There is a quiet dissonance in the air-a hum beneath the clatter of closing bells. The stock market, that great, breathing entity, teeters on ground softer than the polished marble of Wall Street’s corridors. Analysts, many of them, paint with a palette too bright for the canvas at hand. Their optimism, though not entirely baseless, risks becoming a parable of misplaced faith.

The Delicate Balance of Market Forces

The tariffs, those barbed tendrils of policy, have long been a thorn in the side of trade. As Fortune once noted, they are a storm brewing in the harbor, not the open sea. Wall Street, ever the pragmatist, knows this: tariffs gnaw at profit margins like frost on tender shoots and dim the glow of consumer demand. Yet the S&P 500 (^GSPC), that barometer of ambition, climbs. Michelle Gibley of Charles Schwab (SCHW), with the patience of a gardener, reminds us that the economic toll of tariffs is not averted, merely delayed. A seed left too long in the soil will rot.

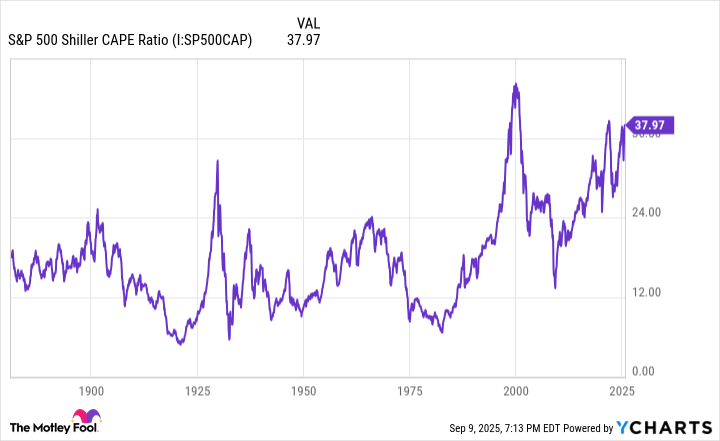

Consider the warnings etched into the numbers: UBS whispers of a 93% chance of recession; JPMorgan, a 40% specter; Goldman Sachs, 30%. Others, less dire, yet no less ominous, foresee stagflation-a stagnant field choked with weeds of inflation. And still, the Shiller CAPE ratio swells to its third-highest tide, the Buffett indicator stretched beyond its markings. These are not mere statistics. They are the murmurs of a market holding its breath.

Yet Wall Street’s hands remain open, offering “buy” ratings to 405 stocks in the S&P 500. Four, and no more, carry the stigma of “sell.” There is a poetry to this contradiction-a chorus of optimism singing over the creak of a bridge uncertain of its load.

The Unraveling Threads

Forty-four stocks in the index are priced higher than their 12-month targets, yet analysts still urge purchase. Is this the folly of spring, when frost lingers but the blossoms insist on blooming? Even more perplexing: twenty-two stocks, forecast to shrink in earnings, carry “buy” ratings. And thirty-nine others, whose growth is but a whisper against the wind, are still deemed worthy of pursuit. One might imagine a farmer sowing seeds in a field where the soil itself is in retreat.

A Path Through the Thicket

In this tangle of data and dogma, there is a quiet example to follow. Warren Buffett, that old cartographer of value, does not chart his course by the lantern of consensus. He reads the terrain-the contours of businesses, the rhythm of their growth, the weight of their valuations-before laying a finger on the tiller. His Berkshire Hathaway (BRK.A) (BRK.B) hoards cash like a squirrel gathering nuts for winter. It is not panic, but prudence. Buffett knows the market is a seasoned oak; its branches may bend, but they do not break if rooted deep.

Investors, too, might do well to temper their sails. Let the winds of speculation pass, and wait for the stillness where truth reveals itself. Even if I am mistaken in these musings, Buffett’s approach-a blend of patience and vigilance-is a lighthouse in uncertain waters. Perhaps Wall Street’s optimism is not entirely misplaced. But in the end, the market is not a playpen for recklessness; it is a field where the patient reap.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

2025-09-11 17:47