This action makes the Tokyo-listed corporation the biggest corporate Bitcoin holder in Asia, adding more weight to its status as a pioneer in embracing digital assets.

A Strategic Shift Towards Bitcoin

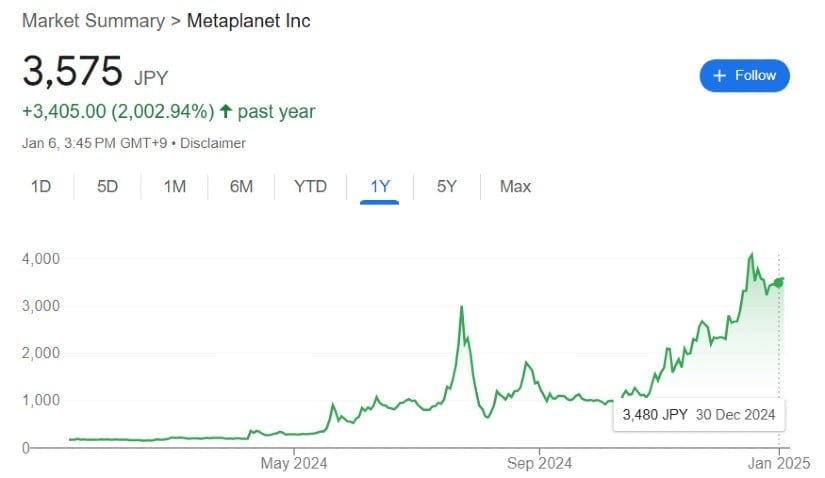

Metaplanet kick-started its Bitcoin amassing venture in April 2024, mimicking the approach taken by U.S.-based MicroStrategy, which paved the way for corporate Bitcoin asset management. In a recent update on platform X, CEO Simon Gerovich revealed their aim to reach this objective by 2025, which they plan to accomplish using the most advantageous financial market tools at their disposal. This strategy involves a blend of debt, stock offerings, and convertible bonds to finance the necessary purchases.

2021 proved to be groundbreaking for Metaplanet. We shattered previous records, enlarged our Bitcoin reserves, and solidified our status as Asia’s premier Bitcoin Treasury Company, as stated by Gerovich. This year, however, we’re not merely constructing a company; we are igniting a revolution.

The company’s approach is designed to protect itself from economic difficulties in Japan, like the fluctuation of the yen and increasing national debt, by adopting Bitcoin as a backup investment.

On Metaplanet, strategic partnerships have been instrumental in expanding its impact. In November 2024, the firm teamed up with BTC Media to debut Bitcoin Magazine in Japan, offering top-tier content specifically designed for local Bitcoin enthusiasts. This collaboration signifies Metaplanet’s dedication to fostering Bitcoin acceptance both at home and abroad.

Record-Breaking Bitcoin Purchases

In the month of December 2024, Metaplanet marked a significant milestone by buying a record amount of Bitcoin, totaling 619.7 BTC for roughly $60 million. This expansion increased their Bitcoin holdings to a grand total of 1,762 BTC, which was valued at an impressive $174.5 million. Notably, the company’s financial standing has experienced a remarkable resurgence.

In the year concluding December 31, 2024, Metaplanet anticipates revenue at approximately 890 million yen ($5.8 million), signifying a substantial rise compared to the 261 million yen from the previous year. The company projects operating profits to reach 270 million yen, indicating a strong rebound from a loss of 468 million yen experienced in 2023.

Global Implications and CEO’s Vision

Gerovich predicts that, under a future pro-cryptocurrency administration like a second Trump term, there’s a possibility the U.S. might choose to hold Bitcoin as part of its strategic reserves. According to Gerovich, “If the U.S. were to include Bitcoin in its reserve assets, it would spark a global trend, with nations such as Japan likely to follow suit.

There’s a rising global trend towards viewing Bitcoin as a protective asset during economic uncertainty. Countries like Hong Kong and Germany seem to be following suit, demonstrating Bitcoin’s growing significance within the international financial sphere.

Criticism and Challenges

Although Metaplanet has grand aspirations, there’s a great deal of doubt surrounding it due to these plans. Critics argue that the unpredictable character of Bitcoin casts uncertainty over its accumulation strategy being feasible. Financial experts caution that the heavy reliance on Bitcoin could make the company susceptible to potential risks, especially if the anticipated bull market doesn’t materialize as expected.

Additionally, there have been debates about the company’s openness with shareholders concerning their strategy and risk management. Despite Metaplanet’s pledge to boost shareholder involvement, skeptics suggest that the company should offer more explicit explanations of its future plans and methods for reducing risks.

Bottom Line

Metaplanet’s daring strategy towards Bitcoin integration symbolizes the increasing corporate involvement in digital currencies. Although the company’s ambitious ventures involve potential risks, they simultaneously establish Metaplanet as a trailblazer within Japan’s burgeoning cryptocurrency sector. As the worldwide competition for Bitcoin reserves escalates, attention is focused on Metaplanet to determine if it can meet its high expectations and continue its dominance in the crypto market.

Are you considering purchasing Bitcoin in the year 2025? Given that President Trump’s administration is rumored to be crypto-friendly, many experts believe that this could be a favorable time for investment. If you are thinking about investing, it might be wise not to delay – Metaplanet and Microstrategy are also likely to be purchasing Bitcoin.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-08 11:47