The world of apparel, like a capricious jester, dances merrily one moment and plunges into despair the next. It wears the face of a trusted friend, yet betrays with the suddenness of an indifferent God. And so it is with Lululemon, that formerly invincible titan of premium athleisure, now caught in the undertow of shifting consumer whims. It was not long ago that the brand’s image, as sleek as the polished tiles of a modernist bathhouse, commanded an almost divine reverence. But now, like the mystic of old, it finds itself in a moment of turmoil.

One must ask-what happened? Lululemon’s once-unassailable growth has slowed in North America, where it once reigned supreme, gifting the world with leggings so iconic they were practically sanctified. Yet, in this new age of baggy trousers and looser fits, Lululemon-ever the proud guardian of its high-waisted dominion-failed to adapt quickly enough. The consequence? A stock price plummeting by 66% from its celestial high of early 2024, leaving a trail of despair in its wake.

But, dear reader, let us not rush to judgment. Beneath the surface of this precipitous fall lies a deeper story-one of potential, of misjudgments, and perhaps even of the whispered promise of rebirth. Is this the final gasp of a company on the edge of oblivion, or is it an opportunity wrapped in the guise of failure?

The Rebirth of North America

Lululemon’s heart beats in North America, where it forged its path through the wilderness of consumer preference, creating a brand synonymous with luxury and comfort. Yet, in recent times, it has encountered the brutal truth that even the mightiest of empires falter when they grow complacent. The most recent figures show a paltry 1% growth in the Americas, a meager tribute to the brand’s past glory. And though its consolidated growth stands at a modest 6%, the shadows of stagnation are evident.

What has caused this slide into mediocrity? It is the classic tale of failing to read the winds of change. Lululemon, proud and obstinate, failed to predict the move towards more relaxed, looser clothing styles. But now, as the winds of change howl through the streets, the company is adapting-introducing looser, more generous cuts to its apparel. For a brand that has long thrived on its sense of innovation, I am not so quick to condemn it. The culture, the soul of Lululemon, still burns brightly beneath its designer threads. This too shall pass, I suspect.

Moreover, while Lululemon has experienced a slowdown, it is far from alone in its struggle. Competitors like Nike and Athleta have also seen their revenues slip, a testament to the broader malaise infecting the apparel industry. Yet, unlike those wounded giants, Lululemon has managed to cling to market share, particularly in the men’s and women’s segments. Thus, while the clouds may be gathering, the storm may not be as fierce as it seems.

International Expansion: The Dawning of a New Era

But let us not mistake stagnation for demise. Lululemon’s horizons stretch far beyond the shores of North America. The company’s venture into international markets is in its infancy, a wild, untamed frontier, but it is one where Lululemon is gaining ground. In China, where other brands have faltered, Lululemon’s revenue surged by 24% last quarter-a beacon of hope amidst the fog of uncertainty. And as the world turns its gaze towards Asia, Latin America, and Europe, Lululemon has a vast canvas upon which to paint its future. The company is but a fledgling bird in a global aviary of possibilities.

Yet, for all its promise abroad, Lululemon finds itself trailing in the race of global apparel companies. It is but a humble knight jousting against the towering colossi of Adidas, Nike, and others who have already conquered much of the international market. But time is a cruel yet patient master, and Lululemon will have its day. With each flagship store it opens, the company inches closer to a future where international growth propels it to new heights. The next decade holds great promise, though it will be one of quiet but relentless progress.

Capital Returns: The Dividend Hunter’s Delight

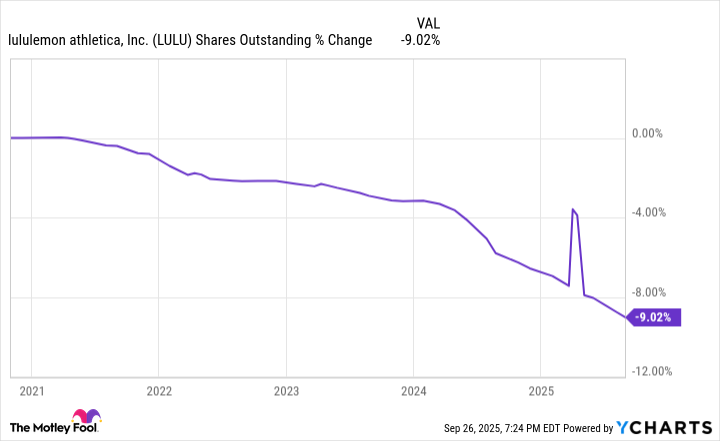

And here we arrive at the crux of the matter-the dividend hunter’s keen eye. Even in the darkest of hours, Lululemon is not without its merits. The company, while contending with slow growth, is still producing returns for its shareholders. Through share buybacks, the number of outstanding shares has dwindled at an accelerated pace, ensuring that earnings per share (EPS) will climb. And as anyone with an eye for dividends knows, a shrinking float means a more potent earnings per share ratio-a delicious treat for the patient investor.

Despite the fear and trepidation coursing through the market, Lululemon’s future shines with a dull but resolute light. The company’s valuation-currently at a P/E ratio of 11.7-suggests a stock in the throes of unjust punishment. But in the world of dividends, sometimes the greatest opportunities arise from the depths of despair. This, I dare say, may well be one such moment.

Thus, with a weary heart and an optimistic spirit, I assert: Lululemon is a buy. Its struggles are but the prelude to a new chapter-one that, if written with care, will find the brand emerging from the ashes like a phoenix reborn.

🦋

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-09-30 14:15