Right. So, the S&P 500 is…doing a thing. Apparently, it’s off to a good start in 2026. Three years of gains, they say. Honestly, it feels less like a triumph and more like a particularly elaborate setup. Like when you spend ages perfecting a soufflé, knowing full well it’s destined to collapse the moment anyone looks at it wrong.

Because here’s the thing: this isn’t your standard champagne-and-confetti market. For the last few years, it’s been all about Tech, growth stocks, the “Magnificent Seven” – basically, a handful of names propping everything else up. It’s like being at a party where one person is doing all the talking, and everyone else is just nodding politely, hoping they don’t get asked a direct question.

But this year? Apparently, things are…broadening. More stocks are participating. Which, on the surface, sounds…healthy. Like a balanced diet. But let’s be real, “healthy” is rarely as fun as a giant slice of cake. The tech sector is still leading, naturally, but even things people pretended didn’t exist – energy, materials, small-caps, value stocks – are getting a look-in. It’s…unexpected. And unexpected in the market usually means “prepare for disappointment.”

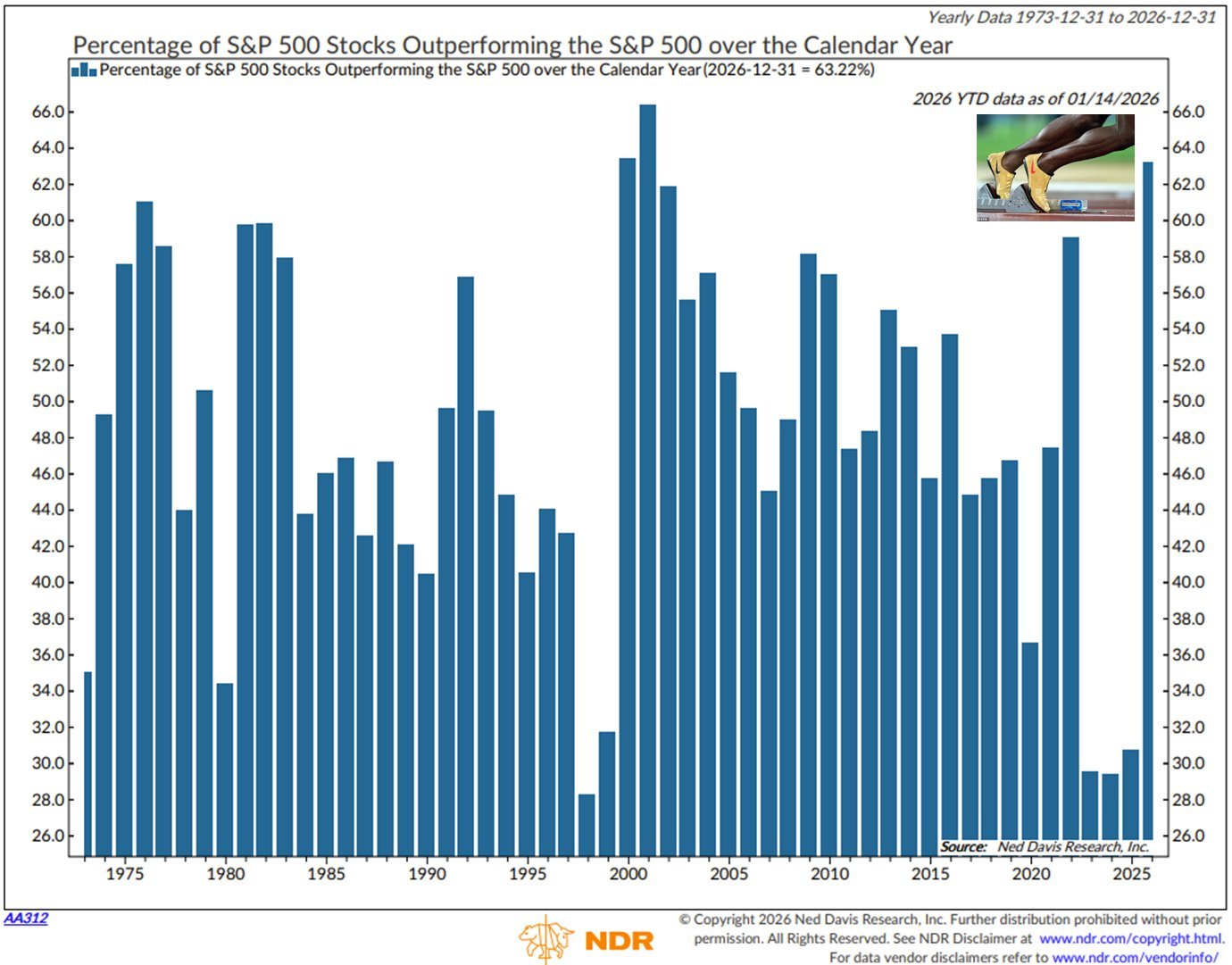

They’re saying 63% of S&P 500 stocks are beating the index. 63%! It feels…suspiciously high. Like a politician’s approval rating after a carefully curated photo op. It’s rare, apparently. The second-highest rate in 50 years. Only beaten by 2001. 2001. Need I say more?

Of course, it’s only January. A month. A blip. A fleeting moment of optimism before the inevitable crash. They want you to think it means something. They always do. I’ll wait. I’m good at waiting. I’ve spent most of my life waiting for things to go wrong, and honestly, it’s a surprisingly accurate strategy.

But historically, this kind of broad participation…doesn’t end well. It’s like when everyone suddenly decides to take up a new hobby. It seems fun, and inclusive, and then everyone realizes they’re terrible at it and the whole thing falls apart.

High Participation Rates & The Inevitable Downturn

In 2022, we saw high participation too, didn’t we? The S&P 500 was down, but a lot of stocks didn’t fall as much. Defensive sectors did okay. Dividend stocks held up. It was…odd. Like a party where everyone’s pretending to have fun while secretly dreading the bill.

Go back further. The early 80s. Broad participation, recession, 20% drop. The early 90s. One good year for breadth, followed by a recession and another 20% drop. The 2000s? Tech bubble, financial crisis. It’s a pattern, people. A depressing, predictable pattern.

Don’t get me wrong, a fast start to the year isn’t guaranteed to lead to disaster. But history suggests a vulnerability. It’s like knowing your favorite sweater has a hole in it. You can still wear it, but you’re constantly bracing yourself for the moment it unravels.

So, enjoy the moment. Revel in the optimism. But please, for the love of all that is holy, don’t start believing this is different. Because it rarely is. And I’ll be over here, quietly preparing for the inevitable.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 20:22