As a seasoned researcher with a keen eye for financial trends, I find myself both intrigued and impressed by the strategic moves of companies like Metaplanet and MicroStrategy. The relentless pursuit of Bitcoin as a treasury management strategy is a testament to their forward-thinking approach in an ever-evolving market landscape.

Evidently, the Japanese investment company Metaplanet is planning to gather approximately $62 million by offering shares to the EVO Fund through a stock acquisition scheme. This capital will then be utilized for purchasing additional Bitcoins as part of their financial management strategy.

The company stressed that it will continue to maintain a Bitcoin-first strategy.

Metaplanet’s Second Bitcoin Purchase in Q4

In a recent press announcement, Metaplanet detailed their strategy, which involves releasing its 12th series of Stock Purchase Options known as Stock Acquisition Rights. Beginning on December 16, 2024, the company plans to distribute approximately 29,000 units via a third-party distribution process.

As an analyst, I’m expressing that each unit I hold grants EVO Fund the opportunity to acquire 100 common shares from me, with each share priced at 614 yen. This adds up to a total potential purchase of 17,806,000 yen in common shares.

In simpler terms, Metaplanet has chosen to focus exclusively on Bitcoin for their financial management. They aim to borrow money and occasionally issue new stocks to acquire more Bitcoin, while simultaneously decreasing their reliance on the weakening Japanese Yen.

This year, Metaplanet has aggressively utilized stock purchase options to boost its Bitcoins reserves.

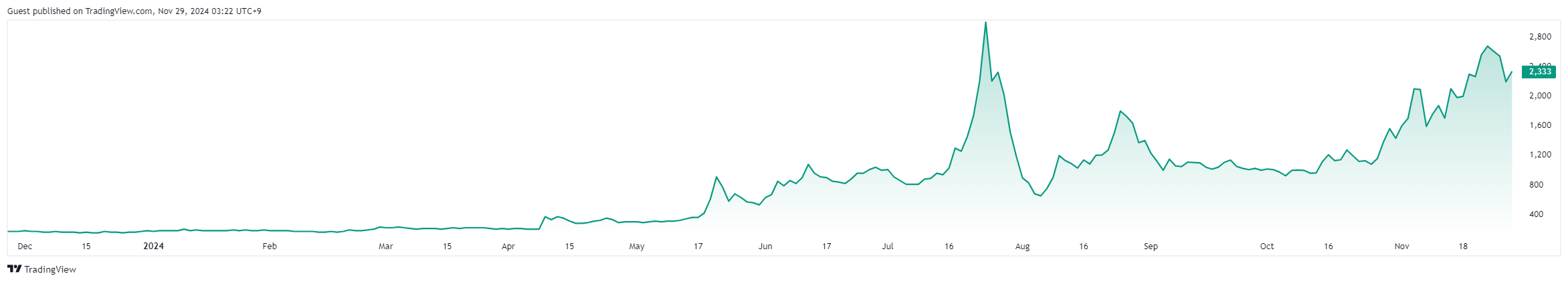

In October, the company completed its 11th offering, bringing in 10 billion yen ($66 million). A large chunk of this was set aside for additional Bitcoin investments. Remarkably, the company’s stocks saw a staggering increase of over 1,000% by the year 2024.

Public Firms Continue to Buy More BTC

More and more publicly-listed corporations are now pouring funds into Bitcoin. Yesterday, even a Chinese public firm, SOS Limited, made a purchase of $50 million in Bitcoins. This announcement led to an impressive jump of over 100% in the company’s stock value.

Furthermore, MicroStrategy has just added another $5.4 billion to its Bitcoin holdings, making this its third such acquisition in November. With these purchases, the firm has invested a staggering $16 billion in Bitcoin this year, cementing its position as the leading institutional owner of Bitcoin.

Just like many other companies, MicroStrategy’s stock growth has followed Bitcoin’s upward trend. This year alone, its shares have soared by an impressive 450%, earning it a spot among the top 100 publicly traded U.S. companies.

Many other companies are also increasing their Bitcoin investments. For instance, Marathon Digital has managed to secure $1 billion via the sale of convertible senior notes, and most of this money will be used for purchasing Bitcoins.

The rising value of Bitcoin is stirring up enthusiasm among investors. Although it has already peaked at $99,000 during this cycle, many public companies still believe in Bitcoin’s future prospects for growth.

Factually, Pantera Capital has estimated that the price of Bitcoin might reach a staggering $740,000 by the year 2028, thereby boosting optimism within the crypto sector.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-11-28 21:55