Let’s face it: investing on Wall Street is like trying to pet a porcupine while wearing oven mitts. Volatility flares up when we least expect it, and the ride can feel like a poorly tuned roller coaster-with the added thrill of existential dread.

With 2025 hitting us like an uninvited relative, the benchmark S&P 500 (^GSPC) has recently seen more dramatic swings than a teenage drama club audition. From the fifth-steepest two-day decline since ’50 to the largest single-session point increase ever (yes, ever), we’re witnessing market moves that feel almost dramatic. I half expect an S&P 500 documentary narrated by Morgan Freeman to pop up any minute now.

Sure, the spirited recovery of the S&P 500, Nasdaq Composite (^IXIC), and Dow Jones Industrial Average (^DJI)-following a tariff-induced meltdown-has left many investors smiling slightly less awkwardly. But isn’t it funny how joy can sometimes rear its head just before a slide back into chaos? As stock valuations reach levels that could make a seasoned investor choke on their morning coffee, we should probably hold on to our hats.

Despite this historic market exuberance pointing towards potential turbulence, I have a sparkling gem to unveil: the Schwab U.S. Dividend Equity ETF (SCHD). It’s the antidote to our investment anxieties, a sort of financial aloe vera for the burns we’ve endured.

Historically expensive stock market blues

Before I wax poetic about why the Schwab U.S. Dividend Equity ETF is the beacon of hope in our foggy market landscape, let’s take a moment to address the elephant in the room: the stock market’s tendency to behave like a toddler on a sugar rush.

Now, “value” is an interesting word, like “moist” but less likely to send chills down my spine. What one investor sees as excessively priced, another might treat as a clearance sale at a yard sale. It’s this delightful disparity-like watching my uncle argue about the proper way to grill burgers-that adds unpredictability to the stock market.

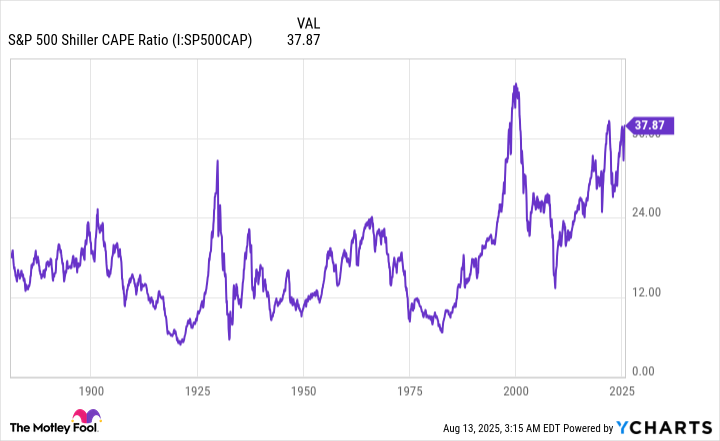

Investors have historically leaned on the price-to-earnings (P/E) ratio as their trusty sidekick. However, like a misunderstood character in a novel, the P/E can easily lead you astray by only considering 12 months of earnings, rendering it nearly useless during tremors and crises. Enter the S&P 500’s Shiller P/E ratio-known on the street as the CAPE ratio, although it’s decidedly less fun at parties.

The Shiller P/E, which factors in average inflation-adjusted EPS over the previous decade, gives us a clearer picture-one that suggests we’ll need to brace ourselves. Historically, a Shiller P/E above 30 has often heralded market corrections. And just as every family reunion ends in someone’s tears, market fluctuations rarely leave us unscathed.

If history has its way-like a particularly stubborn family tradition-the high-flying growth stocks currently dominating the bull market may be in for a rough time. Companies capitalizing on AI and crypto mania seem especially poised for what I call a financial water balloon fight.

Why the Schwab U.S. Dividend Equity ETF is worth your time

Now that we’ve trudged through the historical swamp, let’s highlight why the Schwab U.S. Dividend Equity ETF deserves a place in your portfolio. First off, dividend stocks have a remarkable penchant for outshining their non-paying counterparts over the years. While growth stocks might seem like the shiny new toys, it’s the steady income stocks that have consistently returned smiles (and money) to investors’ faces.

In a study called The Power of Dividends: Past, Present, and Future, the clever analysts at Hartford Funds found that over 51 years (1973-2024), stocks that distribute dividends have outperformed their non-paying siblings-9.2% versus 4.31%. Moreover, while my blood pressure rises listening to stock market news, these income stocks are, in essence, the emotional support animals of the investment world.

Secondly, the Schwab U.S. Dividend Equity ETF encompasses 103 time-tested public companies that know how to weather the storm. The top three holdings? Well, let me introduce you: Chevron, Altria Group, and PepsiCo. You may know them as the sturdy pillars of America, as reliable as a family recipe for spaghetti that’s whispered down the generations:

- Chevron, the giant energy stalwart with tentacles reaching into all possible energy veins, also knows a thing or two about cash flow.

- Altria, the heavyweight tobacco titan, finds its customers as loyal as my dog when I’ve snuck him a bite of my cheeseburger. Price hikes? They barely raise an eyebrow.

- PepsiCo offers snacks and drinks-a comforting embrace in a world of economic uncertainty.

The companies behind this ETF are adept at generating solid operating cash flows. It’s almost ironic; we invest in the stock market to escape the mundanity of life, only to find ourselves drawn to businesses that exude financial stability, like that one uncle who always carries cash and pays the tab.

Next up is valuation-reason number three this ETF should be on your radar. While we’re witnessing the Shiller P/E inching towards its third most expensive point in a century and a half, the TTM P/E ratio for Schwab’s ETF is hovering around 17. If the S&P 500 and its friends decide to make a swift exit, the mature businesses in this ETF could save you from the financial dumpster fire.

And let’s not forget the juicy yield-while the S&P 500 fails to impress at a feeble 1.2%, the Schwab U.S. Dividend Equity ETF boasts a bountiful 3.87%. It’s like discovering a forgotten $20 bill in an old coat pocket-exhilarating.

Finally, the expense ratio for this ETF is practically transparent-only 0.06%. Bear in mind, this means just $0.60 of every $1,000 you put in goes toward covering those pesky management fees. It’s practically a steal.

So in a market that resembles my uncle’s questionable holiday sweater collection-full of bright colors and questionable taste-the Schwab U.S. Dividend Equity ETF offers the perfect blend of high yields, low fees, potential downside protection, and healthy upside reward as we navigate this financial madness. So here’s to cautious optimism! 🎉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-15 11:02