Now, most folks see the S&P 500 (^GSPC +0.69%) nudging ever upwards and think, “Good. Progress. Shiny numbers.” And usually, they’re right. It’s a signal that the economic gremlins aren’t currently dismantling the machinery of commerce, or at least, not too enthusiastically. But the market, bless its capricious heart, is a bit like a wizard with a fondness for irony. It likes to whisper warnings in a language only a few bother to learn.

For a while there, 2023 to 2025, the bull market was being driven by Tech and Growth stocks. Predictable, really. When everyone’s feeling optimistic, they naturally flock to the things that promise to be even more shiny and profitable. It’s the way of things. Like moths to a particularly gaudy flame. But 2026… well, 2026 is being different. The S&P 500 is still perched near its all-time highs, but the Tech sector is currently performing with all the enthusiasm of a damp squib. Instead, we’re seeing Energy, Consumer Staples, Industrials, Materials, and Utilities leading the charge.

And that, my friends, is when you start to raise an eyebrow. When investors start shuffling towards Consumer Staples and Utilities, it’s usually a sign that they’re feeling a bit… twitchy. It’s like noticing the stable boys are suddenly very interested in the quality of the hay. They’re not worried about a glorious charge, they’re thinking about weathering the storm. So, we have a market at record highs, but driven by the sectors that thrive when everyone else is nervously clutching their purses. Which narrative is the correct one? It’s a bit like trying to decide if the wizard is benevolent or merely very good at disguises.

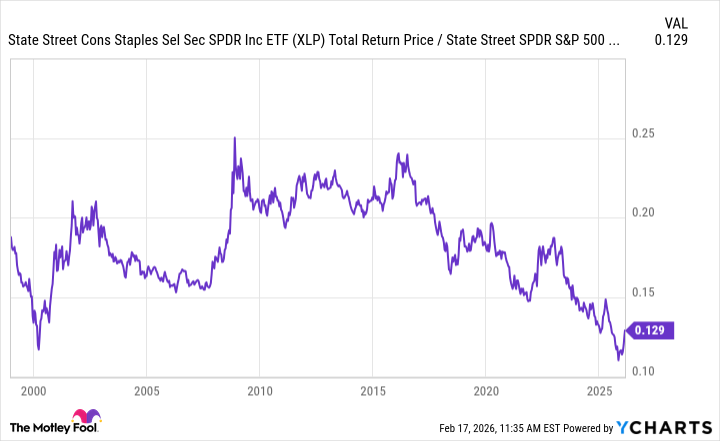

Let’s take a closer look at the Consumer Staples sector, represented by the State Street Consumer Staples Select Sector SPDR ETF (XLP +0.25%), and compare it to the State Street SPDR S&P 500 ETF (SPY +0.65%) over the last quarter-century. It’s a bit like consulting the ancient scrolls… or, in this case, a very detailed graph.

When that line is trending upwards, it means Consumer Staples are outperforming the market. And lo and behold, we see this happening during rather obvious periods in history – the Tech Bubble (a particularly flamboyant period, if I recall correctly), the Financial Crisis (less flamboyant, more… panicked), and the 2022 bear market. It’s as if investors collectively decide that, when things get dicey, they’d rather own shares in companies that sell beans and bandages than in companies that promise to teleport your cat to Mars.

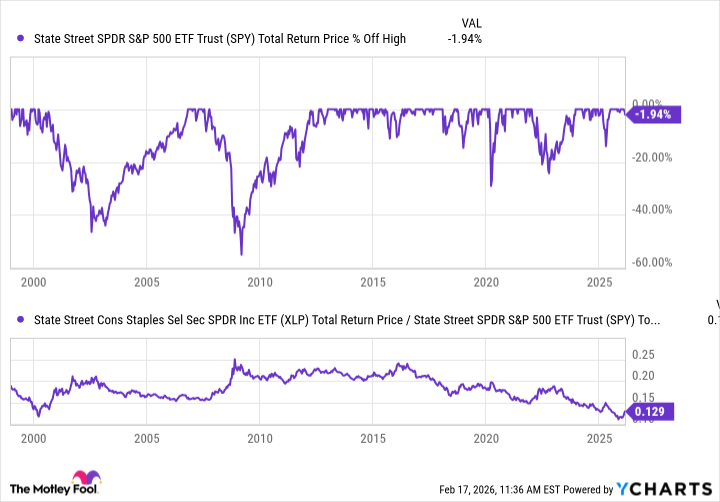

And then there’s 2026. This ratio moved sharply higher. It’s still a modest blip on the long-term chart, but it’s there, lurking like a mischievous imp. Now, let’s overlay a chart of S&P 500 drawdowns over the same timeframe. A bit like comparing the weather forecast to the actual storm.

As expected, the two lines are almost perfectly inversely correlated. When Consumer Staples outperform, it’s almost always during a downturn in the S&P 500. Conversely, when the sector lags, the S&P 500 is either at or moving toward new highs. It’s a remarkably consistent pattern. Almost… suspiciously consistent.

Virtually every spike in the Consumer Staples-to-S&P 500 ratio has also resulted in a 10%+ correction for the index. Just recently, we saw it happen during the first-quarter 2025 “Liberation Day” scare. It happened during the 2022 bear market. It happened during the COVID-19 recession (albeit briefly). 2016, 2008, and 2001 all saw corrections and/or bear markets when Consumer Staples led the market. It’s enough to make you suspect someone is manipulating the market… or that the market simply has a sense of humor.

What Happens Next?

Today, Consumer Staples is sharply beating the S&P 500, but without the correction. In order to bring this relationship back in line with the historical norm, one of two things would need to happen. Either the Consumer Staples sector needs to reverse course sharply (perhaps due to a sudden, inexplicable surge in demand for canned peaches), or the S&P 500 needs to correct.

Given current market trends and questions around tech capex spending, valuations, and the health of the labor market, it would suggest that the latter is more likely. Given that the 10-year Treasury yield has fallen by roughly 20 basis points since the beginning of February, I believe broader risk-off sentiment is deepening. It’s like the air is getting thick with anticipation… or possibly just a particularly potent batch of swamp gas.

A correction in the S&P 500 isn’t a guarantee even with this signal. But the S&P 500 is looking especially vulnerable to one. The market, after all, is a fickle beast. It rewards those who understand its whims… and occasionally devours them whole. And remember, even the most carefully constructed forecast is merely a polite suggestion to the universe.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 18:32