One offers predictions about the market at one’s peril, for past forecasts are merely amusing epitaphs on the graves of good intentions. I have, shall we say, accumulated a certain experience in being delightfully incorrect. As the astute Mr. Housel observed, to be surprised by the market is simply to admit one has no firmer grasp on the future than a butterfly on a gale. A humbling thought, and one I embrace with a certain panache.

Consequently, to claim precise knowledge of 2026 would be… vulgar. I offer not prophecy, but rather a series of observations, delicately poised between hope and skepticism. The market, after all, is less a science and more a rather capricious mistress.

The Gemini Gambit

GOOG“>

OpenAI’s aspirations for an IPO, and the rumored trillion-dollar valuation, now seem… ambitious. HSBC suggests a rather substantial funding requirement—over two hundred billion dollars. One wonders if the pursuit of profit might ultimately eclipse the pursuit of intelligence. Should Gemini solidify its position, OpenAI may find investors less eager to fund a fading star. The ripple effect could be considerable, and, I confess, rather diverting.

The Inevitable Correction

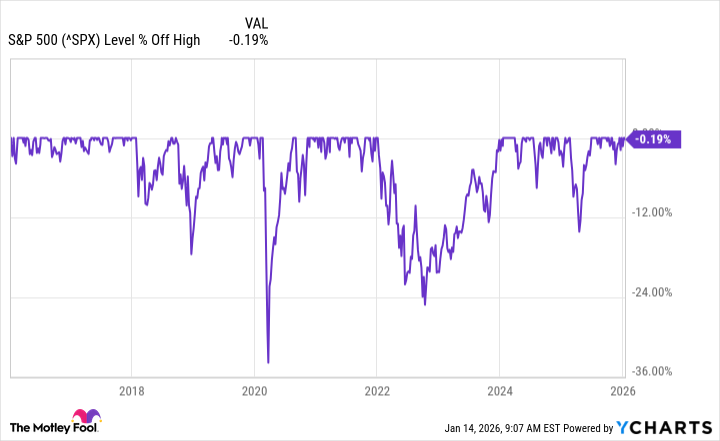

The market, like a pampered debutante, is prone to fits of pique. Many fear an ‘AI bubble,’ though whether it is genuine or merely a collective delusion remains to be seen. Regardless, fear is a potent catalyst. A correction—a decline of at least ten percent—is not merely likely, it is statistically… inevitable. Such downturns occur with a regularity that is almost comforting. The S&P 500, as any chart will reveal, is a study in cyclicality.

Given the recent correction in early 2025, a further adjustment in the latter half of 2026 seems… probable. One should never mistake a temporary setback for a permanent decline, of course. The market, like a resilient actress, always manages to recover her composure.

The Power Predicament

The current enthusiasm for artificial intelligence demands a corresponding surge in electrical power. However, supply is failing to keep pace with demand. This imbalance, manifesting in higher prices, is… inconvenient. The Trump administration, with a characteristic directness, has suggested that Microsoft ensure these costs are not passed on to consumers. A delicate balancing act, to be sure.

This power bottleneck presents certain opportunities. New capacity requires years to build, while AI requires power now. Businesses that can help power companies optimize their existing infrastructure will undoubtedly flourish. Itron, for example, deploying smart meters to monitor demand, is well-positioned to benefit. Their value will only increase as the strain on the grid intensifies.

Tesla, with its Megapack batteries, offers another potential solution. Elon Musk rightly points out that smoothing out demand throughout the day would alleviate much of the pressure. A rather elegant solution, though one that requires a degree of foresight that is often lacking. Itron and Tesla, therefore, appear poised to profit from this predicament, though other contenders may yet emerge.

The Inevitable Ascent

Finally, let us not succumb to undue pessimism. To be a pessimist is often considered intelligent, but to profit from optimism is far more rewarding. The S&P 500, despite its occasional tantrums, tends to rise over time. Even in 2025, despite a near-19% decline at one point, the year concluded with a respectable 16% gain. An above-average performance, and a testament to the market’s inherent resilience.

Therefore, while a correction is likely, I anticipate a positive overall outcome for 2026. Strong infrastructure spending, declining inflation, and lower mortgage rates all contribute to a favorable outlook. I intend, therefore, to continue investing, navigating the inevitable ups and downs with a mixture of prudence and… amusement. For the market, after all, is a grand spectacle, best enjoyed with a glass of champagne and a detached, ironic smile.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 04:23