroller of the Currency.

In addition, Dietze has been part of the board at the cryptocurrency asset management company Galaxy Digital, and Winiarski brings expertise from a private, worldwide digital sports platform.

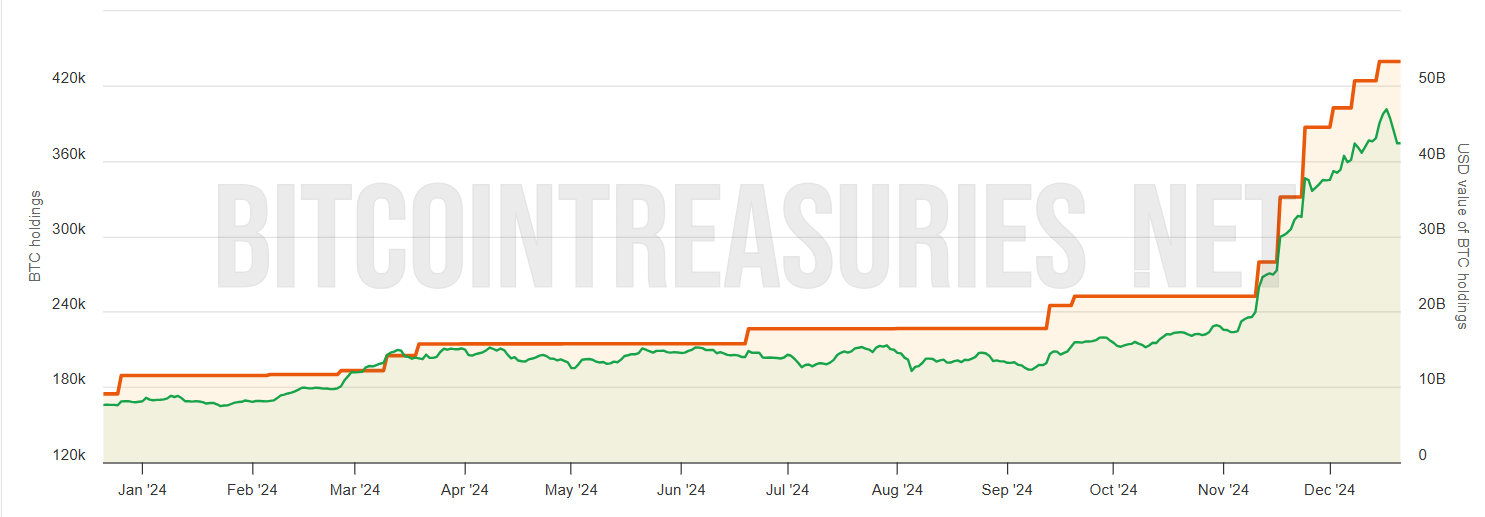

In simple terms, MicroStrategy is the corporation with the most Bitcoin shares on the open market, as per Bitcoin Treasuries’ records. The company presently owns approximately 439,000 Bitcoins, which are worth more than $43 billion.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-21 14:25