Lululemon (LULU), once a siren song for investors, now resembles a shipwreck in the stock market’s tempest. Shares have taken a nosedive, plunging nearly 50% in 2025. Yet, in the world of dividend hunting, a crash can sometimes be a prelude to a crescendo. The question is: does this fall herald a once-in-a-lifetime opportunity, or is it merely a mirage?

The athleisure realm, once a golden goose, has grown weary. Consumers, like fickle lovers, have shifted their affections to new trends. Lululemon’s stock, once a beacon, now wavers under the weight of competition and macroeconomic clouds. Still, the company’s fundamentals whisper of resilience, like a seasoned gambler who knows when to hold and when to fold.

The Slow Dance of North America

North America, Lululemon’s former playground, now moves at a glacial pace. Revenue, once a rocket, has settled into a cautious stroll. Yet, in the grand theater of business, even a 4% growth in a stagnant market can be a triumph. The athleisure sector, like a tired performer, struggles to captivate audiences. Nike’s 11% plunge and Athleta’s 6% dip paint a broader picture: Lululemon’s slowdown is less a failure and more a reflection of a weary industry.

Still, the company clings to its market share, a tenacious gardener tending to a wilting rose. The question is not whether growth will return, but when-and at what cost.

International Ambitions: The East and Beyond

While North America sputters, the rest of the world hums with promise. International revenue, a fledgling bird, has taken flight, growing 20% year-over-year. China, despite its economic hiccups, has welcomed Lululemon with open arms, its consumers proving that even in a spending recession, luxury can endure. The Milan flagship store, a gilded jewel in Europe‘s crown, signals a bold step into uncharted territory.

For a dividend hunter, these expansions are not mere ventures-they are bets on the future, where the odds may yet favor the bold.

The Parabolic Possibility

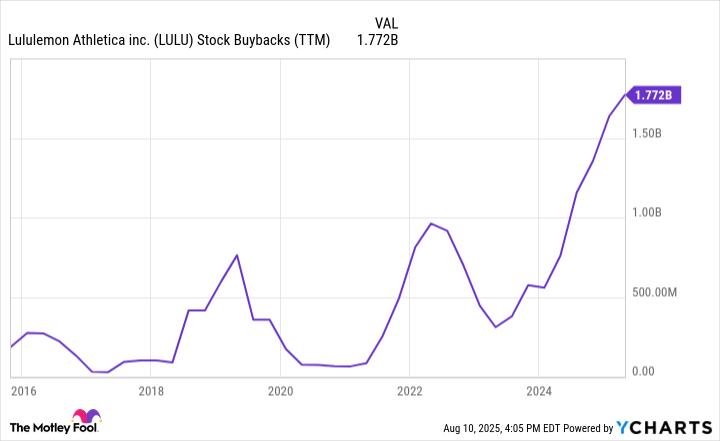

Lululemon’s market cap, now a modest $22.7 billion, offers a tantalizing P/E ratio of under 13-a figure that screams “bargain” to the discerning investor. With profit margins expanding like a well-tended garden and a buyback program that could swallow 10% of shares annually, the stock’s allure grows. It is a tale of two markets: one stagnant, the other brimming with potential.

As the dividend hunter knows, the best opportunities often arrive in the wake of chaos. Lululemon’s fall may yet be the prelude to a rise that defies expectations. After all, in the world of finance, the only constant is the thrill of the gamble.

So, to the question: is this a once-in-a-lifetime chance? Perhaps. But as the old adage goes, the best investments are those that outlast the fads-and the fads, in this case, are still in full swing. 🎯

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-13 04:25