Over the last day, there’s been a significant drop in the cryptocurrency market, particularly affecting meme coins.

As a researcher, I’ve observed a significant downward trend in the cryptocurrency market based on data from CoinGecko. Specifically, the total crypto market capitalization has plunged by approximately 15% from its previous level. Interestingly, the market cap of meme coins has seen an even steeper decline, dipping more than 12%, to a current figure of around $113.32 billion. This dip could be attributed to large investors, or ‘whales’, liquidating their positions in these coins.

Meme Coin Market Reacts to Whale Sell-Offs

On January 8, the overall value of all cryptocurrencies combined fell to approximately $3.42 trillion, with significant declines seen in major digital currencies such as Bitcoin and Ethereum, which both experienced losses.

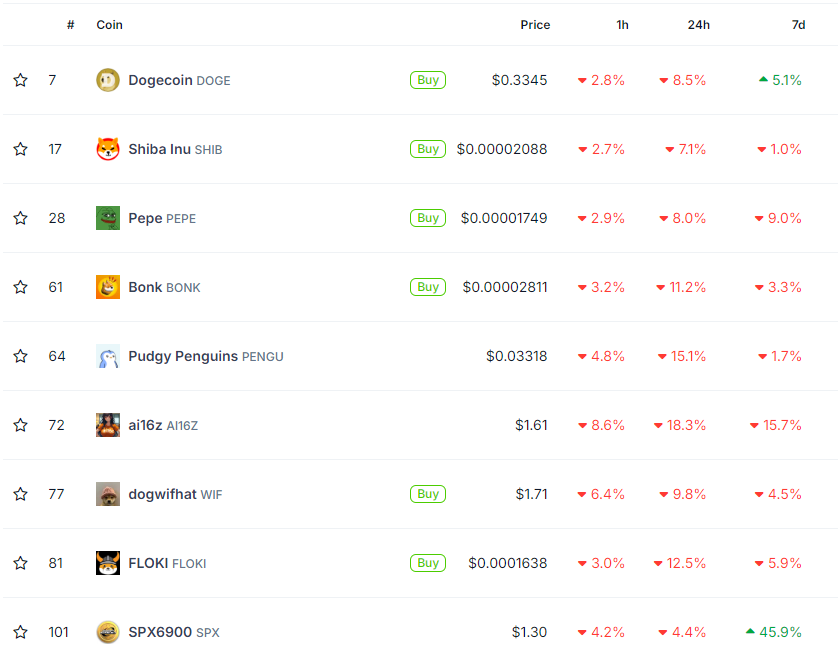

It’s worth noting that the leading meme-based cryptocurrencies have experienced significant setbacks. Notable examples like Dogecoin and Shiba Inu have seen substantial decreases over a 24-hour period, causing a general dip in the total market value of meme coins.

dogecoin’s value stood at approximately $0.33 following a 8.5% decline over the last 24 hours. On the other hand, Shiba Inu experienced a drop of more than 7% during that time frame as well.

It seems that the general decline in the meme coin market might be due to large investors (whales) selling off their holdings, causing a decrease in demand for these coins.

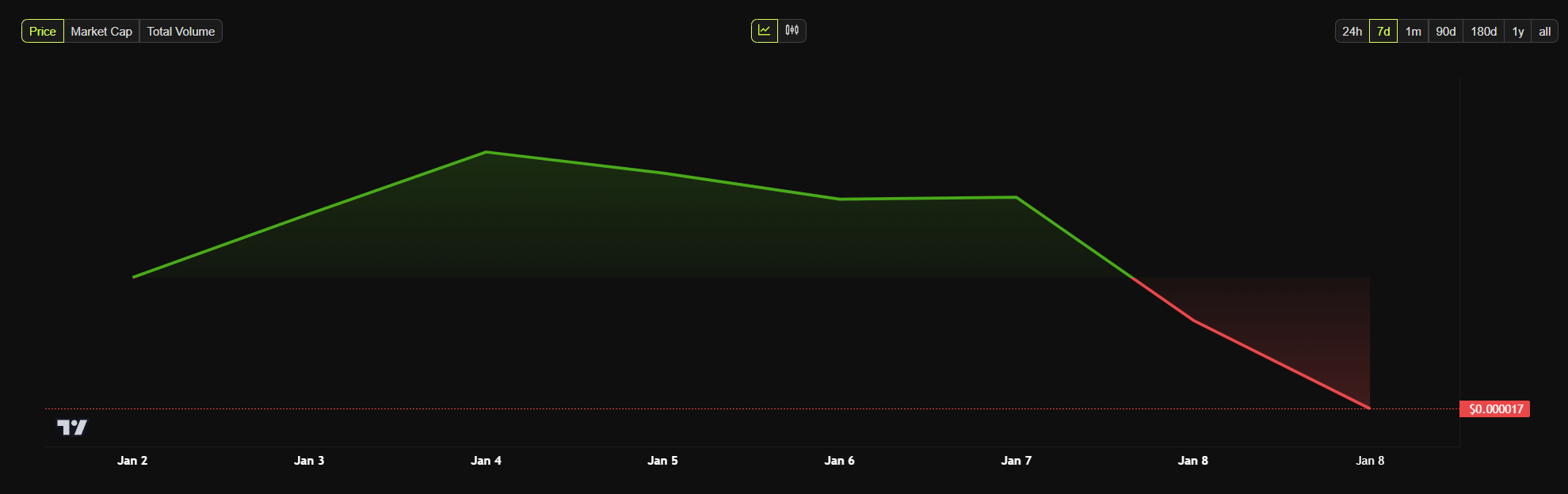

As reported by the cryptocurrency analytics platform Spotonchain, a significant investor (often referred to as a “whale”) transferred approximately 210 billion Pepe tokens, valued at roughly $3.95 million, into the Kraken exchange. Over the last two days, this whale has offloaded around 427 billion Pepe coins.

In summary, a whale transferred approximately 427 billion PEPE coins to Kraken at an average price of about $0.00001987, which equates to around $8.49 million. This action left behind approximately 1 trillion PEPE ($18.5 million) and is estimated to have generated a profit of around $2.15 million (an increase of 8.67%) from this second PEPE trade, as reported by Spotonchain.

This action might have made negative feelings about the market even stronger. Additionally, Pepe experienced a drop in value exceeding 10% within the past day.

Pepe rose to become one of the top three meme cryptocurrencies due to its popularity on social media and viral trends. However, a recent sale suggests that influential investors may be adjusting their investment strategies.

As an analyst, I observed a significant transaction involving a different whale who offloaded approximately 74.483 billion MOG tokens in exchange for around 177,736 USDC. This substantial liquidation event adds weight to the notion that the meme coin market might be experiencing a decline in popularity.

As these whales unload their holdings, the increased selling force may have triggered a chain reaction that lowered the values of meme coins, thereby intensifying the market’s downward trend.

Meanwhile, another whale has invested around $18 million into meme tokens such as WIF and POPCAT over the last 24 hours. Interestingly, despite these large purchases, the value of these tokens hasn’t increased, as both WIF and POPCAT’s price charts are currently showing a downward trend.

It’s important to point out that meme coins tend to be highly volatile. Despite their popularity due to the meme culture surrounding them, their price fluctuations can be quite unforeseeable.

After things calm down, some might see this dip as a chance to buy, considering that the cryptocurrencies could bounce back later.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-08 21:10