Beginning in early 2025, MANTRA aims to convert more than a billion dollars worth of DAMAC Group’s assets into digital tokens, as mentioned in a statement released on Thursday.

Under the guidance of business magnate Hussain Sajwani, based in the United Arab Emirates, the DAMAC Group manages a vast empire spanning various sectors such as real estate, hospitality, and technology-focused ventures like data centers.

MANTRA Takes a Major Step in RWA Tokenization

2022 saw DAMAC commence the acceptance of cryptocurrency transactions, with plans to further embrace blockchain technology for asset tokenization. This innovative step enables potential investors to gain access to DAMAC’s varied investment opportunities – such as real estate projects and other business endeavors – via digital tokens.

This method is designed to streamline investment procedures, providing a wider range of possibilities for both individual and corporate investors. We’ll disclose more about the unique features and tokenized deals within a few weeks. The launch of these deals is planned for early 2025.

According to MANTRA CEO, John Patrick Mullin, “Our collaboration with DAMAC Group serves as validation for the Real World Assets (RWA) industry. We’re excited to team up with such distinguished leaders who share our aspirations and recognize the immense potential of moving conventional financing options onto the blockchain.

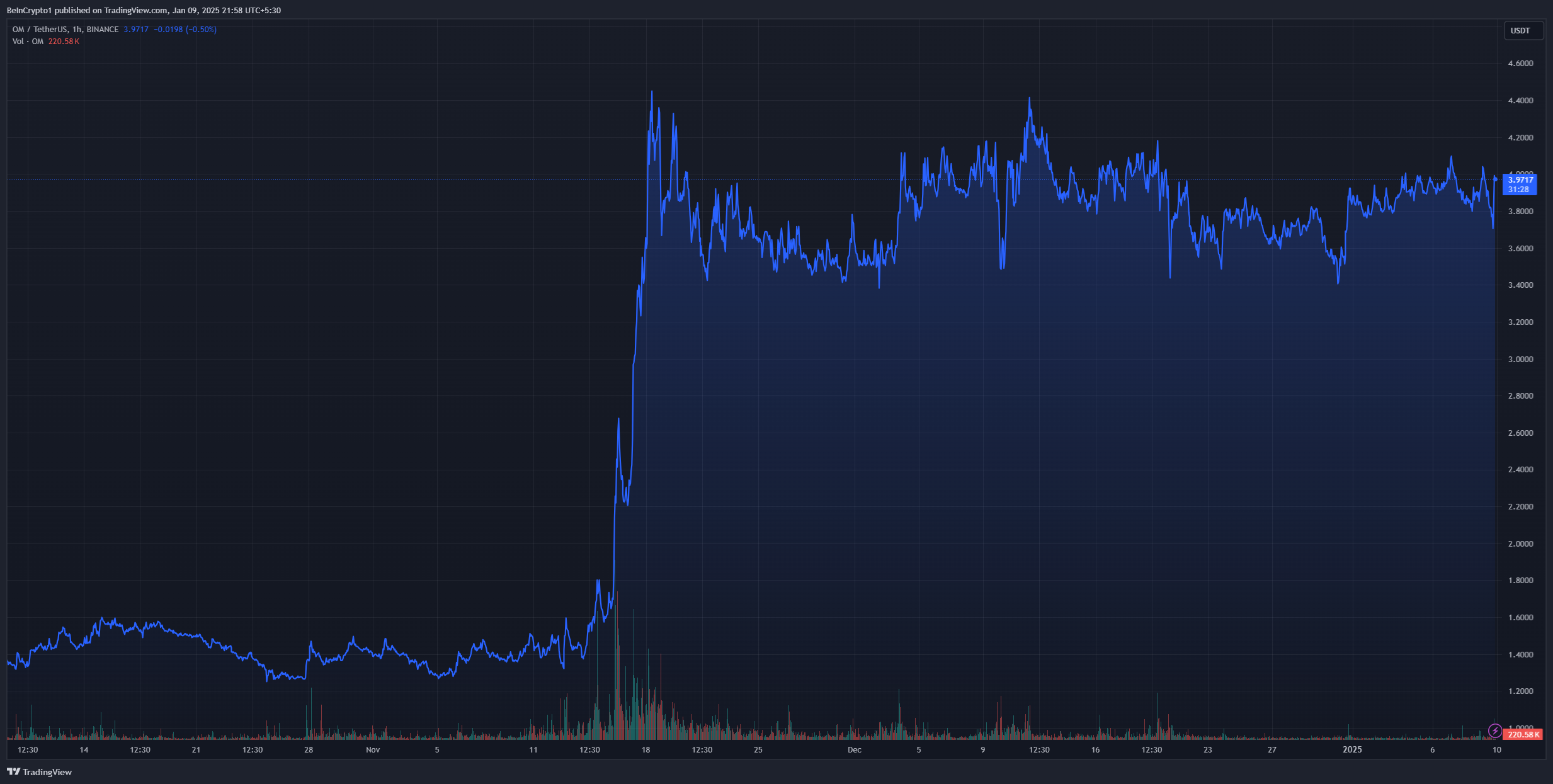

In October, MANTRA officially launched its primary network. Since then, its native coin, OM, has experienced a substantial increase in market value. Over the past three months, this token surged by 200%, reaching a market cap of $3.6 billion and hitting an all-time high in December.

Partnering with MANTRA, DAMAC is moving towards investment models that leverage blockchain technology, marking a significant evolution in the way traditional markets operate. These new models aim to streamline processes and make investing more accessible for global investors, potentially revolutionizing the entire investment landscape.

Growing Interest in Real-World Asset Tokenization

As a researcher, I’d describe tokenization as the process whereby conventional assets such as real estate, securities, or commodities are transformed into digitally represented tokens on a blockchain platform, signifying ownership.

Worldwide, this method is becoming increasingly popular because it has the ability to accelerate transaction times and offer more investment opportunities. Experts predict that the market value for tokens representing real-life assets may surpass trillions of dollars by the end of the next ten years.

2024 was a busy year for that particular sector, with BlackRock introducing their BUIDL tokenized fund in March. Since then, this fund has grown to operate on five major blockchains: Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

This fund offers returns through on-chain earnings, versatile asset storage, and seamless integration options. Already, initiatives like Ethena and Frax have debuted stablecoins that are supported by this very fund.

As an analyst, I’m excited to share that I’ve observed Tether moving forward with its tokenization strategy, gearing up to launch Hadron. This platform, set to debut in February 2025, is designed specifically for Real-World Asset (RWA) tokenization. Notably, Hadron will offer a comprehensive user interface and API support tailored for institutional users.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-09 20:12