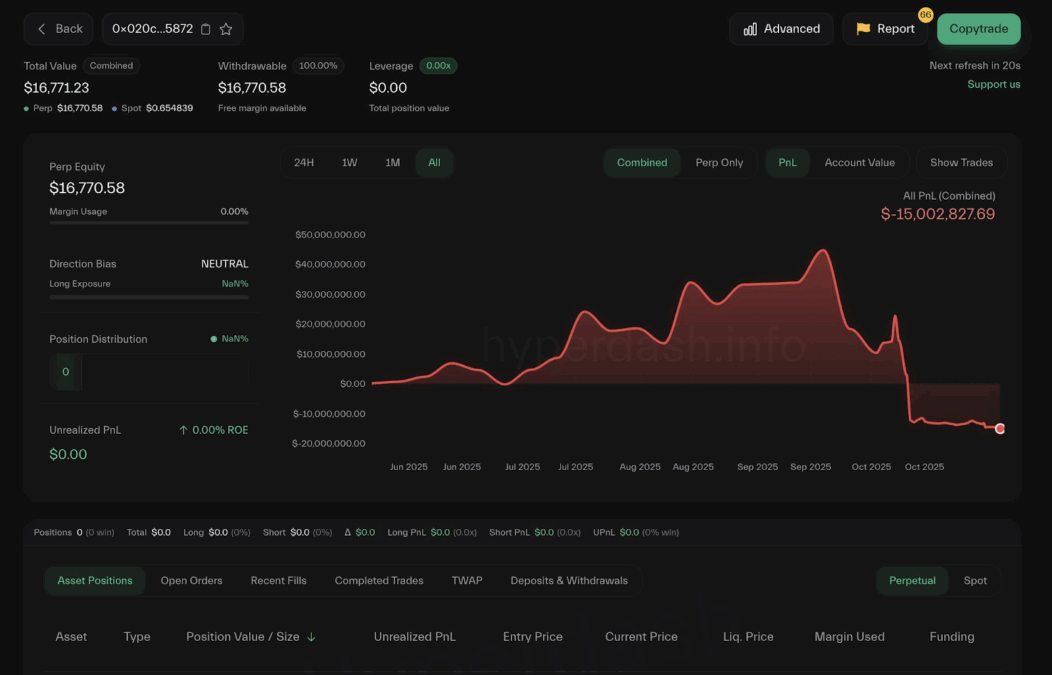

Permit me to regale you with the tale of Jeffrey Huang, alias Machi Big Brother, a gentleman whose financial acumen resembles a toddler’s attempt to solve a Rubik’s Cube-brimming with enthusiasm, yet tragically inept. On-chain data, that most unyielding of chroniclers, reveals our hero has been summarily liquidated, his once-vaunted $15 million portfolio now reduced to a paltry $16,771. A fate as inevitable as a tea-soaked crumpet at a garden party, one might say.

The incident, a masterclass in volatility, underscores the perils of high-leverage trading on decentralized platforms-where fortunes are made and lost faster than a debutante’s reputation at a London ball. Even the most seasoned investors, armed with spreadsheets and existential dread, cannot escape the whims of the market gods.

“Machi Big Brother has been fully liquidated, with only $16,771 left in his account – marking a total loss of over $15M.” – Lookonchain (@lookonchain), November 3, 2025

The High-Stakes Crypto Gambler

Our intrepid trader had staked his last shilling on a leveraged long position in Ethereum and other volatile assets on Hyperliquid-a strategy akin to playing Russian roulette with a champagne flute. When the market plummeted, his account, once a glittering trove of unrealized profits, was forcibly liquidated. A fate as poetic as a poet who forgets to rhyme.

Machi’s trading history is a rollercoaster of “I told you so” moments, punctuated by losses that would make a Victorian miser weep into his waistcoat. One might say he’s the crypto equivalent of a man who bets his top hat on a horse race, only to lose it to a goat.

Who Is This Machi Big Brother?

Jeffrey Huang, a man whose career oscillates between the absurd and the audacious, first gained notoriety in the 1990s as a member of the L.A. Boyz-a group whose musical legacy is best described as “undiscovered.” By 2003, he’d founded MACHI, a label so avant-garde it could only be appreciated by those who’ve never heard of the word “taste.”

By 2017, Huang had pivoted to crypto, a realm where his wallet movements are scrutinized with the intensity of a gossip columnist following a royal scandal. A whale in the digital ocean, he swims with the confidence of a man who’s forgotten the water is cold.

The NFT “Godfather” (Or So He Thinks)

Machi, hailed by some as the “Godfather of NFTs,” is a figure of both reverence and ridicule. His Bored Ape Yacht Club collection, once a symbol of status, was traded with the enthusiasm of a man selling his grandmother’s pearls at a flea market. His sales, large-scale and impulsive, have left the NFT market reeling-like a drawing room after a fire sale.

During the crypto bear market, he realized losses equivalent to 5,900 ETH (or roughly $11 million). A sum so staggering it could fund a lifetime supply of tea for an entire village-assuming the villagers share his passion for speculative assets.

Huang’s Crypto Odyssey

Huang’s ventures include the 2018 ICO of Mithril, a project so obscure it could only be found on a map drawn in invisible ink. He also founded Cream Finance, a DeFi platform that collapsed with the grace of a soufflé in a hurricane. In 2018, he was accused of embezzling 22,000 ETH from Formosa Financial-a scandal he attempted to bury with a defamation lawsuit, which he later withdrew, much to the delight of tabloid writers.

More recently, he launched Ape.fi, a DeFi project for BAYC holders, a venture as doomed as a man trying to sell ice to Eskimos. Despite his recent liquidation, Machi remains a figure of fascination, a crypto equivalent of a man who insists on wearing a top hat to a rock concert-because why not?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-03 23:22