As a seasoned analyst with over two decades of experience, I find Semler Scientific’s recent moves intriguing. The company’s strategic acquisition of Bitcoin and subsequent expansion of its ATM offering program is a bold move, especially in the volatile cryptocurrency market.

On Monday, the healthcare tech firm Semler Scientific (SMLR), which is listed on Nasdaq, disclosed that it had purchased an extra 297 Bitcoins and broadened its stock issuance plan.

Based on the official statement, the company bought approximately 1,570 Bitcoins from November 18th to the 22nd, spending a total of $29.1 million. The average price paid for each Bitcoin, including fees, was about $97,995. This purchase adds to Semler’s existing holdings, which now totals 1,570 Bitcoins and cost a combined $117.8 million, with an average cost of $75,039 per Bitcoin.

In addition to buying bitcoin, the company has also increased its ability to sell new shares on the market using Cantor Fitzgerald & Co, a broker-dealer, through an at-the-market (ATM) program. This program allows companies to offer shares for sale at current market prices without setting a fixed price as in traditional secondary offerings. Semler has increased its ATM program by $50 million, bringing the total to $100 million, under a new prospectus supplement to its August 13, 2024, Form S-3 shelf registration. As of November 22, the company has already raised around $50 million through this program.

Issuing new shares has brought about substantial alterations in Semler’s capital layout. The number of basic shares increased from 6,987,000 on June 30th to 8,289,000 by November 22nd. Concurrently, the number of outstanding options decreased from 1,098 to 855 over the same period. Considering all possible shares that could be issued through option exercises, regardless of their vesting conditions or exercise prices, Semler’s assumed diluted shares rose from 8,086,000 to 9,143,000.

Semler has introduced a fresh evaluation method called “Bitcoin Acquisition Yield” to assess their Bitcoin purchasing approach. They reported this value stood at 58.4% from July 1 (the start of their Bitcoin strategy) to November 22, and 37.1% from October 1 to November 22.

Instead of saying “However, the company provides extensive disclaimers about this metric,” you could rephrase it as “The company offers significant warnings regarding this particular metric.

The metric under consideration has several drawbacks: it fails to distinguish whether Bitcoin acquisitions were financed through operations or stock sales, lacks the ability to forecast stock performance, and could potentially over-or-underestimate the influence of using equity capital for Bitcoin purchases. Semler points out that owning stocks does not equate to ownership of their Bitcoin reserves, and historically, the company has not issued dividends.

Chairman Eric Semler had this to say:

We’re excited to share that we’ve achieved an impressive 58.4% return on Bitcoin (BTC) and significant strides in the process of acquiring more bitcoins, which benefits our shareholders in a financially advantageous manner.

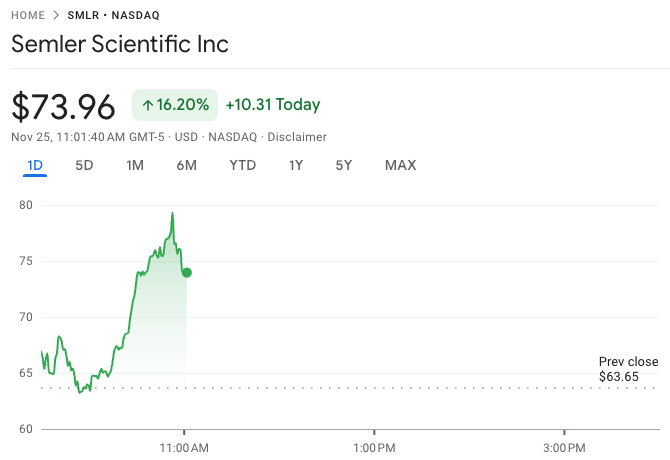

Currently, Semler’s stocks are being traded approximately at $73.96, marking an increase of more than 16% for the day. So far this year, the stocks have surged by about 66.41%.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-11-25 19:23