Over the past couple of years, the S&P 500 index (^GSPC) has significantly surged, with numerous stocks propelling this rise. However, one standout group is widely recognized as the driving force behind this upward trend. I’m referring to the “Magnificent Seven,” a dynamic cluster of tech giants that reign supreme in rapidly expanding sectors such as artificial intelligence (AI), cloud computing, and autonomous vehicle technologies. These powerhouses have experienced remarkable growth not only in their earnings but also in their stock values due to their groundbreaking innovations and pioneering roles.

However, a specific stock has demonstrated that you don’t need to belong to an exclusive club to generate exceptional profits for investors, and it’s caught the eye of billionaire Philippe Laffont from Coatue Management – he was quick to recognize its potential and acquire shares in the first quarter itself. Let’s explore this AI stock that has outperformed every single member of the Magnificent Seven this year.

Laffont’s focus on technology

Initially, let’s discuss the significance of Laffont’s involvement with the stock, given that he manages over $22 billion in securities subject to quarterly reporting to the Securities and Exchange Commission (SEC). Managers handling more than $100 million in U.S. securities are required to file form 13F, which provides us with valuable insights into the strategies and recent actions of top-tier investors.

Laffont is an ex-employee of Tiger Management’s famed hedge fund, Tiger, who later established Coatue in 1999. He has a strong focus on technology stocks, with Meta Platforms, Amazon, and Taiwan Semiconductor Manufacturing being among his primary investments. Given Laffont’s keen interest and knowledge in tech companies, particularly those involving AI, it’s intriguing to follow his industry trends and potentially apply his strategies to our own portfolio, to see if they may prove beneficial.

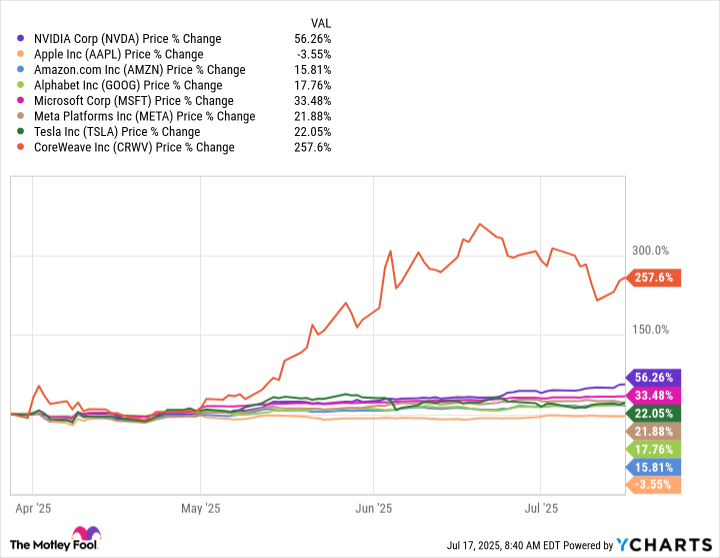

Let’s shift our focus towards the stock that’s been outperforming the prestigious Magnificent Seven, namely CoreWeave (CRWV). This company made its public debut in late March and has seen a remarkable surge of over 250% since then. Here’s an analysis of its performance relative to the Magnificous Seven stocks for the current year:

During the initial quarter, Laffont acquired approximately 14.4 million shares of CoreWeave, making up nearly 2.4% of their portfolio and placing it among the top 16 holdings out of a total 70 investments. This strategic move has already proven beneficial for Laffont, as the stock’s performance attests, and this success can be attributed to the impressive revenue growth that CoreWeave is experiencing.

A revenue increase of more than 400%

CoreWeave experienced a substantial surge in revenues during the latest quarter, exceeding 400%, primarily due to robust interest in their Artificial Intelligence (AI) platform. To clarify, CoreWeave specializes in providing AI-related services or products.

The company offers customers the ability to purchase access to a vital resource during the AI expansion period, which is computational power. CoreWeave has made substantial investments in over 250,000 Nvidia graphics processing units (GPUs), the premier chips driving essential AI tasks, across numerous data centers. Customers have the option to rent these GPUs as needed, even by the hour. This flexibility, combined with CoreWeave’s specialized focus and proficiency in AI workloads, has contributed to its success in this rapidly changing market.

Moreover, market titan Nvidia supports the CoreWeave venture, since they own a 7% share in the company.

All this sounds great — so should you follow Laffont into this potential AI winner?

CoreWeave encounters some challenges, including rivalry with large cloud service providers such as Amazon Web Services and the need to continuously invest to sustain growth, which could make it hard for them to achieve profitability. Therefore, it might not be ideal for conservative investors at this moment. However, if you’re an investor who prioritizes growth over caution and is willing to take some risks, you may find CoreWeave appealing since it has the backing of Laffont and Nvidia. This company could potentially see substantial revenue growth in the near future and even challenge the dominant “Magnificent Seven” players in terms of stock performance.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-20 03:32