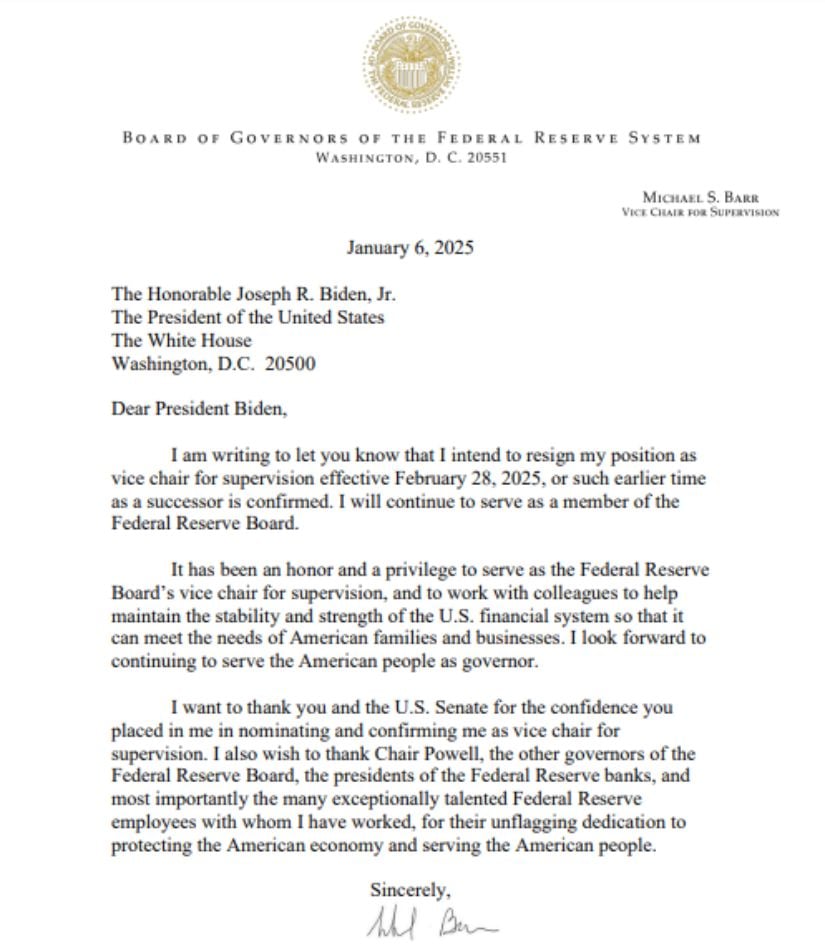

Making this decision more than a year prior to his term’s end in mid-2026 represents a substantial change in American financial regulations. Notably, Barr is going to continue serving on the Federal Reserve Board of Governors.

His resignation occurs while there’s talk about possible legal conflicts with the incoming Trump administration. Rumors indicate that Trump’s advisors might have aimed to replace Barr from his oversight position, which may have sparked legal disagreements and brought up concerns regarding the Fed’s autonomy. In his declaration, Barr mentioned avoiding distractions as the cause for his premature exit, explaining, “The possibility of a dispute over the role could divert attention from our objectives.

Implications for Crypto Regulation

During Barr’s tenure, he was known for his strong stance towards cryptocurrency regulation, which some in the crypto community perceived as a barrier to industry expansion. He advocated for more stringent rules regarding stablecoins and cautioned banks against holding digital assets directly, labeling such actions as potentially dangerous and unwise. This strategy faced criticism from crypto supporters and certain legislators who believed it hampered innovation, arguing that it was overly restrictive.

Senator Cynthia Lummis, a strong advocate for cryptocurrency, publicly rebuked Barr, alleging that he was fostering “Operation Chokepoint 2.0,” a term used by industry leaders to depict what appears to be a coordinated effort to exclude crypto companies from banks. In her recent comments, Lummis stated, “Barr failed to carry out his responsibilities, allowing for unlawful overreach that harmed Wyoming’s digital asset sector.”

A Changing Regulatory Landscape

Barring’s exit opens up opportunities for the Trump administration to install new financial regulators, possibly leading to more favorable policies towards cryptocurrencies. Supporters of cryptocurrency are optimistic about this change, as key figures who advocated for restrictive crypto policies have either resigned or announced their departures from their positions.

In the face of criticism, Barr supported careful regulation of stablecoins and conducted studies into central bank digital currencies (CBDCs), which some industry experts consider essential for promoting cryptocurrency acceptance within the U.S. His balanced stance on innovation and risk management earned him both admiration and controversy during his tenure in office.

Industry Reactions

The resignation of Barr has brought about optimism within the crypto community, as they anticipate a regulatory landscape more favorable to technological advancement. Brian Gardner, a strategist in policy at Stifel, viewed it as beneficial for banks, suggesting there might be less stringent regulations and a change in focus towards supervision.

Custodia Bank’s CEO, Caitlin Long, labeled Barr as the “main enforcer of the Federal Reserve limiting banks from dealing with cryptocurrencies,” highlighting the discontent within the crypto community regarding his policies. Simultaneously, former U.S. prosecutor and crypto proponent John Deaton emphasized the significance of examining supposed attempts to stifle the cryptocurrency sector, arguing, “If these actions are left unchecked, it sets a harmful precedent.

Future Outlook

As Donald Trump’s presidency begins, there is ongoing speculation about the Federal Reserve’s regulatory stance. Possible contenders for the vice chair position, such as Michelle Bowman and Christopher Waller, are known critics of previous policies and could bring a change in perspective if appointed. This potential shift might indicate a significant evolution in the Fed’s handling of digital assets.

At present, the crypto world eagerly anticipates fresh leadership, hoping for a balance between protecting the traditional financial system and promoting growth within the digital economy. Similarly, crypto investors are optimistic that the current bull market, predicted to peak by 2025, will thrive under President Trump’s administration. This scenario appears more probable with each passing day, and we wholeheartedly welcome it. Let’s get ready for the Trump Rally in 2025. It’s time to accumulate Bitcoin (Sats), everyone!

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DODO PREDICTION. DODO cryptocurrency

2025-01-08 18:16