As a analyst, I find myself in agreement with billionaire entrepreneur Mark Cuban, who is renowned for his ownership of the NBA’s Dallas Mavericks and his appearance on the hit TV show Shark Tank. In the face of increasing economic uncertainties, he has once again expressed his preference for Bitcoin over gold as a reliable hedge.

In a recent comment, Cuban highlighted the benefits of Bitcoin, expressing his belief that it holds greater value compared to other assets like gold. He also expressed a preference for owning Bitcoin over gold during an economic collapse. This perspective aligns with the growing perception of Bitcoin as a form of “digital gold”, a decentralized means of storing wealth which bypasses the shortcomings associated with traditional centralized financial systems.

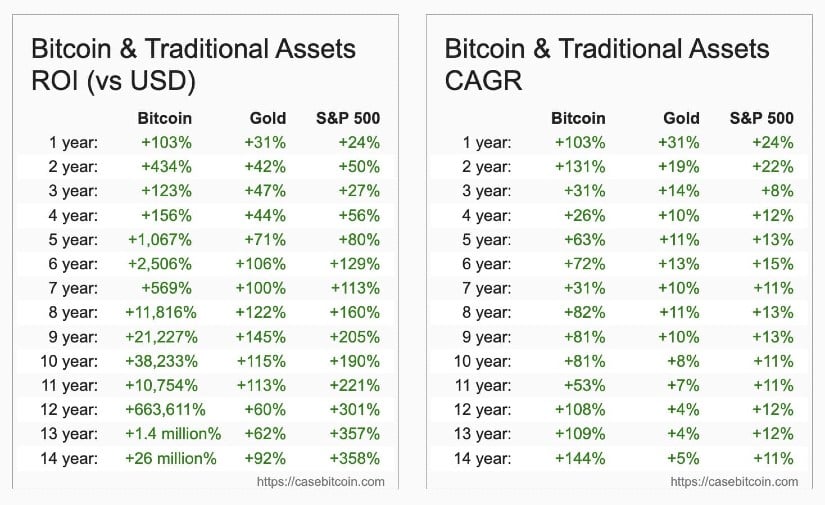

Unlike gold, which is often seen as a secure investment during financial instability, Bitcoin provides unique benefits such as ease of transportation, the ability to be divided into smaller units, and the capacity to transfer value internationally without physical boundaries. These technological perks make Bitcoin an increasingly appealing choice in uncertain times. Mark Cuban’s perspective underscores Bitcoin’s potential not just for being a store of value but also for serving as a practical currency.

A post on platform X, by the account Watcher. Guru, revealed that business magnate Mark Cuban prefers Bitcoin over gold in case of economic turmoil, stating, “I believe it holds more worth.

In 2024, Cuban expressed continued backing for significant digital currencies such as Bitcoin and Ethereum, but warned potential investors about speculative “meme coins.” He compared these to a game of musical chairs because of their unpredictable nature and lack of lasting reliability. His unwavering support for Bitcoin has further solidified his role as a notable champion for this digital currency.

Changing Investor Perceptions

The fact that Cubans tend to favor Bitcoin over gold showcases a substantial change in investor viewpoints, especially given rising worries about inflation and potential global monetary upheavals. More and more, Bitcoin is being viewed as a protective measure not just against inflation but also against the sluggishness of conventional financial systems when it comes to embracing innovative technologies. This trend stems from Bitcoin’s unique qualities, including its ability to be easily divided and its capability to effortlessly facilitate international transactions.

Gold, though traditionally valued for maintaining worth during financial crises, comes with practical difficulties. Cuban pointed out the impracticality of using gold in everyday dealings due to its substantial size and vulnerability to theft. In his words, “People aren’t going to carry around gold bars. ‘Look, he owns gold.’ Zap! ‘Now I own gold,'” demonstrating the inconvenience. In contrast, Bitcoin offers flexibility, enabling fractional ownership and simpler transferability, making it more useful as both a store of value and a means of exchange.

Regardless of Bitcoin’s fluctuations, advocates such as Cuban believe that its future prospects are greater than the associated risks. Likewise, financial guru Suze Orman shares this viewpoint, hinting that the increasing fascination among younger generations towards digital assets could foster Bitcoin’s growth and value in the long run.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-09 12:58