Ah, the great beast of finance stirs yet again—Bloomberg’s own seer, Mike McGlone, proclaims that a monstrous tempest brews in the American markets. Bitcoin, that fickle modern idol, along with crude oil and the stock exchange, stands on the precipice of a “massive correction.” One can almost hear the creaking of the economic foundations, like some ancient door slowly giving way to chaos.

On the ephemeral digital scroll known as X, McGlone speaks of a so-called “self-correcting mechanism” in the United States. A curious euphemism, is it not? It is as if some invisible hand, tired of Trump’s tariff tantrums, prepares to slap the insolent market upside its head, plunging it into delightful bedlam.

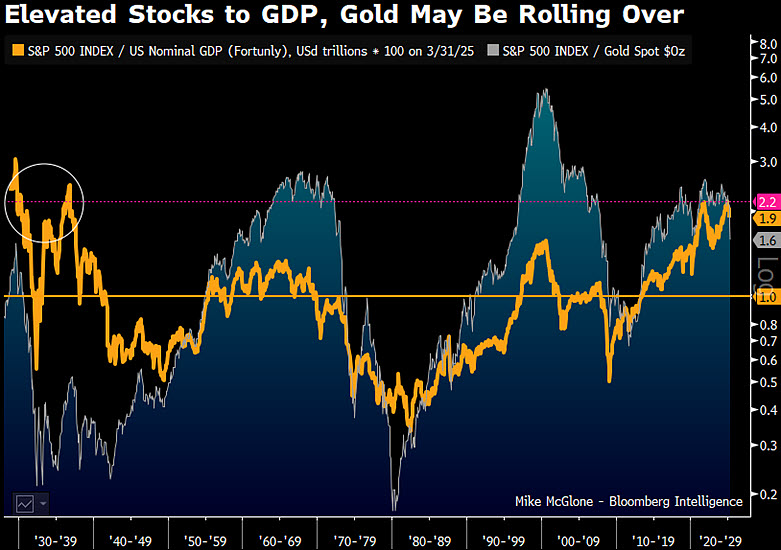

This prophet of numbers unveils a chart—oh, the charts!—where the S&P 500’s ratio to GDP, and to gold no less, ascend to dizzying heights, reminiscing dark days of the 1930s, the 1990s dot-com delirium, and the infamous crash of 2008. History, that relentless taskmaster, wanders these markets again, poised to dole out a cruel rebuke.

“Reversion,” McGlone murmurs, a word heavy with fatalism, portending downfall not just for stocks but for Bitcoin, oil, copper, and bonds—those instruments upon which fortunes rise and fall like the tragic heroes of old.

“America’s self-correcting mechanism is unstoppable,” he asserts—a phrase dripping with irony as if to say, ‘No matter what chaos administrations unleash, the market’s cruel joke eventually plays out.’ Should tariffs and thrift fail, the electoral gods will surely intervene to reorder this great carnival of wealth.

Yet, the market cap versus GDP ratio stands at a vertiginous summit, the highest in a century—like a fool dancing on the edge of a cliff, oblivious or daring fate.

The grim prophecy unfolds:

- Fifty percent plunge in the US stock market, where dreams are built and shattered.

- Crude oil tumbling to a modest $40 a barrel—a sobering antidote to recent excesses.

- Copper reduced to $3 per pound, losing its lustrous allure.

- US 10-year yields at a meek 3%, a sigh of resignation from bond markets.

- Bitcoin humbled to $10,000, cryptocurrencies descending into a 90% abyss—a digital apocalypse.

- Gold standing apart, stubborn and inscrutable at $4,000—an enigmatic outlier in this tale of woe.

Despite the cataclysmic tone, McGlone, with a sardonic grin hidden beneath the analyst’s solemn visage, reassures us that such devastation is but “normal” in the grotesque theater of financial history. A comedy of errors, a tragedy in numbers, all wrapped in the cosmic joke that is capitalism.

Meanwhile, as the prophecies echo through the void, Bitcoin currently pirouettes at a lofty $87,529—perhaps mocking those who dare predict its fall. Or perhaps, it is merely the calm before the storm, a whispered jest from the gods of market madness. 🙃

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-22 03:09