Meta Platforms (META) has generated substantial returns since its initial public offering in 2012. Despite this performance, the equity has frequently been subject to negative sentiment, a dynamic that persists even amidst demonstrable financial strength.

The company’s history includes various challenges – regulatory scrutiny, brand controversies, and strategic shifts – all of which have, at times, overshadowed its underlying business fundamentals. However, these factors have not prevented the delivery of considerable shareholder value.

Over the past decade, Meta has appreciated by 577%, as illustrated below. This performance warrants a reassessment of prevailing market perceptions.

Recent earnings data provides further support for a constructive outlook. The company reported a 24% increase in revenue, reaching $59.9 billion. While increased investment in infrastructure led to margin compression, operating income still grew by 6%, reaching $24.7 billion. Management guidance for the first quarter anticipates revenue between $53.5 and $56.5 billion, representing a projected growth rate of 30% – the highest in five years. This growth is attributable, in part, to AI-driven enhancements in advertising targeting and measurement, as well as the introduction of generative AI tools for ad creation.

Valuation Assessment

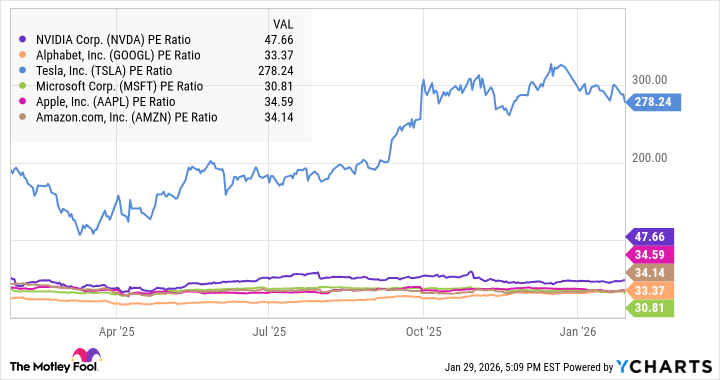

Despite a recent increase following the earnings release, Meta’s valuation remains comparatively low. The company generated $74.7 billion in net income last year, translating to earnings per share of $29.04. This yields a price-to-earnings ratio of 25.4, which is below both the S&P 500 average of 28.1 and the valuations of its peers within the “Magnificent Seven” group.

As depicted above, Meta trades at a discount exceeding 20% relative to its peers, despite demonstrating faster revenue growth than all but one company within the group (Nvidia). This discrepancy suggests potential undervaluation.

Historical Valuation Trends

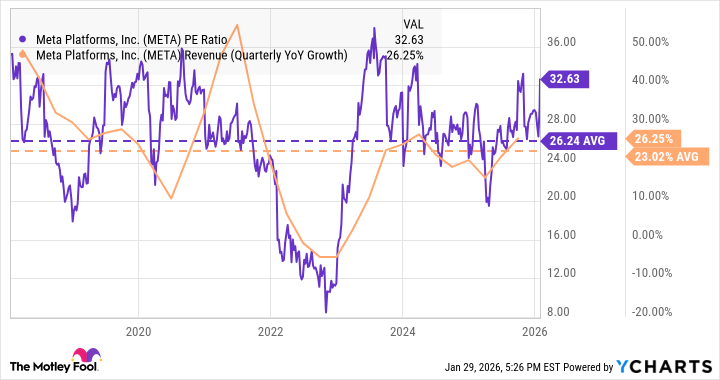

A review of historical data reveals a consistent pattern of Meta trading at a discount. The chart below illustrates the company’s revenue growth rate and P/E ratio over the past eight years.

Over this period, Meta’s average P/E ratio has been approximately 26, aligning with the S&P 500 average, while its average revenue growth has been 23%. This combination of growth and valuation is uncommon, particularly for a company of this scale. The market’s apparent difficulty in accurately valuing Meta is mirrored in the case of Alphabet, which, until recently, also traded at a significant discount.

Both companies possess substantial economic moats and demonstrate strong revenue and profit margins. Their dominance in digital advertising has created a duopoly, yet their valuations have often resembled those of average companies. While classified as software companies, they trade at a discount to software-as-a-service (SaaS) stocks, which are typically valued based on revenue multiples. However, Meta and Alphabet possess assets that surpass mere subscription-based software: platforms engaging billions of users daily, combined with highly sophisticated advertising models generating substantial high-margin profits, all without direct competition.

Investor Considerations

While upward price movement is generally desirable, a consistently modest valuation can offer certain advantages. As previously observed by Warren Buffett, a languishing share price facilitates increased share repurchases and allows the company to acquire shares at attractive levels. Furthermore, lower valuations can mitigate downside risk during broader market corrections.

Continued market misunderstanding of Meta’s intrinsic value may ultimately prove beneficial for long-term investors. This disconnect could provide opportunities for accretive investment and fuel future gains.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2026-01-31 21:52