As a seasoned crypto investor with over a decade of experience in this volatile market, I have learned to read between the lines when it comes to price charts and technical indicators. The recent surge in Mantra (OM) has been nothing short of impressive, but as someone who’s seen a few bull runs come and go, I can’t help but feel a sense of caution.

The price of Mantra (OM) reached an unprecedented peak on November 18 and skyrocketed by 155.29% over the past week. This extraordinary surge underscores the robust positive sentiment fueling OM, propelling it to its highest ever valuation.

On the other hand, current signals such as RSI and the Ichimoku Cloud seem to point towards a potential softening of the upward trend.

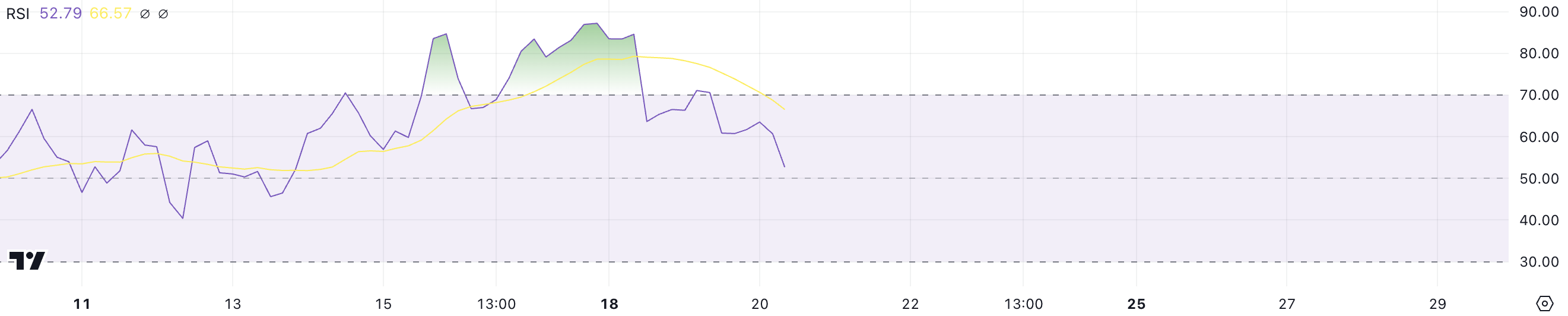

OM RSI Shows The Neutral Zone

As a crypto investor, I’ve noticed that OM’s Relative Strength Index (RSI) has dipped to 52.7 recently, down from the overbought levels it maintained between November 16 and November 18 when it consistently surpassed 70. During this period, Mantra price also reached new record highs due to the escalating buzz surrounding real-world assets (RWA).

This decrease suggests a lessening of purchasing enthusiasm, implying that the intense upward push experienced previously has relaxed. This change signifies a market equilibrium, where both buyers and sellers now hold equal sway over the Open Market’s price.

The Relative Strength Index (RSI) measures the intensity of price changes. When the RSI is greater than 70, it suggests a strong bullish trend with possible overextension, whereas an RSI less than 30 indicates significant bearish influence.

At 52.7, OM’s RSI is in a neutral range, suggesting the market is neither overheated nor oversold.

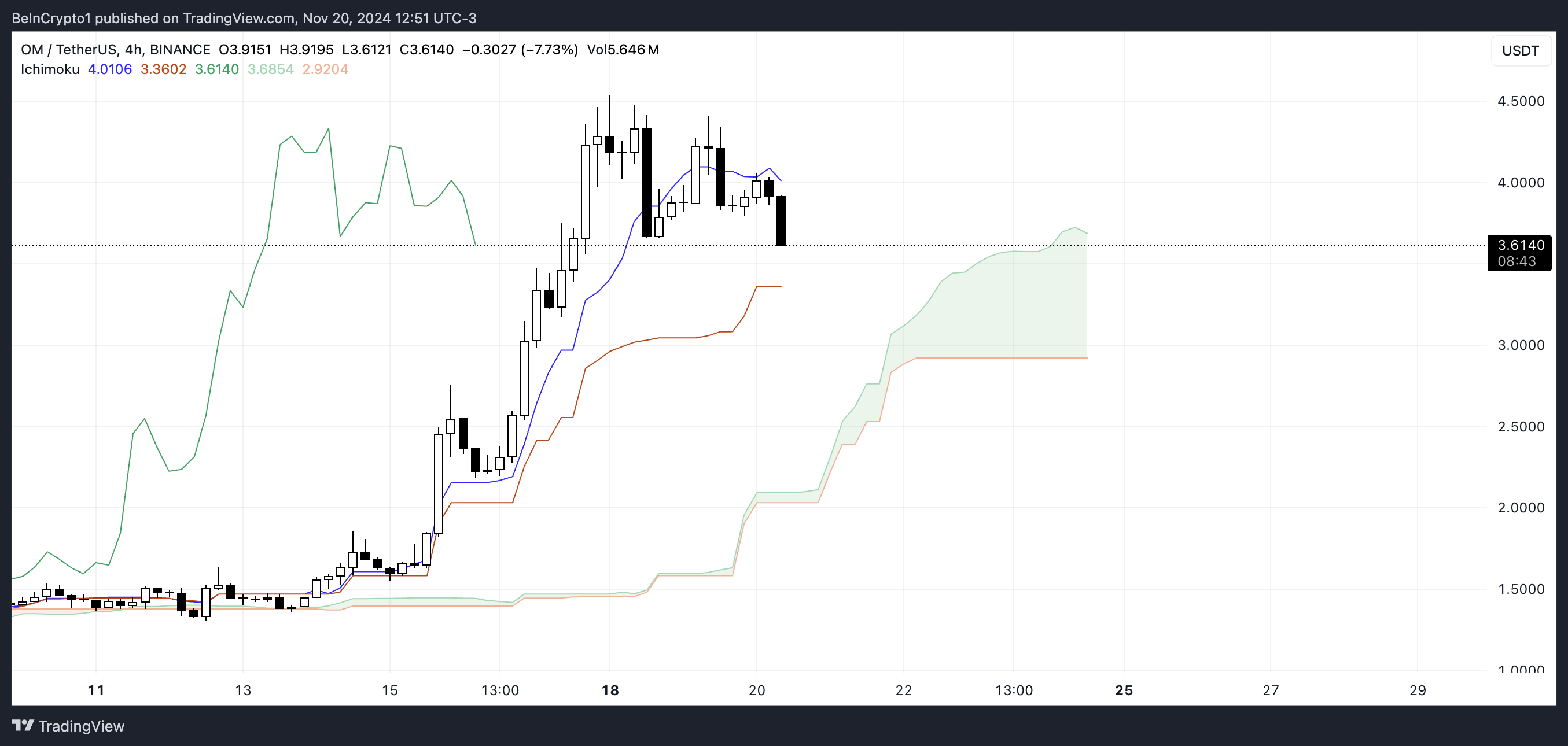

Ichimoku Cloud Shows Mantra Uptrend Is Weakening

According to the Ichimoku Cloud chart for OM, the short-term price trend appears to be weakening. The price has dipped below the Tenkan-sen line (blue line), suggesting a decrease in short-term momentum, and it’s currently nearing the lower limit of the green cloud (Kumo).

If a point dips beneath the cloud formation, it could signal a shift towards a downward trend, since the cloud usually functions as a crucial support level.

Ahead lies a rather dense green mist, indicating that though the general direction might hold some backing, this backing is currently under scrutiny.

If the Open Market (OM) price finishes lower than its moving average, it might suggest a possible shift from the current upward trend towards a prolonged downward trend.

OM Price Prediction: Can Mantra Go Below $3 In November?

If the decline of OM persists and gains strength, it might approach its most robust support area around $2.98. If this support doesn’t manage to withstand the pressure, there’s a possibility that the price could descend even more, possibly dipping down to approximately $1.81.

This scenario would signal a deeper bearish reversal and a significant loss of momentum.

Should the upward trend rebound, the OM price might strive for fresh peaks as it confronts the potential resistance at $4.53.

Reaching this stage could very well propel OM beyond its past maximum, creating a fresh record and positioning Mantra among the most significant coins within the Real World Asset (RWA) network.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-21 00:34