Behold the name Uber (UBER), a monolith so grand it has colonized the American psyche with the precision of a bureaucrat stamping permits. It presides over three-fourths of the ride-hailing realm, as though the roads themselves were its private estate. Yet beneath this gilded canopy, a sprout of rebellion stirs. Lyft (LYFT), that sly fox of the streets, slinks forward-unprofitable no longer, yet undervalued still, as if the market were a befuddled scribe who forgot to update the ledger.

What is a dividend hunter to do? One does not chase the emperor’s robes; one seeks the hidden groves where golden acorns fall unobserved. Uber’s shares, inflated like a carnival balloon, promise only a pop. Lyft, meanwhile, drifts like a shadow across the chart, its numbers whispering of margins expanding with the grace of a bureaucratic form finally filled correctly after decades of red tape.

The Industry’s Tailwind: A Bureaucratic Gale

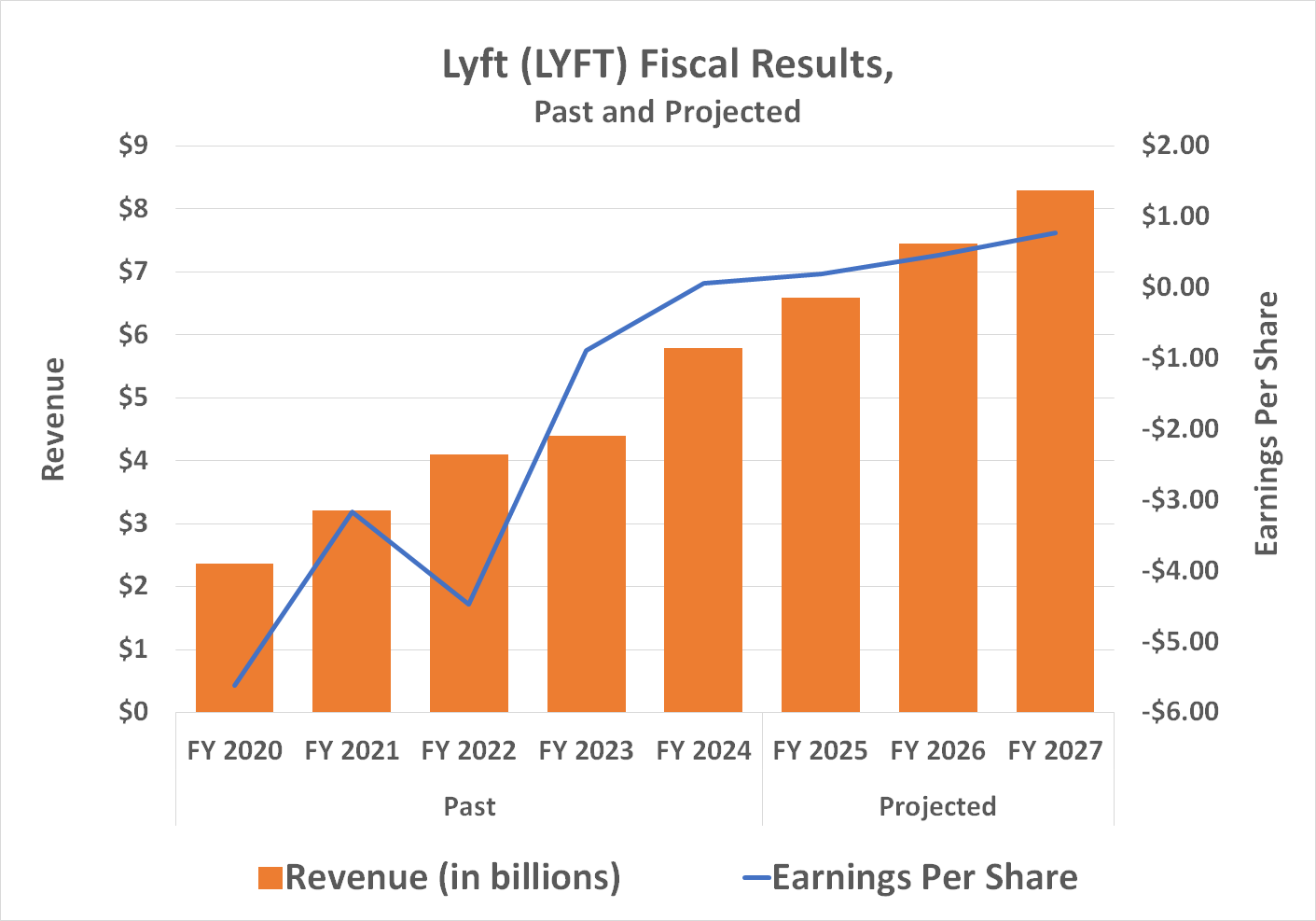

Once, it seemed only one ride-hailing titan could survive the American wilderness. But the world has grown fickle, and the younger generations-those digital nomads who ride in electric chariots-have rendered this notion as quaint as a horse-drawn carriage at a tech conference. Lyft’s 2024 profitability is no mere accident; it is the market’s nod to a company that has learned to dance in the rain of economic absurdity. Analysts, those modern-day soothsayers, predict this rain will continue to fall through 2027. A prophecy, perhaps, but one worth heeding.

Why, then, does Lyft’s chart resemble a flatline? Ah, the masses cling to Uber like a child to a security blanket. They do not see the undercurrents-the slow, inevitable erosion of car ownership, the generational shift toward access over possession. In the 1990s, two-thirds of teenagers clutched driver’s licenses like holy relics. Now, a third? The automobile, that proud steed, is being replaced by the ghost of convenience, and Lyft rides this spectral horse with the flair of a jockey at a haunted derby.

Consider the Deloitte poll: 44% of the 18-34 set would surrender their wheels for the siren call of app-based liberation. Meanwhile, the 55+ crowd clings to their keys with the desperation of a bureaucrat defending a crumbling ministry. The future is not in the hands of the old; it is in the pockets of the young, and Lyft is their taxicab to tomorrow.

Even abroad, where markets are as diverse as a cabinet of curiosities, the same cultural alchemy occurs. Precedence Research, that oracle of numbers, predicts the global ride-hailing market will grow at 18% annually through 2034. A number so precise it must have been scribbled in the margins of a 19th-century ledger by a ghostly accountant.

Reward, Not Risk: The Ledger of Tomorrow

Risk? Of course there is risk. But what is the market if not a theater of absurdity, where logic is a poor actor and sentiment the true playwright? Lyft’s 12% year-to-date revenue growth is no mere blip; it is the first creak of a door opening. The company seeks mid-teens growth for the current quarter, and analysts, those modern-day astrologers, suggest this will continue for years. A promise etched in spreadsheets, perhaps, but one that smells of dividends.

The true test lies in the valuation. At 50 times this year’s earnings, the stock seems rich. But next year’s $0.46 per share? That is but a pebble in the eye of a typhoon. For a company poised to widen margins with the inevitability of a tax audit, this is a price worth paying. Especially when the alternative is to chase Uber’s frothy gains like a dog chasing its tail through a bureaucratic maze.

Do not delay. Though the chart has stagnated since 2022, the bulls are stirring. They are the vultures circling the carcass of overvaluation, waiting for the scent of profit to rise. When the tipping point arrives, Lyft may yet ride the same wave of euphoria that lifted Uber to its throne. Or, if nothing else, you shall own a fragment of a company that proved even the largest bureaucracies can be outmaneuvered by the nimble and the clever. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-20 03:42