Three years past, the shares of Meta Platforms (META) were mired at a lamentable depth of $89, the company’s grand visions for the metaverse seemingly entwined in the gossamer threads of fantasy. Observing the descent beheld before us, one might think of it as an echo of a lost epoch, where a decade’s worth of prior valuations was rendered irrelevant—the frail vapors of optimism dissipating into the void.

Wall Street, in its perennial wisdom, unleashed a clear message. The plummet transcended mere metrics; it was a resignation of faith, an abject surrender to disillusionment, revealing a stark landscape devoid of enthusiasm for what lay ahead for this digital titan.

Yet, unbowed by such relentless market harshness, Mark Zuckerberg, a figure akin to the fierce protagonists of history, gathered his ensemble of executives. He ventured into the depths of the corporate wilderness, orchestrating a symphony of collaboration, fortifying his resolve with a lucid vision to rekindle the trust of investors.

As the narrative unfolds, one might be inclined to utter a cautious cheer—his strategy has borne fruit, at least up to the present juncture. The ascent from $89 to an approximate $718 per share by July 25 speaks not merely of numbers but of a renaissance, a saga that invigorates the very spirit of capital markets. To an untrained eye, a 700% return may paint a picture of a climax reached, but herein lies a whisper of what I suspect is a burgeoning prologue.

Let us delve into the layers of Meta’s metamorphosis, intricately woven with threads of resilience, as the enterprise recalibrates its trajectory from ethereal realms of the metaverse toward the palpable promises of artificial intelligence (AI).

The Remarkable Odyssey of Meta’s Transformation

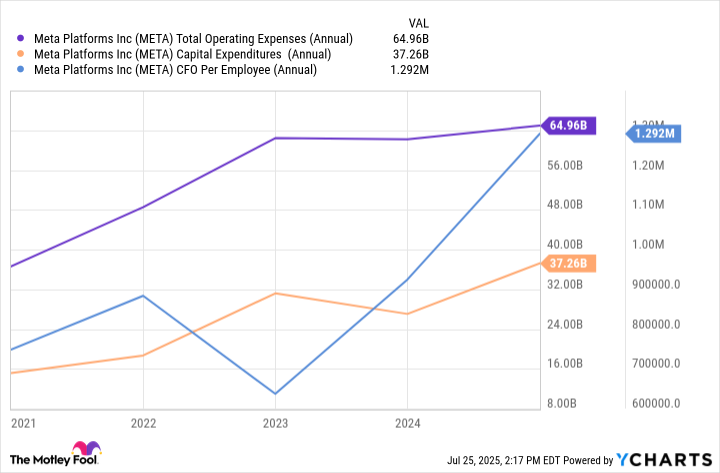

Data delineates a tale—one crafted through immense trials and tribulations—as represented in the chart below, tracking the tragi-comedy of operating costs, capital expenditures, and the per capita cash flow from operations that have lingered amidst the company’s recent years.

Throughout the tumultuous years of 2021 and 2022, Meta’s operating expenses burgeoned, propelled by fervent investments in their Reality Labs division. These forays into unfamiliar territories involved the birth of new forms of wearable technology and enhancements to the much-heralded Meta Quest virtual reality headset. Initially, they might have inspired a glimmer of hope; however, as the relentless march of time proved, interest withered like the fleeting blossoms of spring.

Reality Labs represented not a beacon of profitability but a weight, a burden encumbering Meta’s high-margin advertising bastion, relentlessly pulling it down into the abyss.

As 2023 dawned, however, the management recognized a clarion call—declaring it a “year of efficiency.” It was an acknowledgment of the insatiable appetite for cost and a solemn commitment to recalibrate efforts. As excesses were trimmed away, the reallocation of resources illuminated a new focal point: the profound realm of AI.

In the aftermath of these prudent decisions, the chart illustrates a disciplined stance towards financial stewardship, even amid rising capital expenditures that herald future ventures far more lucrative than prior illusions of grandeur.

With unit economics improving—the cash flow per employee on a steady incline—Meta’s pivot toward AI manifests not only as an act of survival but a renaissance of productivity, ushering in an era of robust operational leverage.

Wall Street’s Optimism Toward Meta

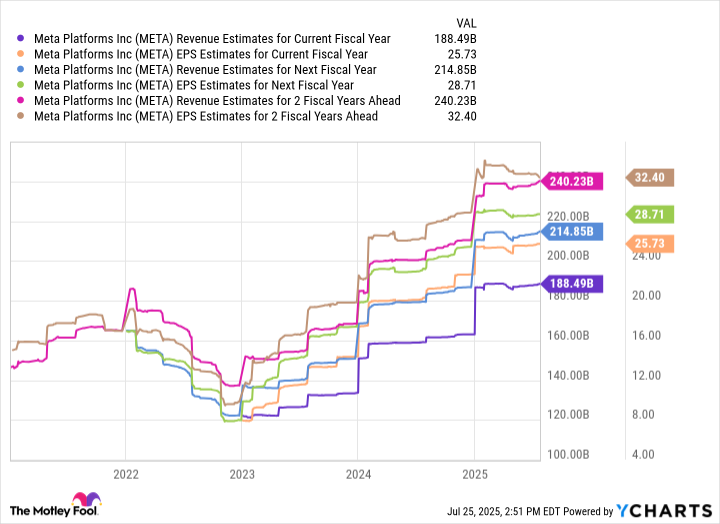

The current cadence of Meta’s stock seems bathed in a glow of validation, a tacit acknowledgment of scaling back unnecessary extravagances while redirecting ambition toward AI. However, caution reigns in my assessment; the current valuations do not yet reflect a state of perfection.

Analyzing the estimates, one discerns that Wall Street anticipates further accelerations in revenue and expansions of profit margins. A canvas unfolding as the company endeavors to exploit nascent opportunities within the AI domain.

Yet, the fruits of the investments in Scale AI and the inception of Meta Superintelligence Labs (MSL) remain latent, forging a path characterized by cautious optimism. The future may reveal that the projections currently articulated subtly underestimate the accretive potential that Scale AI or MSL could yield for Meta’s enduring legacy.

Thus, in light of these revelations, I posit that Meta remains a compelling opportunity. As investors, we find ourselves poised at the precipice, enticed by the prospect that ventures with a long-term horizon may yet reap rewards from this reinvigorated pursuit of truth and dignity amidst an often merciless corporate landscape. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-07-30 03:20