They call them the Magnificent Seven. A boastful name, fit for a traveling circus, not for companies that quietly shape the lives of billions. It began as a Western tale, a gathering of gunslingers. Now, it’s a handful of tech giants, each vying for dominance in a world increasingly tethered to the digital realm. They promise innovation, speak of artificial intelligence as if it were a benevolent god, and consistently deliver earnings – for themselves, at least. The rest of us… we consume.

These companies have become fixtures in our daily routines, woven into the fabric of modern existence. Their success is undeniable, a relentless upward climb reflected in the stock market. They’ve propelled the S&P 500 higher, a tide lifting all boats, though some yachts benefit more than others. But momentum, like any force, can falter. And the question isn’t whether these giants will fall, but when, and how far.

The valuations, naturally, suggest invincibility. Yet, a closer look reveals cracks in the facade. Some trade at reasonable levels, and one, in particular, stands out as… inexpensive. Meta Platforms. A curious case, indeed. Is it a bargain, a trap for the unwary, or a genuine opportunity? Let us examine the bones of this beast, and see what secrets they hold.

The Price of Dreams

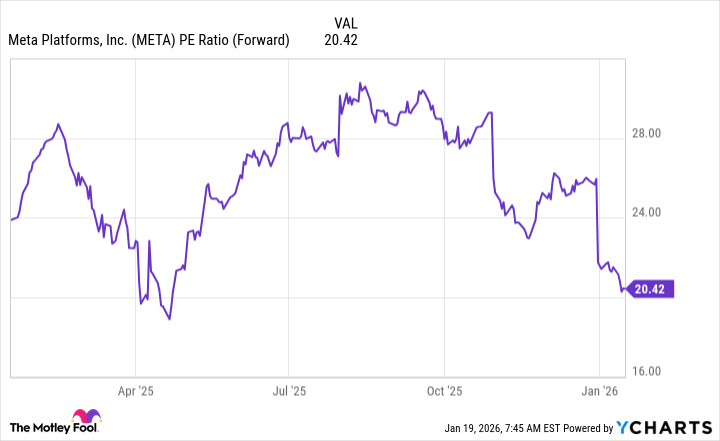

The Magnificent Seven, laid bare. As the charts demonstrate, Meta stands apart. A mere 20 times forward earnings, while its brethren command at least 28 times, and some, far more. A discrepancy, certainly. Is it a sign of weakness, a reflection of underlying problems, or simply a temporary mispricing? The market, after all, is rarely rational. It’s a fickle beast, driven by fear and greed, and often, by sheer speculation.

A glance further reveals Meta trading at its lowest valuation in a year. A whisper of doubt, perhaps, a premonition of trouble. Or, just a fleeting opportunity for those willing to look beyond the headlines. It’s a game of perception, after all. And the market often rewards those who see what others miss.

Meta, of course, is best known for its social media empires – Facebook, Messenger, Instagram, WhatsApp. Billions of faces staring into screens, sharing their lives, their dreams, their anxieties. A vast ocean of data, meticulously collected, analyzed, and monetized. Advertising, the lifeblood of this operation. Advertisers flock to Meta, eager to reach this captive audience. A simple equation: attention equals profit. But attention is a finite resource, and the competition for it is fierce.

This business model has been lucrative for Meta, allowing it to accumulate wealth and invest in future growth. A dividend launched in 2024, a gesture of stability, a sop to shareholders. But beneath the surface, a restless energy, a relentless pursuit of the next big thing.

The AI Illusion

And so, to artificial intelligence. The latest obsession, the promised land. Meta recognized the potential years ago, and has been pouring resources into this new frontier. Data centers sprouting like mushrooms, algorithms refined and perfected, a large language model constantly evolving. And now, Meta Superintelligence Labs, a division dedicated to the pursuit of… what, exactly? The creation of a digital god? The automation of human thought? The possibilities are both exhilarating and terrifying.

The hiring of Alexandr Wang, founder of Scale AI, a student prodigy, to lead this division, is a clear signal of intent. Meta is serious about AI. It aims to automate advertising entirely by 2026, to streamline the process, to generate better results. A seductive vision, promising efficiency and profit. But what of the human cost? The jobs lost, the skills rendered obsolete? These are questions rarely asked, let alone answered.

The Weight of Ambition

Advertising drives Meta’s revenue, undoubtedly. A victory in AI-powered advertising could be substantial. But success is not guaranteed. The effort requires massive investment, and carries inherent risks. The stock has suffered in recent months, reflecting these concerns. Investors worry about overcapacity, about the potential for slowdown.

Mark Zuckerberg, ever the pragmatist, addressed these concerns in a recent earnings call. Demand for compute remains high, he claims. And in the worst-case scenario, Meta can slow its buildout, grow into existing infrastructure. A convenient reassurance, perhaps, but one that rings hollow to those who have witnessed the relentless expansion of this digital empire.

Today, considering Meta’s reasonable valuation, and the points outlined above, the stock appears to be a worthwhile gamble. A potential rollout of AI advancements in advertising could serve as a catalyst for revenue and stock price growth in 2026, or beyond. But remember this: the market is a cruel mistress. And even the most magnificent of seven can fall.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-21 13:13