For the discerning investor, the integrated energy colossus offers a mosaic of yield and stability, its facets polished by the paradoxical alchemy of oil and time. Three titans-Chevron, ExxonMobil, and TotalEnergies-stand sentinel at the crossroads of this labyrinthine sector, their dividends shimmering like mirages in the desert of market volatility. Yet, as any connoisseur of capital knows, the true art lies not in mere acquisition but in the patient dissection of risk and reward.

The Integrated Paradox

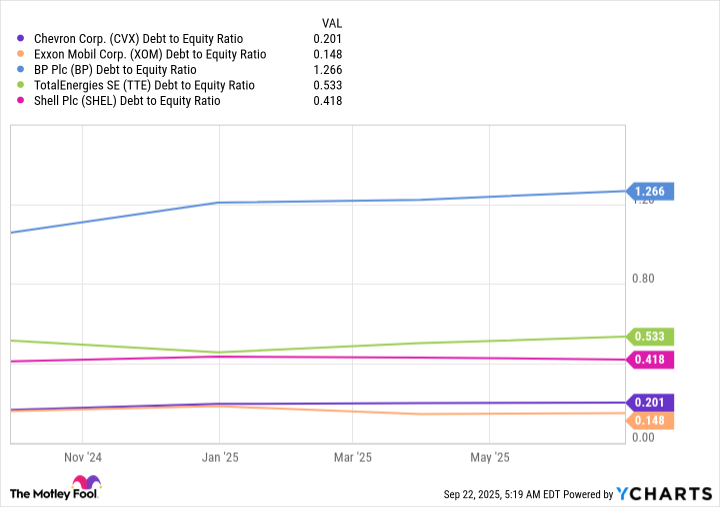

The roll call of integrated energy giants is a sparse gallery: Chevron, Exxon, TotalEnergies, BP, Shell. Yet BP and Shell, with their half-hearted flirtations with clean energy, have left a stain on their dividend records, a blemish that lingers like an indelible ink on parchment. Their recent reversals of fortune-abandoning green pledges as readily as one discards a moth-eaten coat-render them less than ideal companions for the long-haul investor. Thus, the stage is set for the triumvirate of Chevron, Exxon, and TotalEnergies to bask in the limelight of dividend reliability.

The integrated model, that architectural marvel of diversification, softens the seismic tremors of the energy cycle. Upstream, midstream, downstream-each segment dances to its own rhythm, yet the choreography is such that the whole remains eerily stable. A ballet of pipelines, refineries, and wells, where the crescendos of boom and the whispers of bust are harmonized into a symphony of steady returns.

Exxon and Chevron: The Fiscal Tightrope Artists

Among the U.S. titans, Exxon and Chevron emerge as paragons of fiscal restraint. Their balance sheets, leaner than a Victorian waistcoat, boast debt-to-equity ratios of 0.15 and 0.20 respectively. Austerity, it seems, is their muse. When the market’s pendulum swings, they deploy debt like a surgeon’s scalpel-precisely, sparingly-to sustain dividends. Commodity prices recover, and leverage retreats like a retreating tide, leaving behind a shore of profitability.

Exxon’s 43-year dividend streak and Chevron’s 38-year odyssey are not mere numbers but chronicles of resilience. The former offers a yield of 3.5%, the latter a more generous 4.4%, both eclipsing the S&P 500’s paltry 1.2% and the energy sector’s average of 3.2%. For the conservative, Exxon is the safer bet; for the daring, Chevron’s higher yield is a siren’s song. A $1,000 investment buys eight shares of the former, six of the latter-a modest beginning, perhaps, but one that whispers of compounding’s inexorable arithmetic.

TotalEnergies: The Solar Salvo

TotalEnergies, that French enigma, offers a dual-edged proposition. While its upstream focus on oil and gas may seem anachronistic, its foray into clean energy-a 10% slice of its adjusted net operating income in 2024-suggests a strategic gambit. Unlike BP and Shell, which axed dividends in their green crusades, TotalEnergies chose a subtler path: preserving yield while hedging against the solar salvoes of the future. A 6.6% yield glimmers enticingly, though U.S. investors must contend with the thorn of French tax withholding-a 15% levy that dims the dividend’s luster, albeit temporarily.

For the investor who fears the slow collapse of hydrocarbon empires, TotalEnergies is a prudent counterpoint. Its capital allocations in renewables are not a mere nod to fashion but a calculated bet on the next century’s energy landscape. A $1,000 stake yields 16 shares, a fractional stake in a company straddling two eras: the fossil-fueled present and the electric future.

The Eternal Game of Chess

The optimal moment to acquire these stocks is during the market’s blind spot-the deep energy downturn when sentiment turns sour. Yet, such moments are rare and require the patience of a hermit crab awaiting the perfect shell. For now, with energy prices languishing and yields blooming, the trio remains a compelling hand to play. They are not merely investments but artifacts in the museum of capital, their dividends etched in the annals of time. And in this game of chess, where each move is a calculated risk, the integrated giants offer a chequered board of rewards for those who dare to hold their pawns for eternity. 🕯️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

2025-09-25 14:03