As a researcher who has spent countless hours diving deep into the world of decentralized finance (DeFi), I must say that witnessing Raydium’s meteoric rise to the top is nothing short of astonishing. Coming from a background where Ethereum was once king, it’s fascinating to see Solana’s ecosystem flourish and outpace its predecessor in terms of daily DEX volume.

Raydium, the leading automated market maker (AMM) on the Solana network, surpassed Uniswap as the foremost platform in terms of monthly trading volume.

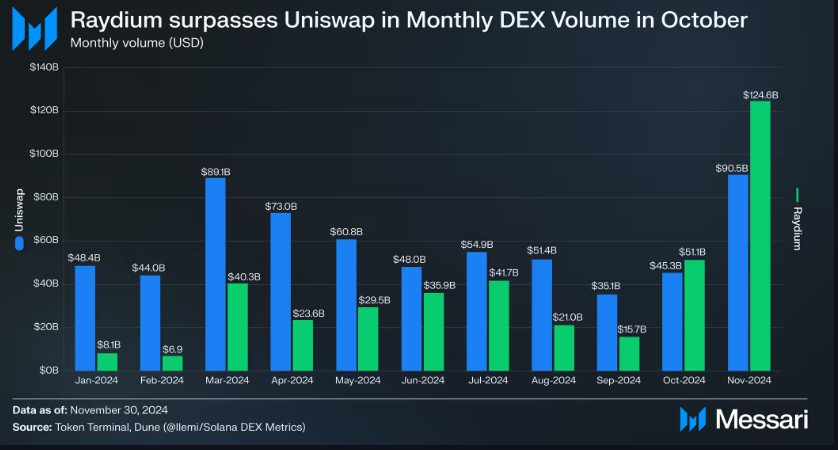

As a crypto investor, I was thrilled to learn that Raydium, a decentralized exchange on Solana, hit a staggering $124.6 billion in volume during November 2024. This figure surpassed Uniswap’s $90.5 billion by an impressive 30%. This remarkable achievement underscores the meteoric rise of the Solana ecosystem and the increasing influence of meme coin trading within it.

Raydium’s Rise to the Top

In November, Raydium accounted for more than 60% of the daily trading volume among Decentralized Exchanges (DEX) within the Solana network. This dominance showcases Raydium’s capacity to leverage Solana’s high transaction speed and minimal fees. These key features draw users looking for a smooth and affordable decentralized finance (DeFi) journey.

Based on the findings, it was in October 2024 that Raydium first took the lead in the worldwide Decentralized Exchange (DEX) standings. This upward trend intensified in November. This growth forms part of a larger transition happening within the DeFi sector, where Solana’s daily DEX trading volume has surpassed Ethereum’s since early October 2024. By November, Solana was responsible for almost half (nearly 50%) of the monthly DEX volume across all blockchains, while Ethereum accounted for only 18%.

A significant factor behind Raydium’s achievement is the rapid growth in the trade of meme coins. By November 2024, these coins made up a staggering 65% of Raydium’s overall monthly trading activity, setting a new record for the platform.

After the U.S. presidential election on November 5, there was a significant increase in this surge. On average, daily trading of meme coins on Raydium reached close to $2 billion, which is nearly three times the trading volume prior to the election.

The partnership between Raydium and Pump.fun, a launchpad for meme coins on Solana, has been key to Raydium’s growth. What makes Pump.fun unique is that it adds liquidity to Raydium’s Automated Market Making (AMM) pools when a token reaches a certain market value, constantly offering fresh trading possibilities. This innovative method has earned Raydium popularity among meme coin enthusiasts, making it their preferred platform for such activities.

Raydium’s rise to the top among DEXs is due not only to its success but also to strategic improvements. The introduction of its V3 interface in March 2024 brought a collection of user-friendly features. Among them are a management page for portfolios, combined liquidity pools, and advanced trading tools such as chart views for token pairs and options for precise swaps.

By integrating these updates alongside updated Constant Product Market Maker (CPMM) pools that support the Token-2022 initiative, we’ve significantly improved the user-friendliness and efficiency of our platform.

Solana’s Ecosystem Boom

On Raydium, liquidity contributors gain advantages through trading commissions and incentives in the form of RAY tokens, the platform’s native currency. Moreover, the option to deposit RAY for extra benefits encourages more involvement and strengthens user commitment.

In a similar vein, Radium’s prosperity reflects the larger expansion of Solana’s Decentralized Finance (DeFi) community. The technical advantages Solana offers, such as its capability to manage large transaction numbers at minimal costs, have attracted users and liquidity from Ethereum. By Q3 of 2024, Solana’s weekly DEX trading volumes were three times greater than Ethereum’s.

As a crypto investor, I found myself riding the wave of success into Q4, as Solana consistently surpassed Ethereum in daily DEX volumes. The speed and affordability at which transactions can be processed on its network have made it an attractive choice for high-frequency trading and smaller trades, which are often priced out on Ethereum.

Raydium’s rapid ascension underscores its smart placement within the market and the expanding landscape of Solana’s ecosystem. However, it also serves as a reminder of both the potential dangers and advantages that exist as the Decentralized Exchange (DEX) market undergoes transformation.

As a researcher, I’ve noticed an exciting rise in the trade of meme coins, but it’s crucial to acknowledge that this surge also brings increased volatility and potential regulatory oversight. Moreover, as decentralized exchange (DEX) competition heats up, maintaining user engagement and ensuring liquidity becomes an ongoing challenge that necessitates consistent innovation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-11 19:46