As a seasoned analyst with over two decades of market analysis under my belt, I’ve seen trends come and go like the tides. The current trajectory of Mantra (OM) has been quite impressive, with its 183.20% surge in the last 30 days. However, the technical indicators suggest that we might be witnessing a change in momentum.

In just the past month, the price of Mantra (OM) has experienced a significant surge, rising by an impressive 183.20%. On November 18, OM set a new record high, and at present, it is approximately 10% lower than that peak level.

Even though it’s been delivering strong results, there are signs that its upward trend may be slowing down. Whether OM manages to surpass its current resistance levels and reach new heights, or experiences a possible downturn, will depend on how the present conflicting signals unfold.

OM’s Trend Is Fading Away

The Mantra Average Directional Index (ADX), which measures trend strength, has dropped significantly from 35 to 21.6 in a single day. This significant decrease suggests that the robustness of OM’s uptrend may be diminishing, despite the fact that its price is still climbing.

A smaller ADX value indicates that although the trend is still present, it might not have enough power to maintain substantial growth. Should the ADX keep decreasing, the upward trend may weaken, potentially leading Oil & Minerals (OM) to experience a period of consolidation or even reverse direction.

The ADX (Average Directional Movement Index) gauges the intensity of a trend’s direction, and a value exceeding 25 indicates a robust trend, while a value under 20 points to a weak or nonexistent trend. Currently, OM’s ADX stands at 21.6, which is in a transitional area, indicating that the upward trend may be weakening but it hasn’t totally vanished yet.

To keep the Open Market (OM) price continuing its upward trend, it’s crucial that the Average Directional Index (ADX) rises again above 25, signaling a return of momentum. If the ADX remains steady near its current level, the price could either pause or advance at a slower pace, underlining the importance of renewed buying enthusiasm to keep fueling the uptrend.

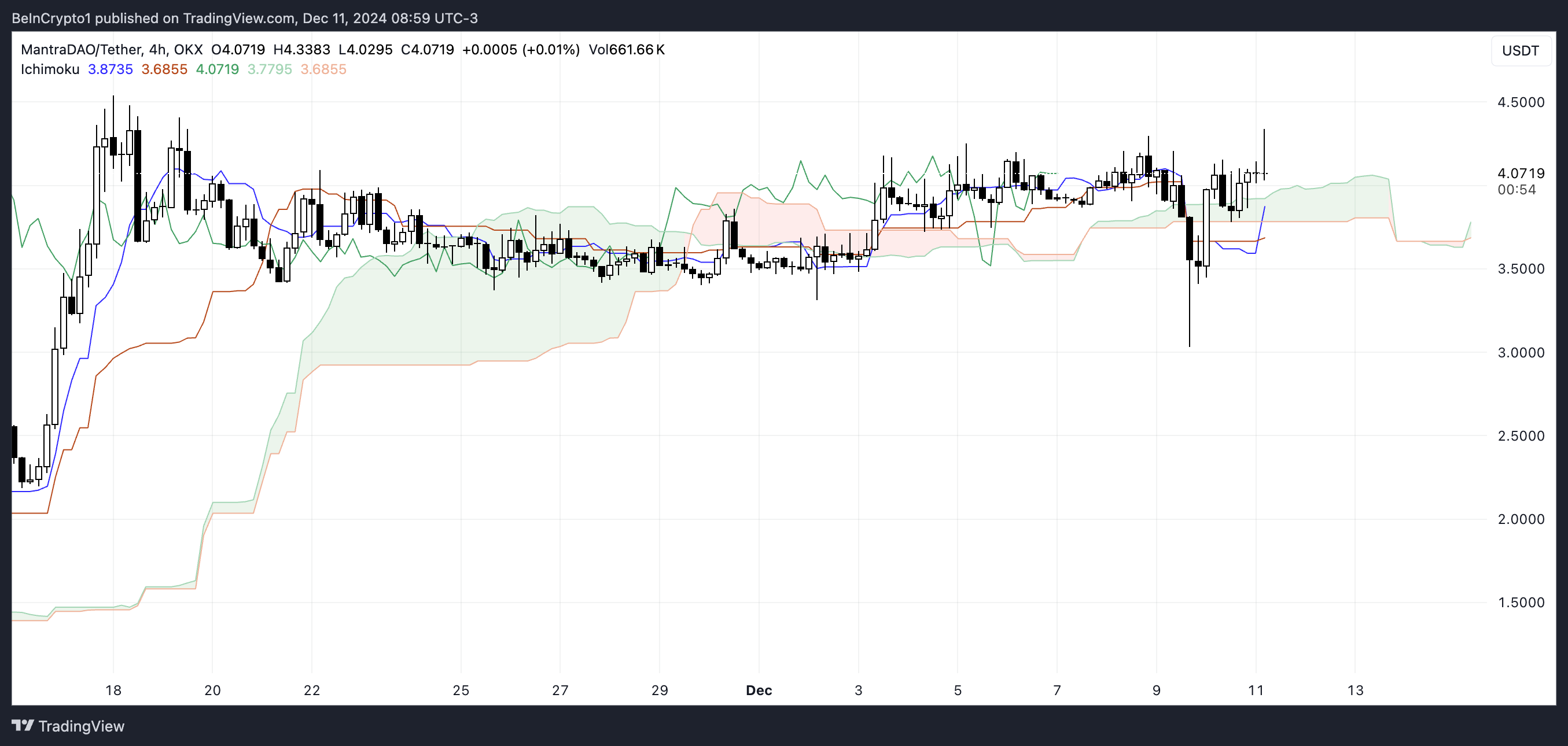

Ichimoku Cloud Shows Cautious Next Steps for Mantra

As a crypto investor, I’m observing some intriguing mixed signals from the Ichimoku Cloud for OM. While the current price position is above the cloud, traditionally, this points towards a bullish market trend. However, the cloud appears relatively flat, which could imply a lack of significant momentum in either direction, suggesting potential for a sideways movement or a slowdown in the trend’s pace.

As a crypto investor, I’ve noticed an intriguing development: The Tenkan-sen line has dropped below the Kijun-sen line, which typically signals a bearish trend. However, there’s a green cloud on the horizon, indicating potential continuation of Mantra’s uptrend. If the Real-World Assets narrative regains its momentum, Mantra price could potentially keep moving upwards.

The Ichimoku Cloud is an extensive tool that offers valuable information about market trends, speed, and potential support or resistance points. When the price exceeds the cloud, it suggests a bullish outlook; on the other hand, when the price falls below it, it indicates a bearish stance. Given that OM is presently above the cloud but showing signs of slow momentum, the trend could be in a phase of consolidation.

To ensure a more powerful upward movement, the price should continue to remain above the “cloud” while the Tenkan-sen line crosses back above the Kijun-sen line, indicating a resurgence of bullish momentum. If the price drops below the “cloud,” it might change the trend to downward, aiming for lower levels of support.

OM Price Prediction: A New All-Time High Soon?

At present, the Exponential Moving Averages (EMAs) from OM are suggesting a positive market direction, as the shorter-term averages sit higher than the longer-term ones, signaling a bullish trend.

Yet, the decreasing gap between the Exponential Moving Averages (EMAs) indicates a potential slowdown in momentum, hinting that the current trend may reverse shortly. This mirrors increasing market turbulence as both buyers and sellers vie for control.

Should the upward trend persist, we might expect OM to challenge its resistance at approximately $4.29. Overcoming this barrier could propel it towards $4.53, setting new record highs and positioning Mantra as a notable frontrunner within the Real World Asset (RWA) coin category.

If a downward trend emerges, the OM price could potentially drop to $3.41, which would signify a 16% decrease. The shrinking space between the EMAs underscores the need to keep a close eye on price fluctuations for any indication of a breakout or breakdown.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-11 23:14