As a seasoned crypto investor with battle scars from countless market cycles, I can’t help but feel a sense of deja vu when reading about the risks associated with influencer-promoted meme coins. The allure of quick profits is ever-present, but the reality often leaves investors with more losses than gains.

Recent research by CoinWire highlights the risks of investing in meme coins, especially those promoted by influencers on X (formerly Twitter).

The research indicates that despite their claims of substantial returns, many of these digital tokens often lead to significant financial losses for investors instead.

Influencer-Promoted Meme Coins: The Grim Reality

The promise of quick riches is often tempting, but most investors end up chasing a mirage. A recent CoinWire report analyzed 1,567 meme coins endorsed by 377 influencers over the last three months. The findings are startling: 76% of influencers promote dead meme coins — tokens that have lost over 90% of their value.

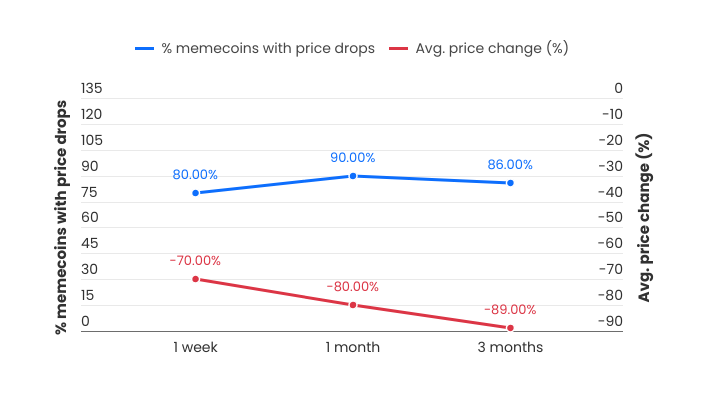

New discoveries show that approximately two out of every three (67%) meme coins endorsed by influencers hold no value currently. Moreover, the research indicates that nearly nine out of ten (86%) influencer-endorsed meme coins suffer a drop in value by ten times within three months. Lastly, just one percent of influencers have managed to successfully boost a memecoin with a tenfold increase in value.

Over the initial week, around 80% of newly promoted meme coins experience a significant drop in value, losing approximately 70%. This trend worsens as we approach the end of the first month, with losses reaching up to 80%.

Influencer promotions frequently tout rapid increases in returns, stirring interest among both seasoned and novice investors. However, analysis reveals that many of these marketing efforts prioritize income for the influencers themselves rather than the quality of the ventures they endorse.

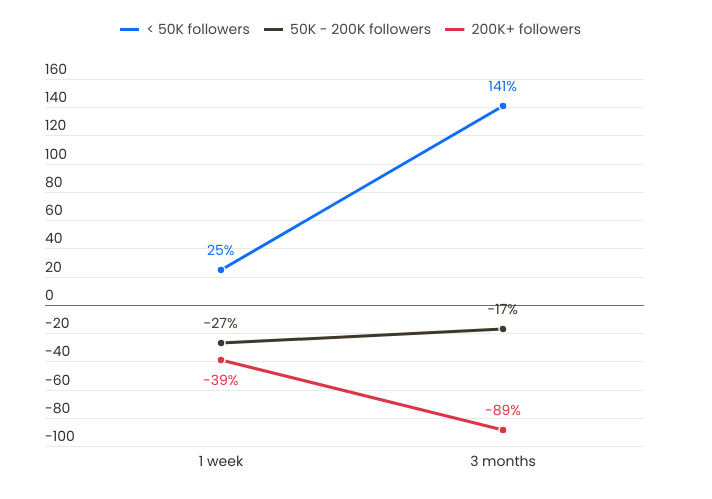

Large influencers with more than 200,000 followers tend to yield the poorest results, averaging a negative return of 89% within three months. On the other hand, smaller influencers boasting fewer than 50,000 followers often deliver slightly superior outcomes, and some may even generate positive returns over the long term.

As a crypto enthusiast, I’ve noticed that influencers tend to earn an average of $399 for each promotional tweet they make about a coin, which might motivate them to endorse meme coins without considering their potential viability. This financial setup often results in their followers experiencing the losses.

The Role of X in the Meme Coin Boom

It’s important to note that issues with influencer-endorsed tokens aren’t just occasional occurrences. In fact, as BeInCrypto has reported, a staggering 97% of all meme coins end up failing. Out of the approximately 1.7 million that have been created, only 15 have managed to maintain success over time. This failure is due to various reasons, including the absence of practical use and poor project administration.

As a researcher delving into the fascinating world of meme coins, I’ve come to realize that it’s not just the coins themselves that are buzzing with activity, but also the ecosystem surrounding them. Recently, the investigative work of ZachXBT has shed light on a concerning issue: 16 influencer accounts within this space were found to be involved in coordinated pump-and-dump schemes. These manipulative actions have left their followers bearing the brunt of the financial losses. This revelation has sparked intense discussions about the ethical obligations that influencers carry in crypto markets, a topic that demands careful consideration and ongoing discourse.

Currently, X serves as a significant tool for propagating meme coins among influential figures. Its knack for creating buzz renders it an efficient means of promoting meme coins, yet it also fosters a setting where potential financial hazards may arise.

Although the market stats are dismal, some traders continue to discover chances within this unpredictable environment. Cryptocurrency influencers such as Justin Sun, creator of TRON, propose assessing meme coins by considering factors like the size of the community, the power of the story, and their practical use.

Currently, digital currency expert Miles Deutscher has published a simple 4-step strategy for investing in meme coins: prioritize timing in the market, scrutinize token economics, grasp project fundamentals, and employ stop-loss techniques to mitigate risk. Essentially, this method highlights the significance of being careful and thorough.

While the hype surrounding meme coins is undeniable, this context highlights the need for caution. Influencer endorsements, though enticing, are not reliable indicators of a token’s potential. Investors should scrutinize projects, considering factors like utility, community engagement, and long-term viability.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-25 13:07