So, everyone’s falling over themselves about these “Magnificent Seven” stocks. Spectacular performance, they say. Right. Like a slightly above-average Tuesday. It’s just… the hype. The sheer hype. They made money because, well, everything was cheap for a while. Now they’re not. And now everyone thinks they’re geniuses. It’s infuriating. And this AI thing? Don’t even get me started. It’s just… algorithms. Fancy algorithms. They’re selling us glorified calculators and acting like they’ve unlocked the secrets of the universe.

Now, they want you to believe these companies are poised for even more growth. As if growth is some kind of birthright. I mean, really. Let’s look at these supposed winners, shall we? Because I have a feeling this whole thing is built on a foundation of…optimism. Which, frankly, is terrifying.

1. Nvidia

Nvidia. The chip guy. Everyone needs their chips. Okay, fine. They make graphics cards. And now, suddenly, they’re the key to artificial intelligence. It’s like they decided to rebrand a toaster as a spaceship. They’re making money hand over fist, of course. But at what cost? And forty times forward earnings? Seriously? That’s… a lot. They’re banking on four trillion dollars in AI spending. Four trillion! It’s a number that’s so big, it loses all meaning. It’s like saying there are a lot of stars in the sky. Technically correct, but utterly useless information.

They’ll tell you it’s reasonable. They’ll say there’s room to run. But it’s a bubble, I tell you! A beautifully engineered, silicon-based bubble. And when it pops… oh, when it pops.

2. Alphabet

Alphabet. Google. They’re already making billions off of people searching for… well, whatever it is people search for. And now they want to sell you AI cloud services. It’s like a plumber deciding to open a bakery. They’re good at one thing, and now they’re suddenly experts in everything. They’re offering access to Nvidia’s platforms, which is just… admitting they don’t have their own. And their Gemini thing? Another LLM. Another set of algorithms pretending to be intelligent. And they’re using it to improve Google Search? As if the search engine wasn’t already intrusive enough. It’s a slippery slope, I tell you. A slippery, data-collecting slope.

Twenty-nine times forward earnings. Still expensive. Still relying on advertising revenue. Still a company that knows too much about my search history.

3. Meta Platforms

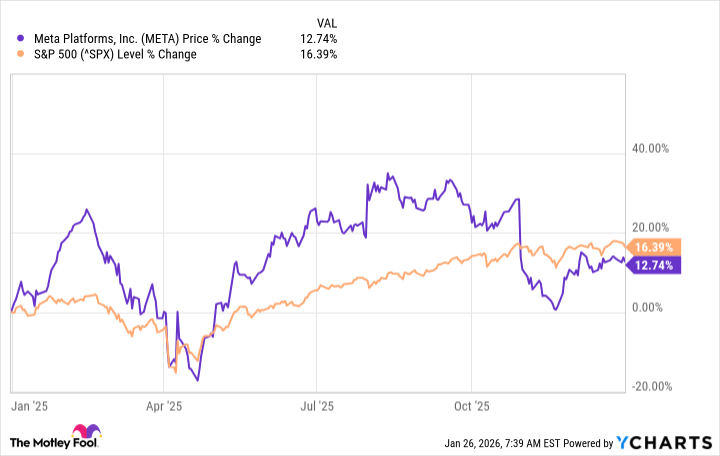

Meta. Facebook. Instagram. The place where everyone pretends their lives are perfect. And now they’re an AI player? It’s just… confusing. They underperformed the S&P 500 last year. Which, frankly, is a good sign. Maybe people are starting to wake up. But everyone’s worried about a slowdown? As if a slowdown is some kind of existential threat. Zuckerberg says they can slow spending? Like that’s some kind of revelation. Of course, they can slow spending. Everyone can slow spending. It’s called being responsible.

They’re the cheapest of the Magnificent Seven at 21 times forward earnings. Which just means they’re the least overpriced. And people are going to rotate out of high-flying stocks? Good. Maybe then we can all get a little perspective. It’s just… the whole thing feels wrong. Like a badly written screenplay. And I have a feeling the credits are going to roll on this whole charade sooner than anyone expects.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Movie Black-Haired Beauties, Ranked

- Best Video Games Based On Tabletop Games

2026-01-27 16:22