As a seasoned analyst with over two decades of market experience under my belt, I must say that today’s Tokyo stock market turmoil is reminiscent of some of the most turbulent periods I’ve witnessed during my career. The rapid decline of the Nikkei 225 index and the subsequent sell-off in tech stocks, particularly the Magnificent 7, is a stark reminder of the unpredictable nature of the markets.

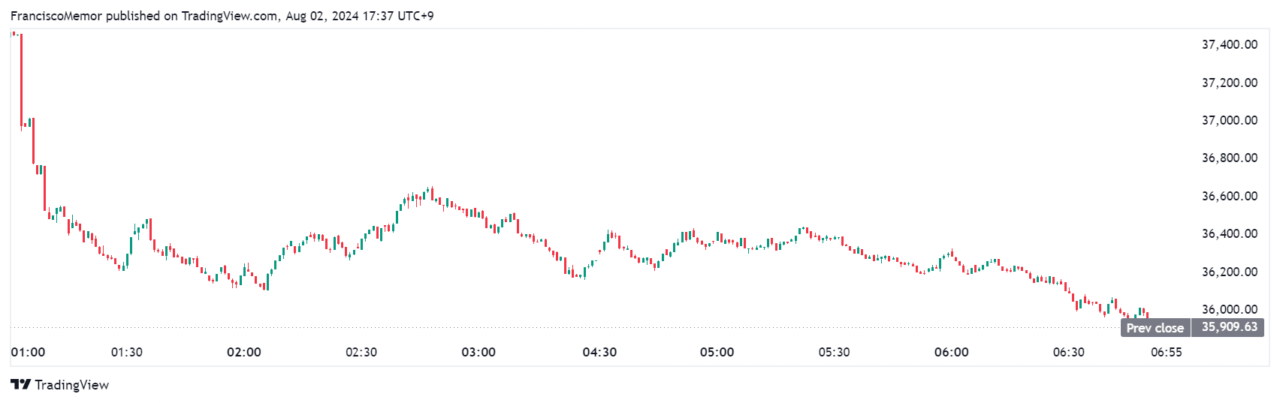

Tokyo’s stock market experienced a significant setback during the previous trading day, as the Nikkei 225 index dropped by a substantial 5.81%. This decline took the index to its lowest level in six months, and it nearly matched the second-largest daily drop since the Black Monday crash of 1987.

The index ended the day at approximately 35,909.70, losing roughly 2,217 points, mirroring the chaos in U.S. stock markets from the previous day, where the Dow Jones Industrial Average dropped more than 700 points at one instance.

Concerns about a potential economic downturn intensified following a dismal performance in the manufacturing sector, causing a wave of selling that particularly impacted the technology-focused Nasdaq Composite index. This was due to investors unloading their stocks during the ongoing tech market correction.

According to CryptoGlobe’s report, a collection of seven large-scale tech companies, known as the Magnificent 7, collectively shed over $2.6 trillion in worth during the past 20 days. This equates to an average daily loss of about $125 billion. To put it into perspective, this total loss is roughly three times greater than the entire value of Brazil’s stock market.

According to Kobeissi Letter, a reputable economics outlet, they pointed out on social media platform X (previously known as Twitter) that the Magnificent 7 lot has accumulated as much value as Nvidia’s entire market capitalization in just 20 days. It’s worth noting that Nvidia itself has lost a staggering $1 trillion since its peak.

In the meantime, the 10-year Treasury yield dipped below 4% due to weak economic indicators impacting the market. The ISM Manufacturing Index indicated a contraction in the U.S. manufacturing sector, and other data suggested jobless claims in the country reached an 11-month peak.

1. The swift increase in the value of the yen compared to the dollar intensified the strain for Japan’s export businesses, as they were already battling a significant challenge. For a moment, the exchange rate reached 148 yen per dollar, worsening the stock market decline in Tokyo.

The chart that currently holds significant global relevance is the one comparing the Japanese Yen and the U.S. Dollar. This chart carries such importance due to a few key factors:

— Ran Neuner (@cryptomanran) August 2, 2024

After an increase in interest rates by the Bank of Japan to 0.25% – the highest level since the Financial Crisis of 2008 (when rates peaked at 0.5%) – the Japanese yen strengthened.

As a researcher examining market trends, I’ve noticed that recent financial turmoil might not be contained solely within traditional risk-assets; it could potentially impact digital assets as well. For instance, over the past 24 hours, Bitcoin‘s price has dipped by more than 1.3%, currently trading at approximately $64,500 – a significant drop from its peak near $70,000 reached just last month.

Historically, the value of cryptocurrencies tends to follow the trends seen in traditional financial markets. When an economic downturn, such as a recession, appears likely (indicated by poor economic data), it usually leads investors to become more cautious and avoid taking risks.

Contrary to expectations, there’s been a rise in Bitcoin withdrawals from exchanges, even though the cryptocurrency has been experiencing volatility or fluctuations since February.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-08-02 16:34