The market, a vast and often opaque mechanism, has lately been fixated on certain names, elevating them to the status of oracles. Palantir Technologies, a purveyor of data divination, has enjoyed a considerable ascent – a 166% gain in the past year, fueled by the relentless demand for its artificial intelligence offerings. Yet, such exuberance, while understandable, often obscures the deeper currents at play. It is a spectacle of concentrated hope, built on valuations that strain credulity. To speak plainly, the price has become… detached.

The anticipation now centers on the fourth-quarter pronouncements from Palantir, a reckoning that must justify the staggering multiple – 416 times trailing earnings, 117 times sales. A precarious edifice, indeed. But while the gaze of the multitude remains fixed upon this particular beacon, a quieter signal emerges from another quarter – Lumentum Holdings. A company, perhaps less glamorous, but possessing a solidity that warrants closer inspection.

Lumentum, a name unfamiliar to many casual observers, has registered a remarkable 328% increase over the past year. This is not the result of ephemeral hype, but a consequence of fundamental shifts – a burgeoning demand for the optical and photonic components that underpin the very infrastructure of this new artificial intelligence age. It is a demand born not of speculation, but of necessity.

The Crushing of Estimates: A Pattern of Quiet Triumph

For four consecutive quarters, Lumentum has surpassed the expectations of Wall Street. This is not mere coincidence, but a testament to the company’s ability to anticipate and capitalize on the escalating needs of data centers – the digital gulags of our time, where information is processed and stored at an ever-increasing rate. The company’s non-GAAP operating margin has risen by a remarkable 15.7 percentage points, reaching 18.7%. Revenue has swelled by 58%, reaching $337 million. Adjusted earnings have multiplied sixfold, reaching $1.10 per share. These are not the metrics of a company merely riding a wave; they are the indicators of a company actively shaping the tide.

Looking ahead to the fiscal second quarter, Lumentum forecasts revenue of $650 million – a year-over-year increase of 62%. Adjusted earnings are projected to more than triple, reaching $1.40 per share. This expansion is not achieved through artifice, but through a deliberate strategy of boosting manufacturing capacity – a commitment to tangible production in an age increasingly dominated by intangible promises.

One anticipates, then, a strong outlook from management. The company now derives over 60% of its revenue from the cloud and AI infrastructure market – a sector poised for exponential growth. Moody’s estimates that infrastructure investments by major hyperscalers could reach $3 trillion in the next five years. Lumentum, therefore, is not merely participating in this expansion; it is positioned to benefit disproportionately from it.

The Price of Substance: A Necessary Discomfort

The market, in its haste to reward novelty, often overlooks the value of substance. Lumentum’s price-to-earnings ratio currently stands at 208, a figure that may give pause to the superficial observer. However, its forward earnings multiple of 58 reveals a more nuanced picture. While Palantir enjoys a higher growth rate, it trades at a considerably lower valuation. Lumentum’s sales multiple of 13 is significantly lower still. This is not to draw a simple equivalence between a hardware-centric company and a software specialist, but to highlight the relative undervaluation of a company that delivers tangible results.

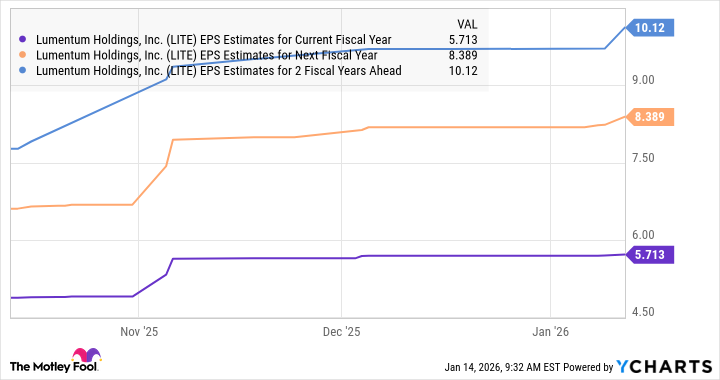

To acquire Lumentum at this juncture appears, therefore, a prudent course. Its outstanding growth is likely to generate further upside for the stock. Even if the valuation multiple were to contract, aligning with the U.S. tech sector’s average earnings multiple of 45 after three years, and assuming the analysts’ predicted EPS of $10.12 is achieved, the stock price could reach $455 – a 28% increase from current levels. But such calculations, while useful, fail to capture the full potential. Lumentum, driven by genuine innovation and sustained demand, could well surpass these projections, trading at a premium valuation that reflects its underlying strength.

The market, like any system, is susceptible to distortion. But amidst the noise and the speculation, it is still possible to discern signals of genuine value. Lumentum, while perhaps lacking the flamboyant allure of its counterparts, offers a quiet reassurance – a promise of sustained growth, rooted in the tangible realities of a rapidly evolving world.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2026-01-16 15:35