Let’s be honest: I’ve bought lottery tickets. Countless times. Units of hope: 12. Units of cash lost: 12. Units of regret: 12. The math is brutal. But here’s the thing-investing isn’t a numbers game. It’s a mindset game. And sometimes, it’s a lot less stressful than waiting for a random number to match.

Stocks? They’re not a quick fix. But over years, they’ve quietly grown my money like a stubborn vine. I’ve watched 10% annual returns creep up, and I’ve muttered, “Is this it?” while my savings account yawned. Still, it’s better than the lottery’s cruel joke: “You could win… if you’re lucky… which you’re not.”

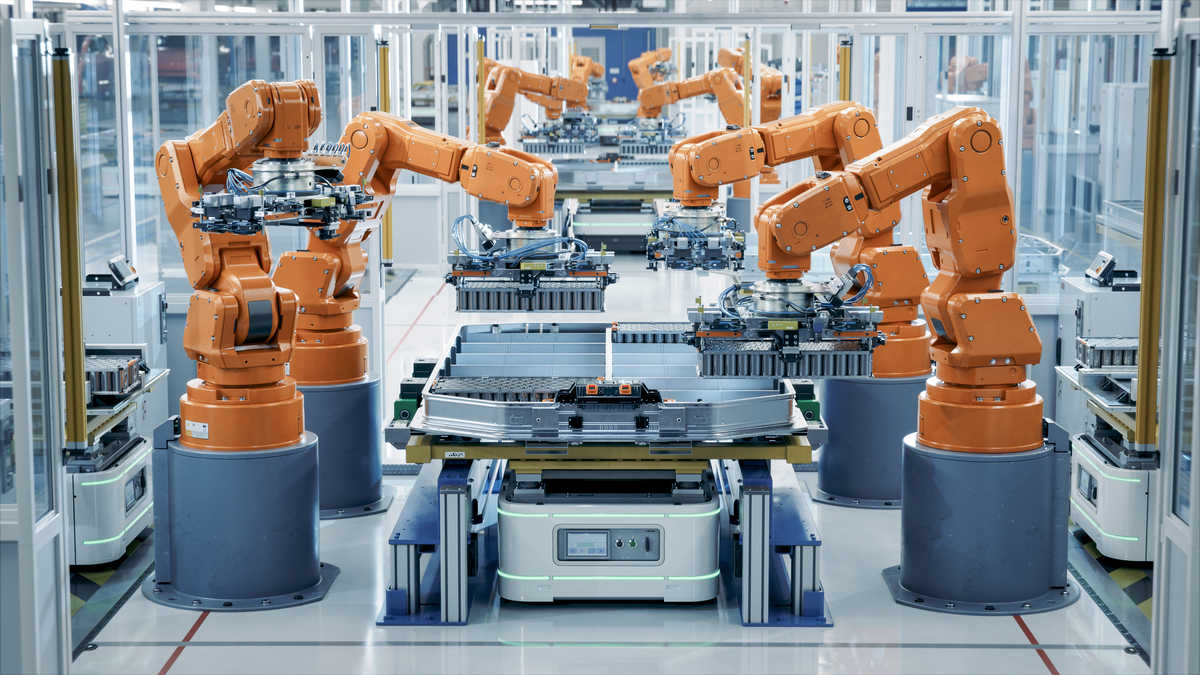

Enter Lucid Group (LCID). A stock that feels like a dare. High risk, higher dreams. Think of it as the financial equivalent of a vintage dress-stunning, but will it fit? The company’s market cap is a fraction of Tesla’s, but that’s the thrill, isn’t it? A chance to bet on a future that might not exist. Or maybe it will.

So here’s my confession: I’m torn. On one hand, I’ve seen companies crash faster than a poorly timed pun. On the other, Lucid’s plans for affordable models feel like a promise. “Three new cars!” they say. “Cheap!” they whisper. I want to believe. I really do. But I’ve also learned that “affordable” can mean “overpriced” in a different language.

Still, compared to the lottery’s zero-sum despair, Lucid feels like a gamble with a slightly better odds. Not great. Not even good. But better. It’s the difference between hoping for a miracle and hoping for a business that might, just might, make you rich. Or at least stop you from buying another ticket.

Units of Doubt: 3. Units of Hope: 1. Units of Cash: Still in the bank. 🚀

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 15:17