They call it an IPO, a grand opening for the fortunate. But look closer. Medline, a supplier of bandages and bedpans, a company born not of innovation, but of necessity, has stepped into the light. Chicago, a city that knows hardship, birthed this enterprise, and now it asks the markets for a blessing. It’s a curious thing, this dance between capital and comfort, but let’s not mistake pragmatism for poetry.

The Business of Keeping Bodies Whole

Medline doesn’t deal in dreams, but in dressings. It’s the largest provider of the mundane necessities that keep hospitals running, the gloves, the swabs, the quiet machinery of care. Three hundred and thirty-five thousand products, shipped from thirty-three factories across a hundred countries. A network that whispers of efficiency, but shouts of scale. They boast next-day delivery to ninety-five percent of American hospitals. A logistical feat, yes, but more accurately, a testament to the relentless demand for things that break and must be replaced. They call themselves the Amazon of medical supplies. A comparison that feels… incomplete. Amazon sells desire. Medline sells relief.

Hospitals, those temples of hope and despair, are their primary patrons. But also the surgery centers, the doctors’ offices, the quiet corners where bodies are mended. They manufacture their own “Medline Brand” products – a private label, they call it. A polite way of saying they cut out the middleman. A sensible strategy, in a world where margins are squeezed tighter than a patient’s chest. They control the chain, from factory floor to hospital bed, and that control is worth something.

The Hands That Held It, Then Let It Go

This isn’t a company born yesterday. It was once public, then swallowed by the private equity giants – Blackstone, Carlyle, Hellman & Friedman. They paid $34 billion for it, a sum that speaks more to their hunger than to Medline’s inherent value. They grew the business, of course, adding factories, increasing sales from $17.5 billion to a projected $30 billion. They squeezed, they optimized, they prepared it for another offering. Now, they’ve released it back into the wild, asking for another payout. The IPO raised $6.3 billion, a down payment on the debt they accumulated while holding it captive. A tidy profit for them, a new burden for those who buy the shares.

The valuation hasn’t changed much, hovering around $35.5 billion. They’ve dressed it up, polished the numbers, but the core remains the same: a supplier of necessities, operating in a world that will always need bandages and bedpans. They call it growth. I call it the predictable rhythm of survival.

The Argument for Solidity

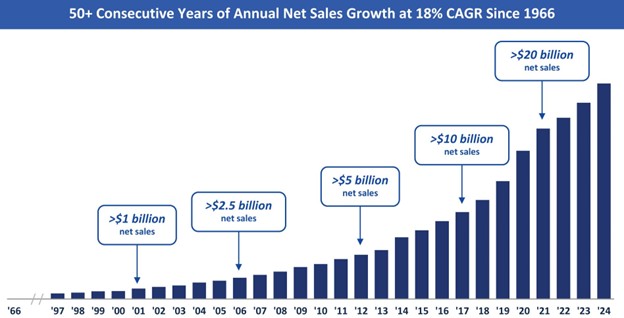

Medline hasn’t known a year of declining sales in half a century. Fifty years of steady, unremarkable growth. Eighteen percent annually, on average. It’s slowed in recent years, of course, the law of large numbers taking hold. But ninety percent of that growth has been organic, built on existing customers, not acquired through risky mergers. They haven’t built an empire on borrowed dreams.

They see a total addressable market of $375 billion – ten times their current revenue. A vast ocean of potential. And healthcare, they argue, is recession-proof. People get sick regardless of the economic climate. A grim comfort, perhaps, but a reliable one.

Analysts project earnings of $1.17 per share for 2025, jumping to $1.52 in 2026. Solid, unremarkable numbers. They also anticipate free cash flow of $1.5 billion this year, and $2.1 billion next year. Money generated not from innovation, but from the steady, reliable demand for things that break and must be replaced.

They’re more profitable than their rivals, and growing faster. Look at the numbers: a gross margin of 27.4%, compared to McKesson’s 4.1% and Cardinal Health’s 3.6%. A clear advantage, built on efficiency and control.

| Metric | Medline | McKesson ($MCK) | Cardinal Health ($CAH) | Owens & Minor ($OMI) |

|---|---|---|---|---|

| Gross Margin | ~27.4% | ~4.1% | ~3.6% | ~20.5% |

| Operating Margin | ~8.5% | ~1.3% | ~1.4% | ~2.1% |

| Net Margin | ~4.8% | ~1% | ~0.8% | ~(-0.5%)* |

The Shadows Beneath the Surface

The P/E multiple is high, at 28. A reflection of optimism, perhaps, or simply a sign that the market is hungry for anything that promises stability. Seventy percent of their sales come from hospitals. A concentration of risk, perhaps, but also a testament to their reliability.

The private equity owners still hold sixty percent of the voting control. A shadow hanging over the future, a reminder that the game is still rigged. But for now, they’ve proven to be good stewards, growing the business and preparing it for another offering.

They could sell their shares, of course, flooding the market and driving down the price. But they’ve waited 180 days, and they’ve proven to be patient players. They’ll likely wait for the opportune moment, maximizing their profits and leaving the rest of us to pick up the pieces.

The Bottom Line

Medline isn’t a glamorous investment. It’s not a disruptive technology, or a visionary startup. It’s a supplier of necessities, operating in a world that will always need bandages and bedpans. But it’s a solid, reliable business, with a history of steady growth and a clear competitive advantage. It’s a company built not on dreams, but on pragmatism. And in a world of uncertainty, that’s a rare and valuable thing.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2026-02-05 09:23