Micron Technology, a name lately tripping from the lips of enthusiasts and fund managers alike, has enjoyed a run of fortune. One might almost suspect a conspiracy of algorithms, or simply the usual hysteria surrounding anything remotely connected to ‘artificial intelligence.’ The stock, it is said, has ascended a dizzying height – a near-quadrupling since 2025. Such exuberance, of course, rarely survives contact with reality. One begins to wonder if the investors are actually looking at the balance sheet, or merely the reflected glory of the latest tech fad.

Comparisons are inevitably drawn to Taiwan Semiconductor Manufacturing, a rather more established, and frankly, less excitable, concern. The question, then, is whether Micron might follow in TSM‘s wake. A charming notion, perhaps, but one requiring a degree of scrutiny that, sadly, seems to be in short supply these days.

The Peculiarities of Silicon

The fundamental distinction, and it is a rather crucial one, lies in the nature of their respective crafts. Micron deals in memory – the fleeting, ephemeral stuff of digital existence. TSM, on the other hand, fabricates logic chips – the very engines of calculation. Both are essential, naturally, but the memory market is, shall we say, less… dignified. It is a commodity, subject to the brutal laws of supply and demand, and prone to cycles of boom and bust that would give even a seasoned gambler pause. Logic chips, while not immune to the vagaries of the market, at least offer the possibility of differentiation, of genuine innovation. One might even call it a science, rather than a glorified warehousing operation.

The current frenzy, fuelled by the AI narrative, has predictably skewed the supply-demand equation. A shortage of memory, coupled with a surfeit of optimism, has sent prices soaring. This, naturally, benefits Micron. But the question, as always, is for how long? The memory market is not known for its enduring prosperity. It is a realm of fleeting advantage, where fortunes are made and lost with alarming speed.

The prevailing wisdom suggests that AI spending will continue unabated for years to come, perhaps even a decade. This provides Micron with a window of opportunity. But the company must tread carefully. Overcapacity is a constant threat, and the inevitable correction will be swift and merciless. The history of the semiconductor industry is littered with the corpses of companies that miscalculated the cycle.

A Fleeting Valuation

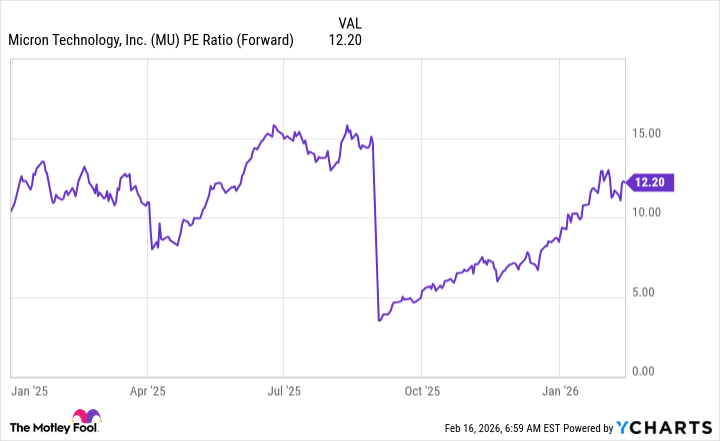

The stock, trading at a seemingly modest twelve times forward earnings, may appear to be a bargain. But such calculations are often deceptive. The discount reflects the inherent cyclicality of the business. Investors, understandably, are wary of owning a high-priced Micron stock when the cycle inevitably turns. It is a case of being cheap for a reason, a concept apparently lost on many of the current shareholders.

Micron is, of course, attempting to address the supply constraints, with new facilities slated to come online in Idaho and New York. This is commendable, but it also exacerbates the long-term problem. Increased capacity will eventually lead to oversupply, and a corresponding decline in prices. The irony, naturally, is that the very measures taken to sustain the current boom will ultimately contribute to its demise.

For my part, I find the risk-reward ratio unappealing. There are, after all, more stable and predictable investments available. Taiwan Semiconductor, with its technological leadership and diversified customer base, offers a far more compelling proposition. It is a company built on substance, not speculation. One might even call it…sensible.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-19 00:22