The market, as it always does, continues its peculiar dance. For a century and more, it has yielded returns that other ventures can only envy, though one learns not to mistake activity for progress. Bonds, commodities, land… they offer a certain solidity, a sense of something there, but it is the market that truly captures the imagination, and occasionally, the savings.

Under the recent administration, the numbers have been… agreeable. The Dow, the S&P 500, the Nasdaq – they all ascended with a cheerfulness that bordered on the excessive. Fifty-seven percent, seventy percent, one hundred and forty-two percent… one almost expects a brass band to accompany the reports. And 2025, the first year of the second term, continued the trend – modest gains, certainly, but gains nonetheless. It’s a comfortable rhythm, though one suspects comfort is often a prelude to something less so.

Artificial intelligence, of course, is the current explanation for everything. And the tax policies, reduced to levels unseen for generations… they certainly didn’t hinder the proceedings. But to believe this will continue indefinitely… well, that would be a particularly optimistic sort of foolishness. History, after all, has a way of reminding us that even the most buoyant bubbles eventually lose air.

A Question of Timing

One should not pretend to predict the market’s whims. To claim certainty would be… unbecoming. There are simply too many variables, too much human emotion swirling within the numbers. If foresight were truly possible, we would all be comfortably retired by now, wouldn’t we?

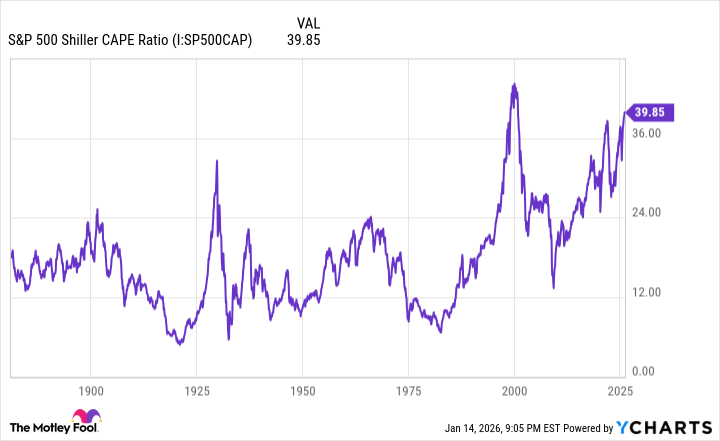

Still, certain patterns emerge. The Shiller P/E Ratio – a rather cumbersome name for a rather useful tool – offers a glimpse into the past, a way of comparing valuations across decades. It’s not a crystal ball, of course, but it’s a more reliable guide than most pronouncements one encounters.

Unlike simpler measures, it accounts for inflation and economic downturns, providing a more… nuanced perspective. And what does it tell us now? That valuations are… elevated. Indeed, they are approaching levels not seen since the late 1990s, a period many would prefer to forget. The ratio has surpassed 30 on several occasions, and currently sits at 40.72, dangerously close to its all-time high. The past, it seems, is not entirely past.

S&P 500 Shiller PE Ratio hits 2nd highest level in history 🚨 The highest was the Dot Com Bubble 🤯

Barchart (@Barchart) December 28, 2025

History suggests that such heights are rarely sustained. There have been five previous instances where the ratio topped 30, and each was followed by a decline – sometimes modest, sometimes… less so. But to predict when the correction will arrive, or how severe it will be… that would be a fool’s errand. The market, like a weary traveler, will stumble when it is ready, not when we expect it to.

A Quiet Patience

A crash, in the immediate future? Unlikely, perhaps. But a correction, a period of turbulence… that seems almost inevitable. The market rarely offers a smooth ascent. There will be setbacks, disappointments, moments of quiet desperation. But these, too, shall pass.

Bear markets, as it happens, are surprisingly brief. A few months, perhaps nine or ten, on average. Crashes are even shorter – a few weeks, a matter of days. Bull markets, on the other hand, tend to linger – years, even decades. It is a peculiar rhythm, a slow, steady climb punctuated by moments of frantic descent.

It’s official. A new bull market is confirmed.

The S&P 500 is now up 20% from its 10/12/22 closing low. The prior bear market saw the index fall 25.4% over 282 days.

Read more at https://t.co/H4p1RcpfIn.

Bespoke (@bespokeinvest) June 8, 2023

And if one holds on long enough – twenty years, perhaps – the market, it seems, always delivers a positive return. Even through wars, recessions, pandemics… it perseveres. It is a comforting thought, though it does little to alleviate the anxiety of the present moment.

So, one might consider the current turbulence not as a threat, but as an opportunity. A chance to acquire assets at a more reasonable price. A chance to build a portfolio for the long term. A chance to… simply wait. For the market, like life itself, is rarely about grand gestures. It is about quiet persistence, a steady accumulation of small gains, and a willingness to accept the inevitable setbacks. And perhaps, just perhaps, a touch of melancholy.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2026-01-17 14:12