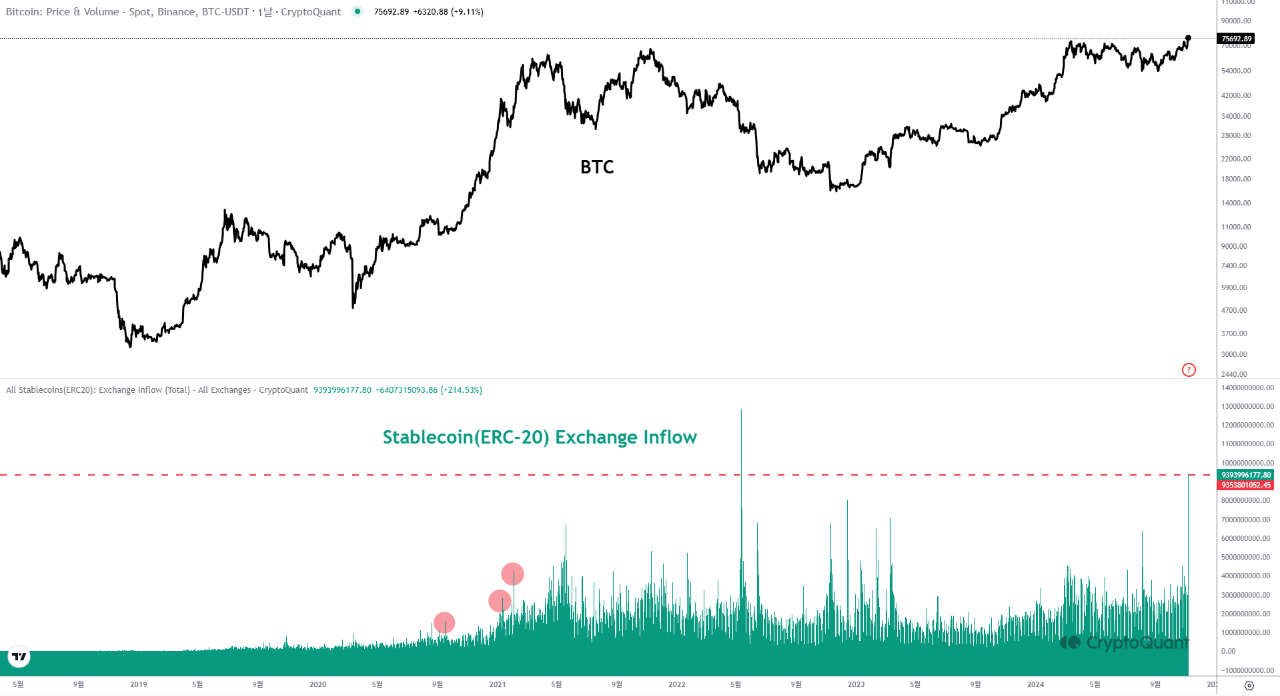

As a seasoned crypto investor with over a decade of experience in this rollercoaster market, I can confidently say that the recent inflows into Binance and Coinbase, totaling $9.3 billion worth of stablecoins, is a clear sign of an impending bull run. The trend of large-scale stablecoin inflows usually precedes market rallies, as we’ve seen historically.

As an analyst, I observed a significant surge in stablecoin inflows to the tune of $9.3 billion on both Binance and Coinbase platforms, which are prominent cryptocurrency exchanges, following the victory of the Republican candidate, Donald Trump, in the United States presidential election. This substantial influx took place on the Ethereum network.

Based on research by CryptoQuant, an organization that specializes in on-chain analytics, approximately $4.3 billion out of a total $9.3 billion in ERC-20 stablecoins not held by these exchanges was transferred to Binance, with around $3.4 billion going to the Nasdaq-listed exchange Coinbase.

According to our research findings, significant influxes of stablecoins into the market and subsequent price increases tend to occur during periods of strong market uptrends or bull markets.

Stablecoin deposits coincide with a period when Bitcoin spot ETFs experienced unprecedented daily inflows worth $1.38 billion. This surge occurred as the price of Bitcoin, the leading cryptocurrency, hit an all-time high near $77,000 following Donald Trump’s victory in the U.S. presidential elections.

Based on Farside’s data, it was found that approximately 81% of all inflows went to BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT). This fund attracted a net inflow of $1.11 billion, significantly surpassing its closest competitor, the Fidelity Wise Origin Bitcoin Fund (FBTC), which saw a net inflow of only $190 million.

On November 7th, the Bitcoin ETF offered by Ark 21 Shares (ARKB) ranked third with an inflow of approximately $17.6 million. Interestingly, no exchange-traded fund focused on spot Bitcoin witnessed outflows that day. In fact, the combined inflows for these spot Bitcoin ETFs now stand at a whopping $25.57 billion according to recent data.

During this period, significant deposits were made as the value of the leading cryptocurrency surged by over 9% in the last seven days, reaching an unprecedented peak. This surge was primarily driven by Donald Trump’s triumph in the U.S. elections, due to his favorable view towards digital currencies.

It was generally anticipated that a win by Donald Trump would likely increase Bitcoin’s value due to his open backing of the cryptocurrency industry. This support could lead to a clearer regulatory landscape, reducing uncertainty, and potentially appointing more pro-cryptocurrency figures to influential roles. For instance.

After U.S. presidential elections, Bitcoin’s price often surges. For instance, it rose by 87%, 44%, and a significant 145% following the elections in 2012, 2016, and 2020 over a period of 90 days each time.

Read More

2024-11-09 02:37