As someone who closely follows the tech industry and invests in related stocks, I find Meta Platforms Inc’s (META) first quarter 2024 results intriguing, given the comments from Mark Zuckerberg, Meta founder and CEO, Susan Li, Meta CFO, and Sarah Kunst, Managing Director at Cleo Capital.

On 24 April 2024, Meta Platforms Inc (NASDAQ: META) Reported its First Quarter 2024 Results.

According to Meta’s press release, Mark Zuckerberg, Meta founder and CEO, had this to say:

“The beginning of the year has been promising. The latest release of Meta AI, featuring Llama 3, is yet another advancement towards creating the world’s most advanced AI. Our applications are thriving, and we’re making consistent strides in developing the metaverse.”

As for the Meta CFO, Susan Li, she said:

“We expect second quarter 2024 total revenue to be in the range of $36.5-39 billion. Our guidance assumes foreign currency is a 1% headwind to year-over-year total revenue growth, based on current exchange rates.

I’ve observed the company’s financial outlook and here’s how it has been revised: The estimated total expenses for the full year of 2024 now lie between $96-99 billion, which is an upgrade from our previous projection of $94-99 billion. This change is a result of increased infrastructure and legal costs. Regarding Reality Labs, I’ve noticed that operating losses are expected to expand significantly year-over-year because of ongoing product development efforts and investments aimed at expanding the ecosystem.

I observed Sarah Kunst, the Managing Director at Cleo Capital, making an appearance on CNBC’s “Worldwide Exchange” the following day to share her insights on Meta’s recently released earnings report.

Here’s a detailed breakdown of her comments:

- Stock Performance and Capex Guidance:

- Kunst noted the significant drop in Meta’s stock price due to the company raising its capital expenditure (capex) guidance while also providing soft revenue guidance. She suggested that this investor reaction is partly fueled by prior experiences with CEO Mark Zuckerberg’s ambitious projects, which haven’t always panned out, referencing his foray into the metaverse as an example.

- AI Investments:

- Despite the costliness of AI, Kunst argued that investing in this technology makes sense for Meta. She emphasized that AI is a substantial and real opportunity, given Meta’s technological capabilities and wealth of data. Kunst expressed confidence that Meta’s bet on AI would be profitable for those investors who remain unshaken by short-term uncertainties.

- Metaverse Skepticism:

- Kunst was critical of Zuckerberg’s continued investment in the metaverse, particularly highlighted by the substantial losses ($3.85 billion) reported by Meta’s Reality Labs segment. She compared this unfavorably with competitors like Apple, who are also venturing into augmented reality technologies. Kunst implied that the market had not embraced the metaverse technology, regardless of the promoter.

- Digital Ads Business:

- Meta’s primary revenue source, digital advertising, missed estimates by 6%, which Kunst attributed to a broader global shift in advertising dynamics rather than a specific issue at Meta. She discussed how the current geopolitical and domestic unrest affects brand-safe advertising, suggesting that these factors are causing companies to reconsider where their ads are placed.

- Comparison with Other Tech Giants:

- She highlighted that while digital ads are a significant revenue stream for other tech companies like Alphabet, Microsoft, and Amazon, Amazon might be better positioned in the current market. This is due to Amazon’s focus on product listing ads, which are considered more brand-safe compared to the social content-based ads prevalent on platforms like Meta.

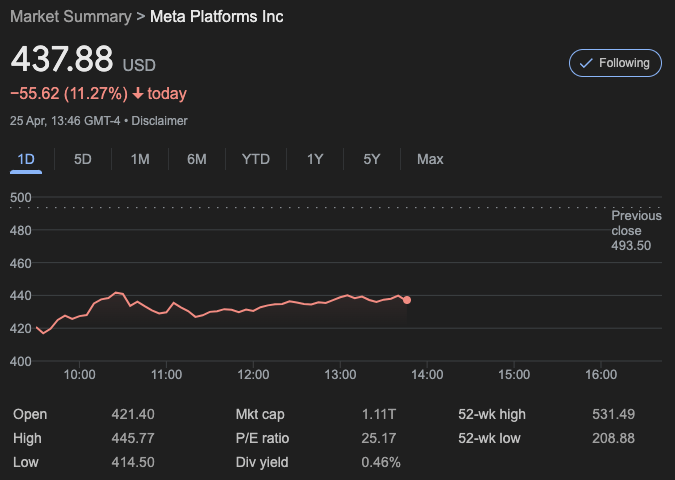

As I observe at 5:46 p.m. UTC on April 25, Meta’s stock price stands at $437.88, marking a decrease of 11.27% for the day.

Read More

2024-04-25 20:57