The stock market, that capricious ballerina in a frock of digits, performed pirouettes during President Donald Trump’s tenure. By the cusp of his first term, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite had skyrocketed by percentages that would make a meteor blush. A decade later, the indices genuflected again before the altar of his second term, their candles flickering with a 14%, 17%, and 22% ascent. Yet, as any seasoned economist knows, economic seasons-like those of the zodiac-hold both harvest and hail.

History, that ancient lexicographer of human folly, casts no straight line but a labyrinth of curves and inflections. The year 2026 looms, unspooling possibilities as coiled as a python’s future. Among these: a Pythonesque collapse under the marigold iconography of That Man.

Statistically, the Market Wears a Cope-Decop

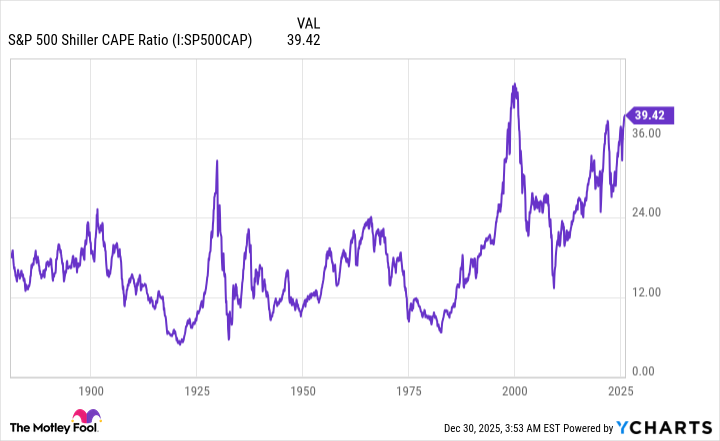

The first hurdle to optimism lies not in policies but in arithmetic. Imagine, if you will, the S&P 500 as a spider spinning a web of-priced vinegar into sugar-coated lies. The Shiller P/E Ratio-a cyclically adjusted mirror to the gastronomic excesses of the Nasdaq-sits at a lavish feast of 40.59. Since 1871’s dawn of oppressive numeracy, only the dot-com colossus (44.19) has shadowed such gluttony.

This P/E cyst, inflated like a golem’s heart, has foreshadowed declines from 20% to 89% over the past 155 years. While the Great Depression’s 89% hemorrhage feels as plausible as a unicorn’s tax return, 49% and 78% suffice to make investors clutch their portfolios like lovers embracing their first quarrel.

Yet the Shiller P/E is no prophet-it is more a soothsayer’s turtle, slow and obstinate. Its predictions, however, have been as unerring as gravity: when the P/E exceeds 30, calamity follows like a shadow in a winter ballroom. Five such instances have already crumbled into rekoning; the sixth (us) now stares at the abyss.

Trump’s Second Year: A Consumerist Oedipus?

Midterm years, those psychological chasms in the political cycle, have historically turned Celtic harps into sawmills. Since 1950, the S&P 500 has averaged a 17.5% drawdown in midterm chaos. Not the gentle lull of a love song but the dirge of a divorce. Republican presidencies, meanwhile, have paired with recessions like bitter ex-lovers reuniting in a musty ballroom. Ten Republicans, ten recessions. Ten tenures, ten tragedies.

“Midterm years: Stocks stage a tango with fear, then lurch toward a rebound. Even the meek outliers…”

Trump’s tariffs, wielded as bluntly as a penknife, may yet fray the threads of corporate profits. A 2024 New York Fed report revealed that His Taxonomy’s China tariffs choked employment, productivity, and profits between 2019 and 2021. The stock market, like a tea leaf reader, may yet sip the dregs of such fiscal sorrows.

The Investor’s Purgatory: Endurance Over Enlightenment

Crashes, those inverted comedies of capitalism, are not calamities but comedowns. Bear markets, with their gnarled chronologies of 286 days, are mere blips compared to the 1,011-day bull-market marathons. Yet the human psyche, impulsive as a drunkard at a bar, misreads these cycles as proclamations of doom. Even the direst data sets from Crestmont Research-tracking 106 rolling 20-year S&P 500 periods-reveal an immutable truth: patience out-dances panic.

“The market is a Rorschach test for time. Twenty years, sworn or stolen, always end with a green light.”

For the patient Hermes of capital, 2026’s turbulence is merely the trumpet before the trill. Bloodied indices are not epitaphs but invitations-bargains whispered from the 2022 abyss. The long-term investor, clothed in Teflon patience, need only await the moonrise of equities, even under the continued reign of That Man.

ditor’s note: The phoenix emoji 🐤, a misprinted myth.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-03 12:12